Contents

Market Overview

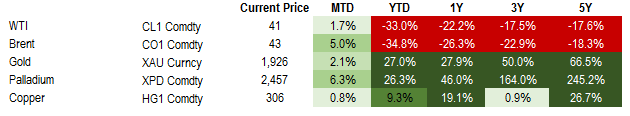

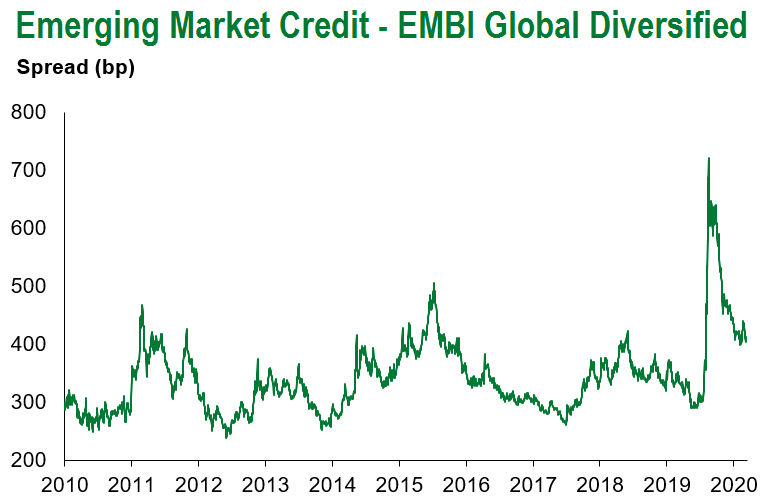

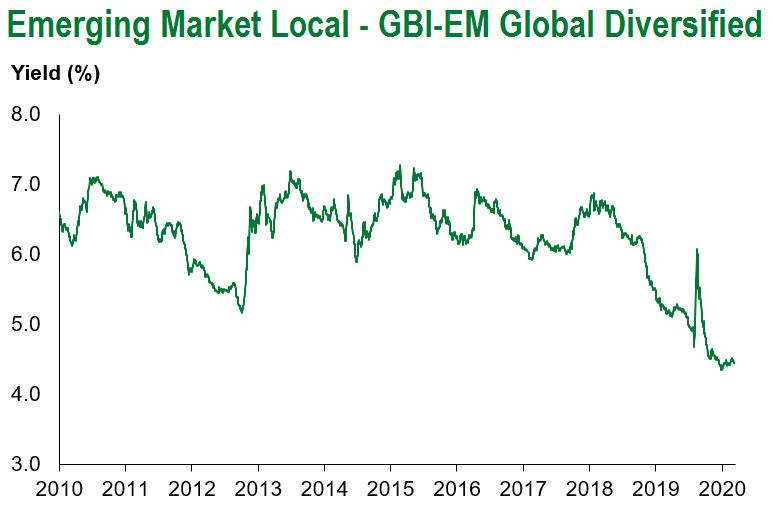

IMF meetings, U.S. earnings, faded stimulus hopes, second wave fears and Presidential town-hall events top off a busy yet volatile week. Equities led on Monday and Tuesday, only for the volatility to set-in as Europe announced tighter lockdown measures and mooted the idea of a strict “circuit breaker”, akin to what Israel exercised earlier this month. U.S. treasuries tightened 3-7bp and bull flattened, as German bunds struck 7-months lows as the 10yr reached -63bp, where Italian and Spanish 30yr bonds hit all-time lows in yield. Crude oil weakness persisted with OPEC+ production slippage and the Gulf of Mexico overcame Hurricane Delta, yet gold ends the week above $1900/oz once again on fragile risk sentiment. EMBI returns were flat on the week, with spreads 7bp wider as Belize, Suriname & Mongolia outperformed but Zambia, Lebanon & El Salvador lagged. Zambia was the laggard on the week, principally for not paying the coupon on its 2024 eurobond as the sovereign uses the grace period in an effort to pass a six-month standstill (see below for more detail). Elsewhere, China issued its first bond transaction directly to U.S. investors via a 144A placement as part of the four-tranche $6 billion issue, with orders topping $27 billion and reinvigorating appetite for defensive assets as the recovery strengthens (as seen with M2 growth and higher exports). Looking into next week, we will have EM central bank decisions out of Hungary (0.6%), Ukraine (6%), Israel (0.1%) and China (3.85%) but all are expected to remain on hold, while the prospects of another hike in Turkey remain. The labor market recovery in Poland is expected to continue, with persisting wage growth even if unemployment remains stable at 6.1%. Meanwhile, China’s GDP forecast is expected to come in at 5.5% for 3Q, complemented by industrial production coming in at 5.5-5.8%. Then we can expect inflation prints out of Brazil, Hong Kong, Singapore and Malaysia.

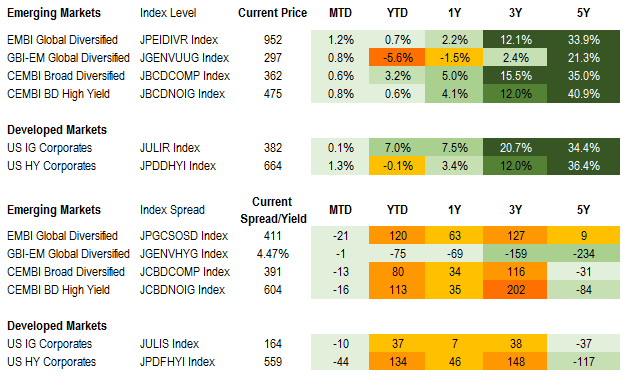

Fixed Income

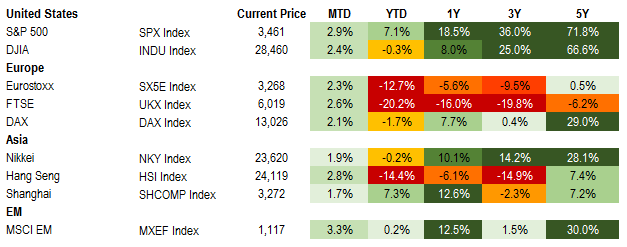

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of October 16, 2020 (Mid Afternoon).

Emerging Markets Weekly Highlights

IMF revises 2020 global growth higher, but warns about risks of prolonged crisis and EM divergence, Argentine authorities and IMF staff concluded meetings in Buenos Aires; currency pressures persisted amid lack of clarity on policy, Zambia missed coupon payment; consent solicitation results to be announced on October 20th, and Global Emerging Market Corporates in focus: Considering implications of additional lockdown measures.

IMF revises 2020 global growth higher, but warns about risks of prolonged crisis and EM divergence

Event: This week, the IMF released its latest World Economic Outlook (WEO), warning that recovery from the worst economic crisis since the Great Depression is likely to be “long, uneven, and highly uncertain.” The Fund revised its 2020 global GDP forecast higher (-4.4% yoy from -5.2% projected back in June) and now expects 5.2% yoy global growth in 2021. For emerging markets, the latest growth projections are -3.3% yoy for 2020 (from -3.0 yoy in June) and 6.0% yoy for 2021 (from 5.9% in June). Meanwhile, the G20 announced a six-month extension until June 2021 of its Debt Service Suspension Initiative (DSSI) that targets to provide near-term debt service relief to low-income countries.

Gramercy commentary: Upward global GDP revisions by the IMF reflect economic data for the first nine months of 2020 that has turned out better relative to expectations during the initial stages of the pandemic when uncertainty was at its highest point. This being said, the global recession this year will still be deep and the recovery in 2021 and beyond gradual and subject to substantial headwinds and lingering uncertainties. Importantly, the ongoing crisis has been highly regressive, hitting the most vulnerable populations the hardest. As such, the poor are getting poorer with close to 90 million people expected to fall into extreme deprivation this year, according to the IMF. Such trends will present highly complex challenges for EM governments that will need to navigate an increasingly delicate balance between supporting the recovery and meeting social obligations on one hand, and not losing control of fiscal sustainability on the other. In that context, it will be essential for market confidence going forward that governments do not withdraw policy support prematurely, but also clearly communicate credible strategies for restoring fiscal space from 2022 onward. This will be a highly complicated task and some sovereigns, especially those that entered the crisis with already weak fiscal and external positions, might face solvency as opposed to temporary liquidity issues related to the emergency created by COVID-19. As such, the DSSI by G20 and the Paris Club that was just extended through June 2021 might also need to evolve toward providing not only liquidity relief, but also debt forgiveness. Thus far, the initiative has not gained much traction, with most eligible countries prioritizing access to international capital markets over the questionable benefit of receiving temporary liquidity relief amid markets that have re-opened quickly for most issuers after the initial shock in March/April. In case the DSSI’s focus shifts toward reducing the level of indebtedness for the poorest global economies, the involvement of China and private creditors will come into much sharper focus going forward.

Argentine authorities and IMF staff concluded meetings in Buenos Aires; currency pressures persisted amid lack of clarity on policy

Event: The IMF stated it had productive conversations with Argentine officials and economic participants on the country’s challenges and potential solutions. Engagement is set to continue and the staff is scheduled to return to Buenos Aires in mid-November for initial discussions on an IMF-supported program. Meanwhile, FX rates in the parallel markets depreciated with the gap between the blue chip swap rate and official rate nearing 115%.

Gramercy commentary: The constructive dialogue with the Fund is a positive step towards rescheduling of the government’s repayments to the IMF beginning in September 2021. We remain of the view that an agreement with the IMF will ultimately be reached with the extent of support to asset prices dependent on the timing and nature (conditionality and duration) of the deal. The ongoing uncertainty regarding the administration’s near and medium term policy agenda combined with a mixed and piecemeal approach to FX management drove the recent pick-up in depreciation in parallel market rates and further erosion of FX reserves. In the near term, the authorities will likely continue to utilize ad hoc measures in an aim to improve and control dollar supply and demand. While this may provide periods of reprieve, depending on the size and scope of the measures, the impact will be temporary and costly. The elimination of near term default risk post restructuring should limit immediate downside price pressure but prolonged use of these unorthodox policies, absent clarity on a broader policy agenda or swift agreement on a new IMF program, could gradually erode the price floor. At the time same, growing potential for eventual cabinet changes amid continued deterioration in economic conditions could lead to improvement in confidence on the policy front and bolster bond price recovery.

Zambia missed coupon payment; consent solicitation results to be announced on October 20th

Event: The Zambian government did not pay a $42.5 million coupon on its $1 billion 8.5% bond due on October 14th. This follows the authorities’ request to bondholders to suspend debt service for six months on its three Eurobonds last month. The deadline to vote on the request was October 16th and results of the consent solicitation will be announced on October 20th. Technical default will be triggered upon expiry of the 30-day grace period on November 13th absent a deal with creditors. Bond prices have fallen roughly 7 points over the week.

Gramercy commentary: The sovereign’s decision not to pay amid current conditions is unsurprising following years of mounting debt and FX reserve pressure. Given the lack of clarity on how the government will use the period of debt suspension, creditors are expected to vote against the authorities’ request. We expect further downside to bond prices in the short-term, given the high likelihood of technical default and degree of uncertainty regarding the government’s policy agenda, restructuring of debts with other major creditors, and ultimate willingness and ability of the administration to enter into a formal IMF program ahead of next year’s presidential election.

Global Emerging Market Corporates in focus: Considering implications of additional lockdown measures

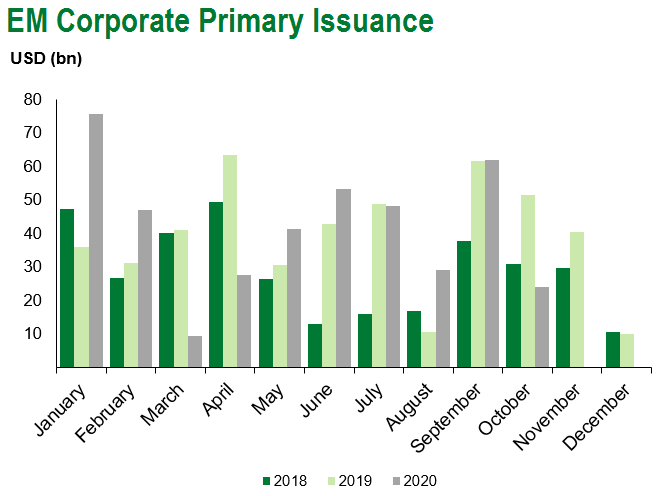

Event: While current trends vary significantly from one country to the next, Bloomberg data shows that the incidence of COVID-19 cases is accelerating worldwide. As governments seek to re-impose lockdown measures in some form, there may be concerns about the potential implications of another wave of the virus on emerging market corporates.

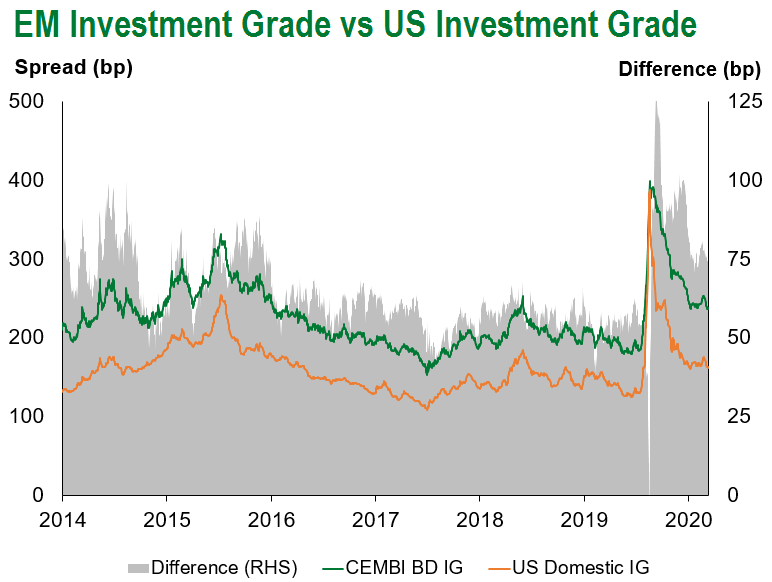

Gramercy commentary: With increased pressure on government finances, authorities may choose to be more selective in providing support. This may mean that entities which are not considered systemically important see funding or other support curtailed or withdrawn. In the bond market, there may be a preference for market leaders in this context. In seeking to replenish lost revenues, authorities may impose one-off taxes on companies which have performed relatively well in the current environment. This, we think, is a risk that cannot be ignored. However, such taxes may pose greater risks to equity investors’ returns than bondholders. Emerging market governments may also seek even more funds from local and international bond markets. For banks, which have been key buyers of these instruments in some countries, it is likely that the outlook for lenders will be even more closely aligned with that of their relevant sovereign. Significant increases in supply from governments can still crowd out corporates, and will therefore, be worth watching. An extension or ratcheting-up of lockdown measures increases the risk of payment deferral schemes remaining in place. We have already seen these schemes extended in some emerging markets. Offsetting this, regulatory forbearance on capital, liquidity and other requirements at banks has not come to an end. This does mean that reported figures may not fully reflect the reality, making in-depth analysis of issuers even more important. Another potential risk of additional lockdown measures is rating downgrades. These negative actions have slowed recently and we have even seen ratings confirmed in some cases. The focus on issuers’ fundamentals may increase, if additional lockdown measures are seen pressuring revenues. Identifying potential winners and losers – as is the case in active management – is vital in the current environment.

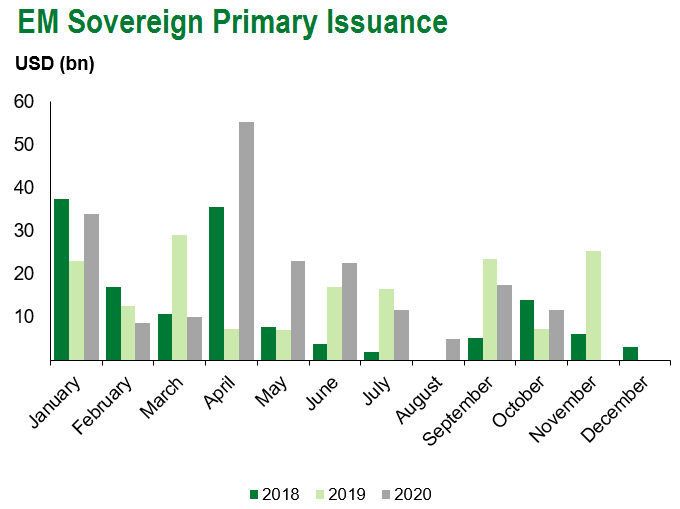

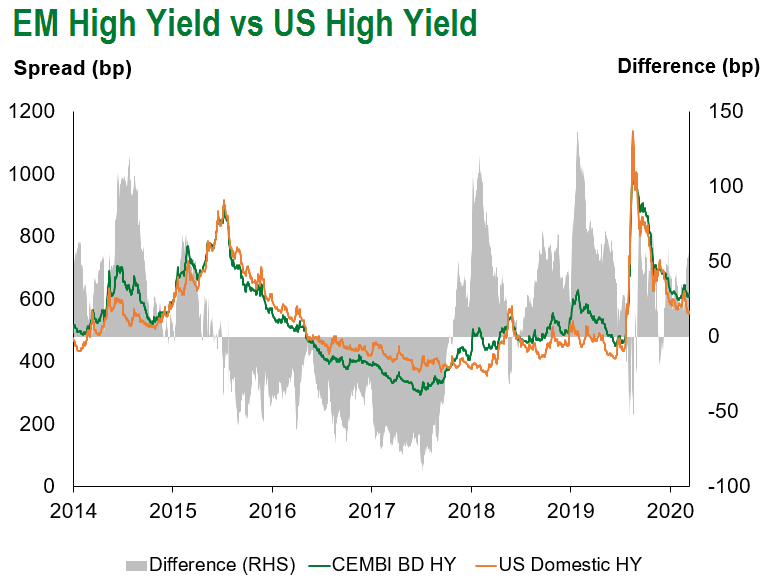

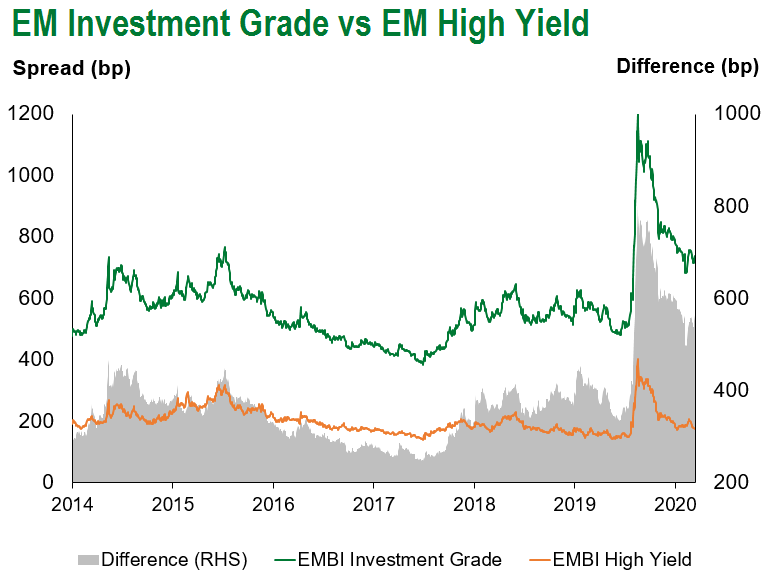

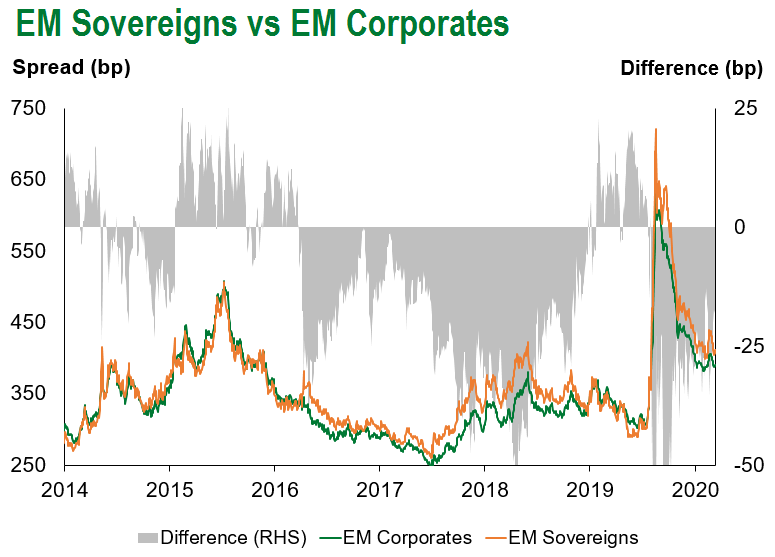

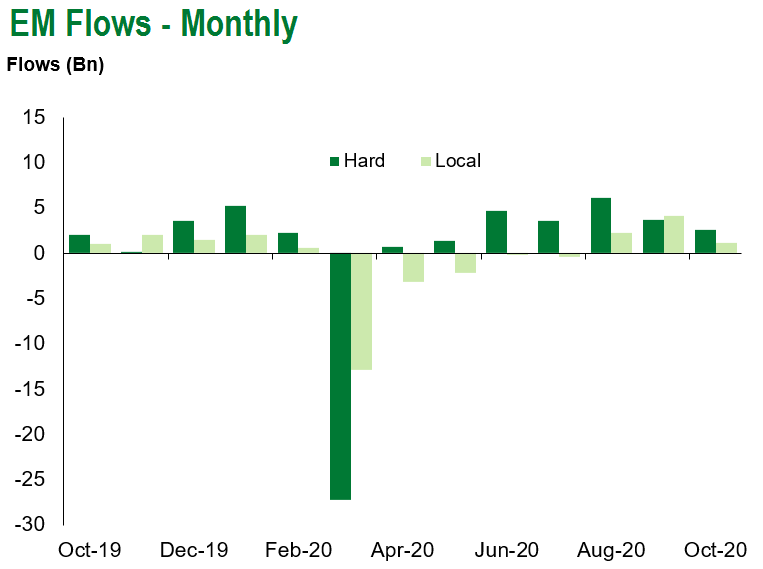

Emerging Markets Technicals

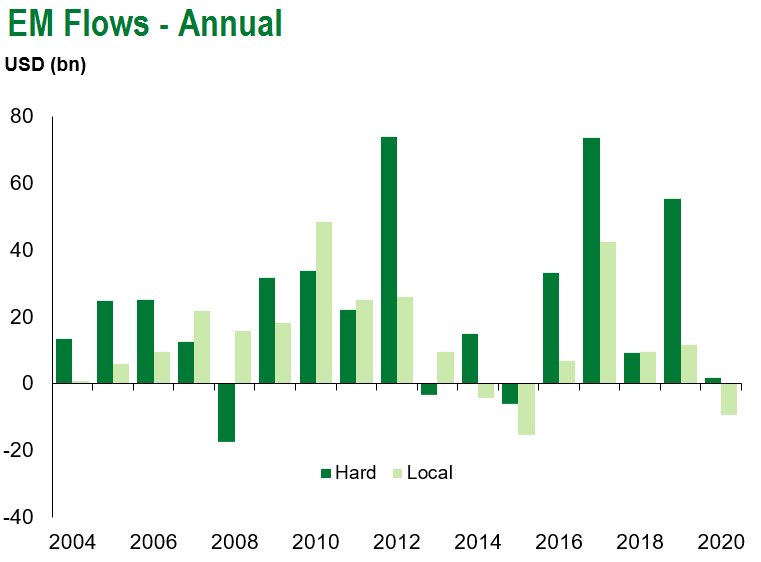

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of October 16, 2020.

COVID Resources

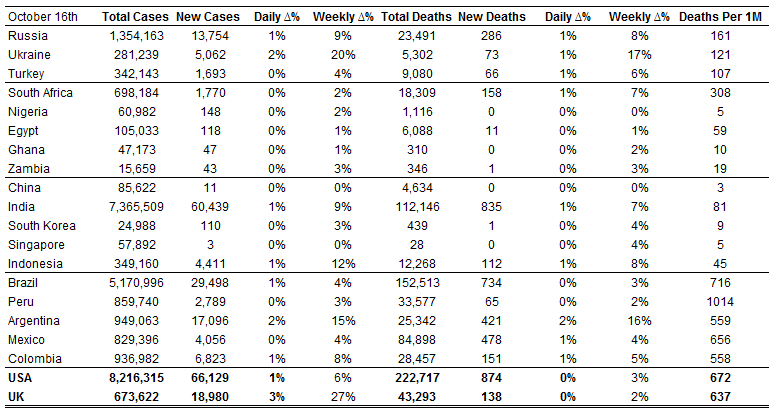

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of October 16, 2020.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.