Contents

Market Overview

Macro Review

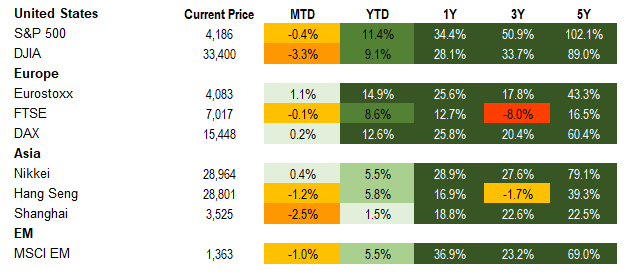

An unexpected Fed pivot. On the one hand, we had a hawkish signal, but this also increases the odds of a policy mistake. Reflationary trades took a backseat as the Fed walked back on the word transitory, but did not raise its core PCE forecast as much as was anticipated within the Summary of Economic Projections. Chair Powell conceded that the Fed had thought about tapering, but further developments will have to wait until the July FOMC or Jackson Hole, with reduced purchases potentially from December. The “dots” also increased 50bp implying two hikes in 2023 (consensus was just one), while the dots increased from 4 to 7 for a 2022 hike, which repriced Eurodollar contracts. However, a JP Morgan survey highlighted that investors were short U.S. Treasuries by the largest factor since 2005, but markets gyrated on Thursday with daily moves not seen since February. EM markets performed rather well against that backdrop, with sizeable inflows into U.S. and EM credit. Global rates were generally weaker on the week with U.S. Treasuries 5-11bp wider up to the 10yr tenor, but the main headline comes back to the 5yr versus 30yr yield differential falling to 110bp from 142bp. The largest moves on the week came with Kiwi, UK gilts and Australian rates, with the latter considering yield curve control as “mature” implying a possible unwind. Meanwhile, SEK, NZD, CHF and AUD broke through 200 day moving averages in G10 FX, but the Nasdaq 100 traded up to all-time highs, while the Dow Jones was -2% this week.

EM Credit Update

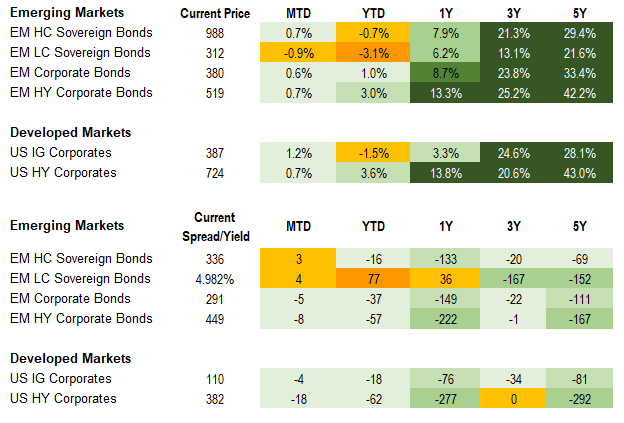

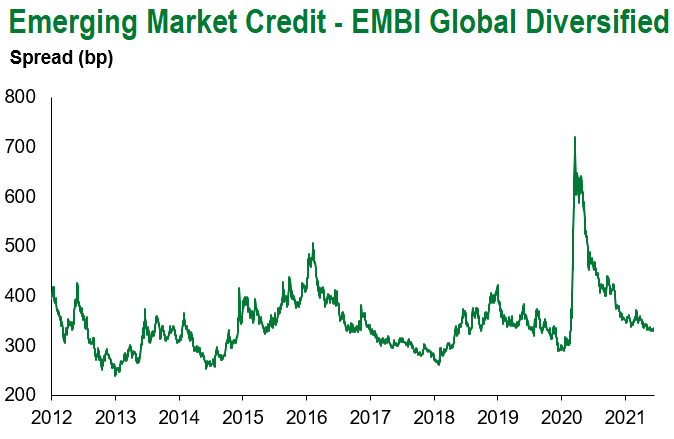

EM credit ended the week down 0.6% as spreads widened 6bp with core rates bull flattening. The significant rally in the 30yr U.S. Treasury to 2.0% allowed EM duration to outperform, while tenors in the short-end and belly widened. Mozambique, Belize and Lithuania outperformed, while Zambia, Sri Lanka and Argentina lagged.

The Week Ahead

The focus next week will likely be on the ECB’s non-monetary meetings and the Bank of England as Andy Haldane is set to vote in his final MPC. We also view European PMI survey figures as key events given Covid-19 easing, albeit with the UK increasingly behind Europe, indeed the German IFO will stand out. We expect rate decisions will remain unchanged, with the exception of possible hikes in Central Europe. Next week, China will likely hold its MLF rate unchanged along with 1yr and 5yr loan prime rates, with further policy decisions out of Czech Republic (0.25%), Hungary (0.60%), Mexico (4.0%), Philippines (2.0%) and Thailand (0.50%). Beyond that Brazil, Hong Kong, Singapore and South Africa will update markets with inflation releases.

Highlights from emerging markets discussed below include: Biden’s meetings with Putin, China further aims to tame commodity price pressure; domestic consumption activity remains solid but underperforms consensus, AMLO unsurprisingly announced plans to push forward electricity, electoral, and defense reforms and Global emerging markets corporates in focus: Navigating cyberspace.

Fixed Income

Equities

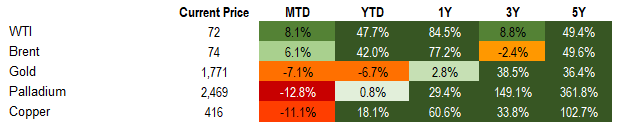

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of June 18, 2021 (Mid Afternoon).

Emerging Markets Weekly Highlights

At their Geneva summit, Presidents Biden and Putin signal mutual interest in “strategic stability” and agreed to launch dialogue on cybersecurity, but risks of flare-ups in diplomatic tensions remain significant

Event: U.S. President Joe Biden and Russian counterpart Vladimir Putin had their first official Heads of State meeting on June 16 in Geneva. The leaders of the world’s two military superpowers discussed a number of thorny bilateral and global issues, including cybersecurity, arms control, climate change, human rights and normalizing diplomatic relations.

Gramercy Commentary: Our assessment is that the meeting met market expectations in terms of producing a generally constructive tone, but no major breakthroughs on the key issues. Overall, the two leaders seem to have focused on expressing their grievances and looking for “low hanging fruit” opportunities for cooperation. In our view, the agreement to return Ambassadors to Washington and Moscow qualifies as a positive surprise relative to low expectations in terms of specific deliverables, and, is likely to improve the communication between the two sides. All else being equal, improving the dialogue on critical issues is a constructive development from a market point of view to the extent it helps reduce geopolitical uncertainty. An area of particular interest for investors is cybersecurity, which has been the main source of tougher U.S. sanctions on Russia in recent years. Going forward, cybersecurity discussions between the White House and Kremlin will likely center on establishing and enforcing clearer “rules of engagement” in cyber space, which is now arguably the main arena for “great power” competition. Such a development would likely reduce, but by no means eliminates the risk of U.S. sanctions on Russia. In fact, potential new revelations about past activities or new aggressive cyber behavior remain the most likely triggers for potential U.S. pressure against Russia via the sanctions channel in the near future. Meanwhile, given Russia’s strong credit fundamentals and macroeconomic tailwinds (e.g. higher commodities prices), we think that investors will interpret the neutral to slightly positive outcome of the Biden-Putin Geneva summit as good news, supporting the existing momentum for Russian assets and reducing the geopolitical risk premium for EM in general.

China further aims to tame commodity price pressure; domestic consumption activity remains solid but underperforms consensus

Event: This week, China’s State Owned Assets Supervision and Administration Commission (Sasac) ordered State-Owned Enterprises to report their commodities futures positions and limit exposure to overseas commodities markets. This was followed by indication from the National Food and Strategic Reserves Administration that it soon plans to release commodity reserves into the market to cool prices. Meanwhile, May retail sales and industrial production data grew robustly at 12.4% y/y and 17.8% y/y, respectively, albeit shy of market expectations of 14% y/y and 18% y/y.

Gramercy Commentary: The commodity measures are not overly surprising following consistent upside surprises to PPI and limited ability for companies to pass costs to consumers. While the ultimate stockpile of reserves and planned amount for release across commodity sectors is unknown, continuation of robust U.S. and energy transition demand should help offset and limit ultimate price downside. With that being said, we expect China to continue with such measures in a gradual manner until PPI dynamics improve driving interim volatility and moderately eroding some of the positive terms of trade effects for commodity exporting countries in 2H. On domestic consumption activity, we anticipate that the combination of incrementally tighter monetary and fiscal policy measures as well as structural factors will contribute to an easing in sequential momentum as the year progresses albeit remain supportive of an overall solid growth level of 8-8.5%.

AMLO unsurprisingly announced plans to push forward electricity, electoral, and defense reforms

Event: President Lopez Obrador plans to present three constitutional reforms to Congress during the summer session and before the new Lower Chamber takes over in September. While details are not yet clear, the electricity reform will likely be similar to the previously approved legislation that supports CFE and government pricing power while the electoral changes would seek to strengthen Morena via reconfiguration of House seats. Lastly, the President would like to make the National Guard a part of the Defense Ministry.

Gramercy Commentary: As previously outlined, this is a reflection of the President’s desire to continue to pursue his agenda, cement his legacy, and strengthen the party. The reforms will likely be blocked by the opposition before the new session begins in September and face greater headwinds with a stronger opposition thereafter thus limiting the near term market impact but nevertheless publically demonstrating AMLO’s intent.

Global emerging markets corporates in focus: Navigating cyberspace

Event: Recent ransomware attacks impacting JBS SA and Colonial Pipeline Co. have, once again, refocused minds on the potential perils of operating in cyberspace.

Gramercy Commentary: The COVID-19 pandemic has meant that companies operating in different industries all around the world have had to find ways of working primarily online. Our collective dependence on properly-functioning internet-based connections was significant before 2020, but has clearly increased since then, in some cases exponentially. Companies’ own systems need to be robust. The same applies to service providers such as web hosting platforms, outages of which can, at a stroke, disrupt the online presence of the myriad entities reliant on these providers. Achieving and maintaining such robustness is no small feat, as ransomware attacks have become increasingly complex and sophisticated. In this context, it’s probably not surprising that the CEO of Bank of America recently stated that the lender currently spends over USD$1bn on cybersecurity each year. Operating online can have many positives. One of these positives is much broader customer reach. An online presence means anyone from (almost) anywhere can access goods and services provided. Whether or not a company can deliver goods and services to disparate locations is a separate matter! Online access to customers has helped many companies keep going through the pandemic, with more than a few offering goods and services via this medium for the first time. It is possible that some of these companies would not have survived the challenges of the pandemic without an online presence. In addition, in some markets increased use of online services has led to improved financial inclusion. For investors, the ability to virtually visit multiple issuers in countries near and far in a single day also has its benefits. The move online has reduced pollution inherent in frequent travel (though this has been at a cost for airports, airlines and related businesses). Further, companies may enjoy cost savings relative to maintaining brick and mortar operations, though this may be offset by the aforementioned cybersecurity expenses. The cost of cybersecurity personnel and products, and susceptibility to potential ransomware attacks have already been mentioned as potential perils of moving more of a business online. Cyberattacks may result in stalled operations, lost revenues and in unbudgeted expenses including payments to perpetrators. Other potential perils include reduced income at entities such as banks, which have had to offer digital services at low or no charge during the pandemic and the increased operational risk inherent in managing employees and customers in different locations. Legal risks related to the loss of client data and/or failure to fulfil customer orders are also worth mentioning. Added to this, issuers may be more vulnerable to fraudulent activity from individuals masquerading as potential clients. The impact of ransomware attacks on insurance premiums payable and on insurers themselves (which may be called upon to make significant pay outs) should not be overlooked. In addition, not every product and service can be adequately delivered online. This most obviously applies to some hospitality services but, more broadly, companies based in markets where the internet infrastructure has much more room for improvement may find online delivery challenging. On balance, the benefits of maintaining an online presence likely outweigh the costs, over time, for most entities operating in emerging markets. Having said that, increased connectivity has been shown to be a double-edged sword. Issuers and investors must take both perils and positives into account.

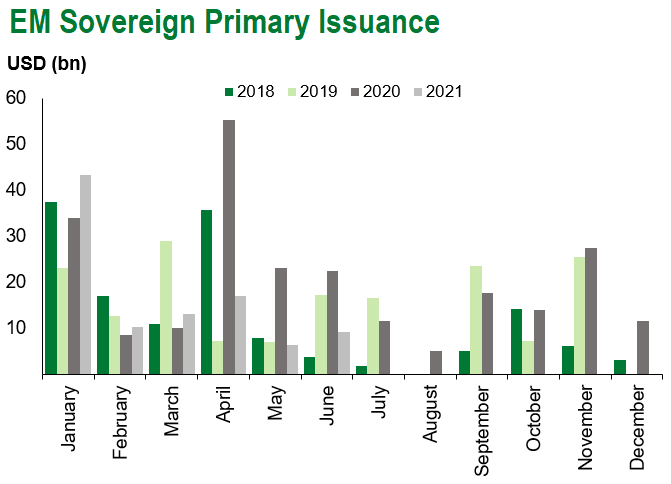

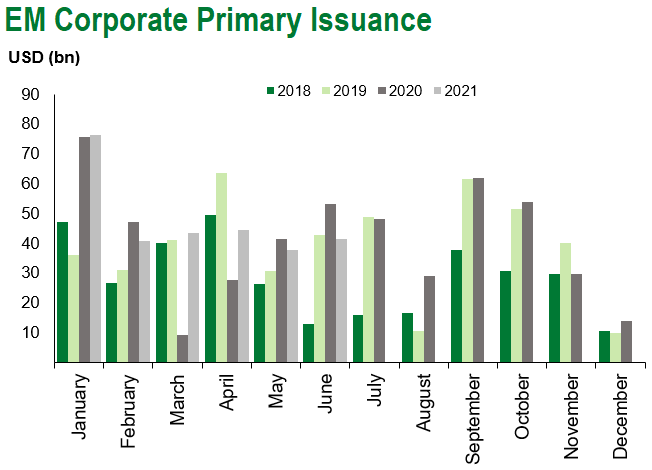

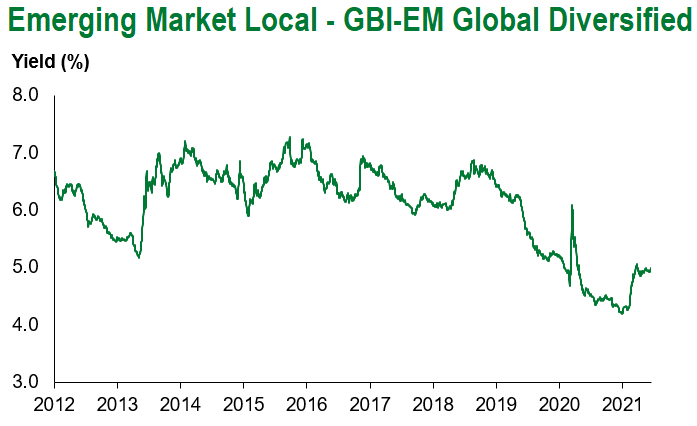

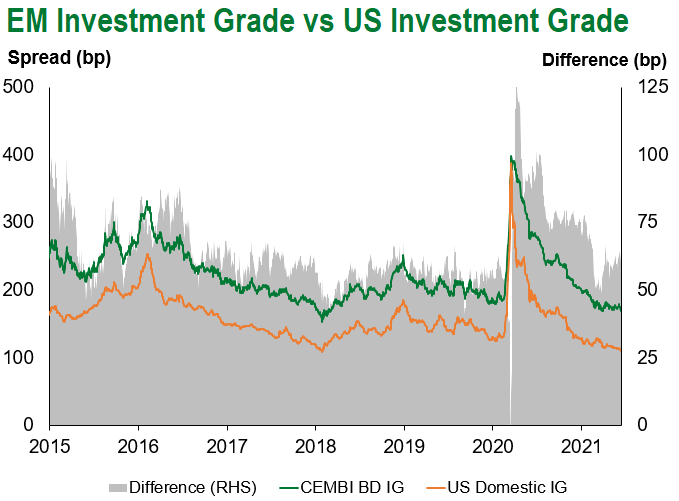

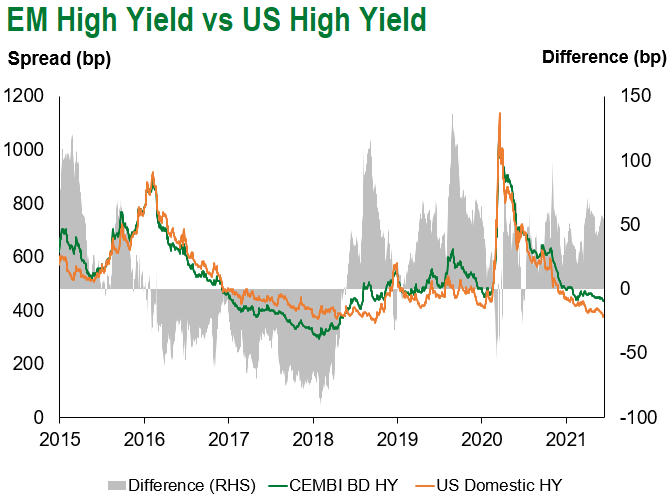

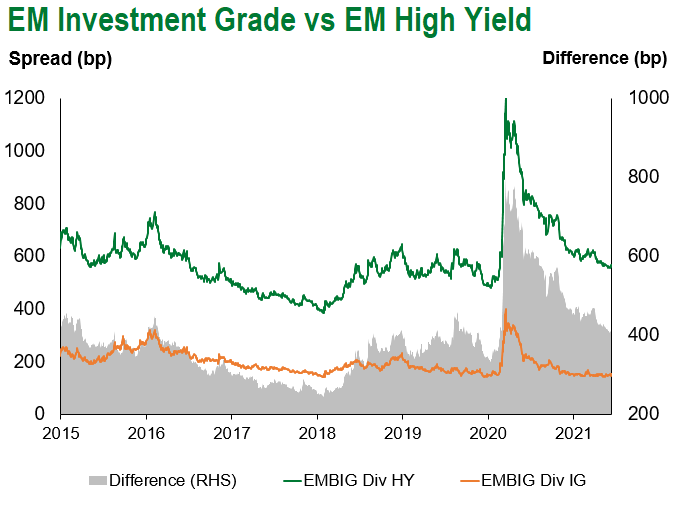

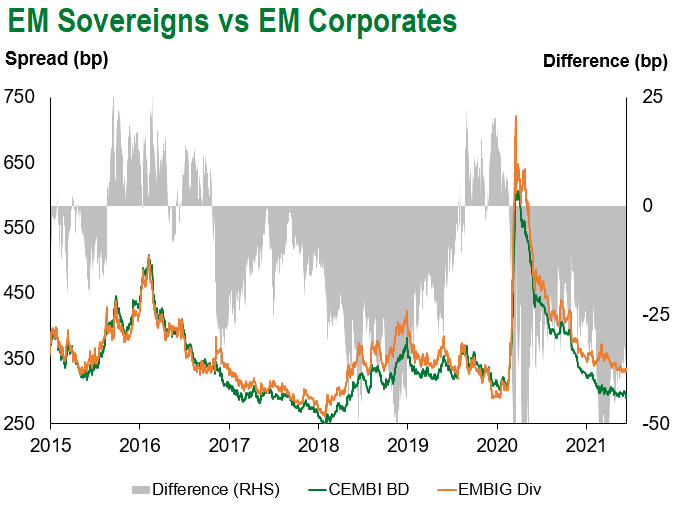

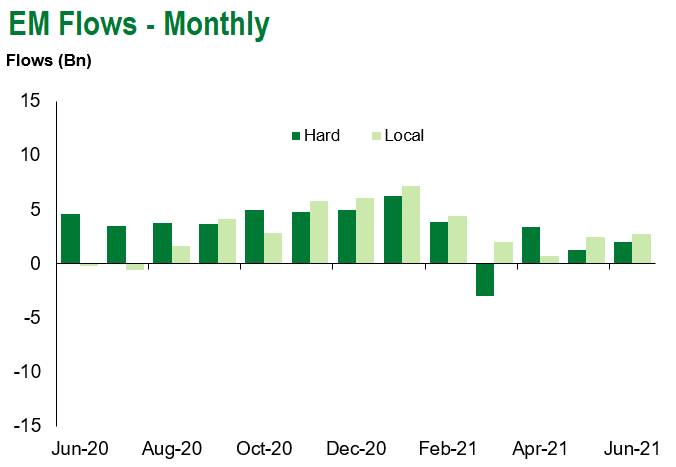

Emerging Markets Technicals

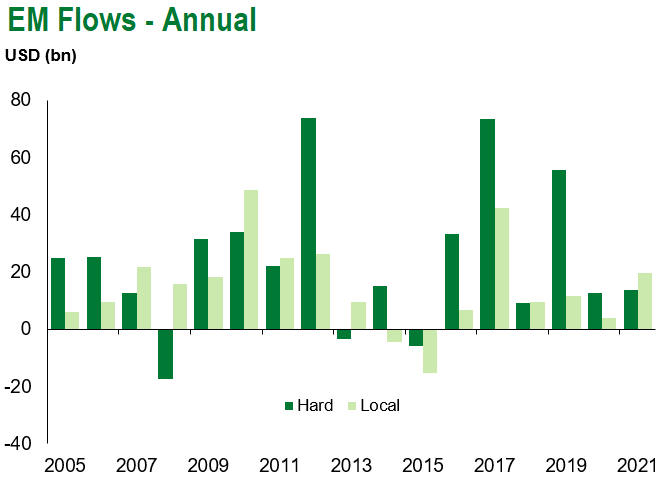

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of June 18, 2021.

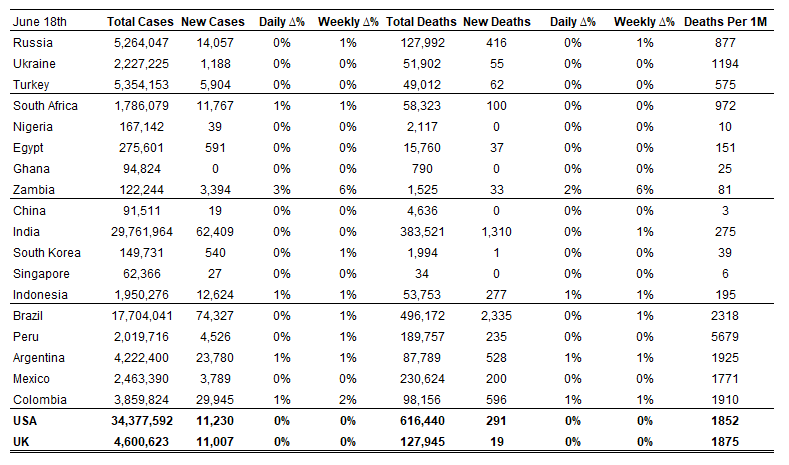

COVID Resources

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of June 18, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.