Contents

Market Overview

Macro Review

A new Omicron vaccine or just another third or fourth booster? That debate has raged on all week, but broadly speaking risk sentiment improved. U.S. value stocks ended the week up 3.3-3.8%, with European counterparts up some 2.5-3.4%, just as the VIX and V2X sharply declined. The move in crude oil was more extreme and up 7-8%, which added a strong tailwind to markets. However, it is never uniform. China cut its RRR rate for a third time by 50 bps this year, while hiking its FX RRR by 200 bps to 9%. The latter is aimed at reducing USD within the onshore banking system. The first takeaway is the PBoC discomfort with the pace of RMB appreciation. The second implication is that the absolute level of 6.35 is proving more of a psychological level than previously thought. We have also seen PPI top expectations at 12.9%, while CPI moderated to 2.3%, which was the lowest level since August 2020. On the flip-side, U.S. CPI rose at its fastest pace since 1982 and inflation readings across CEE and LATAM continue to rise. Two notable candidates stand out: Russia’s inflation target is 4% but the latest print was 8.4% (core is 8.7%). Mexico’s target is 2-4% with a recent reading of 7.7% and core inflation of 5.8%. In response to higher inflation we have already seen Hungary, Ukraine and Peru hike rates over the past week, but Brazil’s 150 bps was its boldest hike yet. Brazil’s Copom also guided another hike of a similar magnitude at the next meeting as well. The extent of rate hikes weighing on growth is a natural follow-up, which we have already begun to see in the case of Brazil as the country entered a technical recession. Meanwhile, geopolitical risk is appearing to thaw between the U.S. and Russia, along with Ukraine and Russia. In addition to the Biden/Putin Summit, the U.S. engaged in further talks with key NATO allies and began to dissect Putin’s draft security agreement. Other events in EM saw both Evergrande and Kaisa enter technical default, with the latter rumored to offer a restructuring proposal as soon as next week. Finally, consternation around whether Australia, Canada and the UK will join the U.S. in boycotting the Winter Olympics in Beijing remain possible, albeit uncertain. Then tighter restrictions in Germany, Austria, Italy and the UK came into force, just as France is faced with the highest number of COVID cases in Europe and considers a fourth vaccine booster.

EM Credit Update

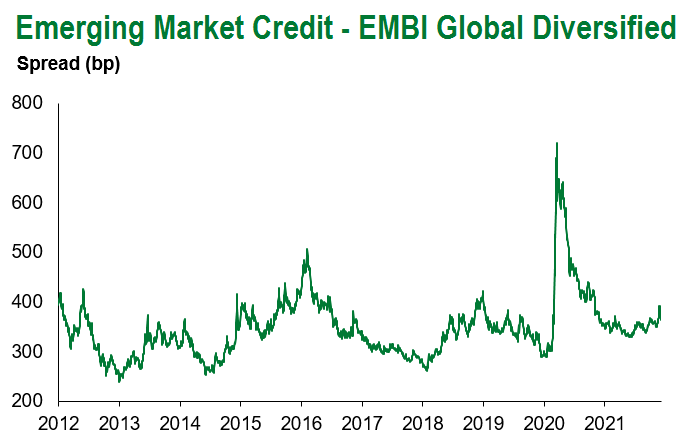

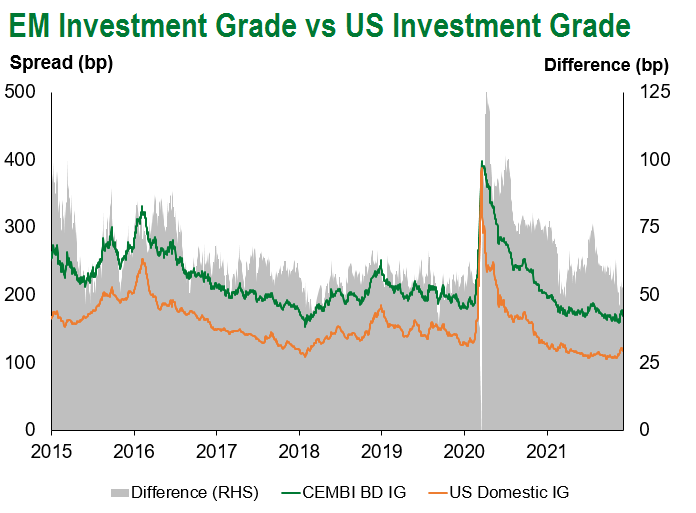

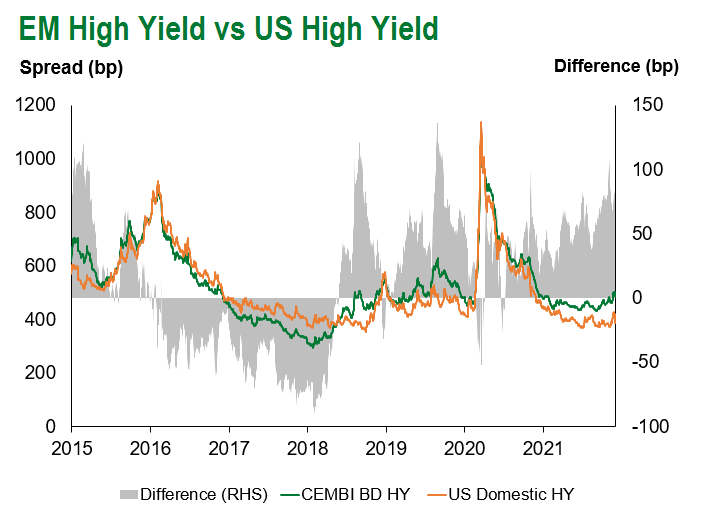

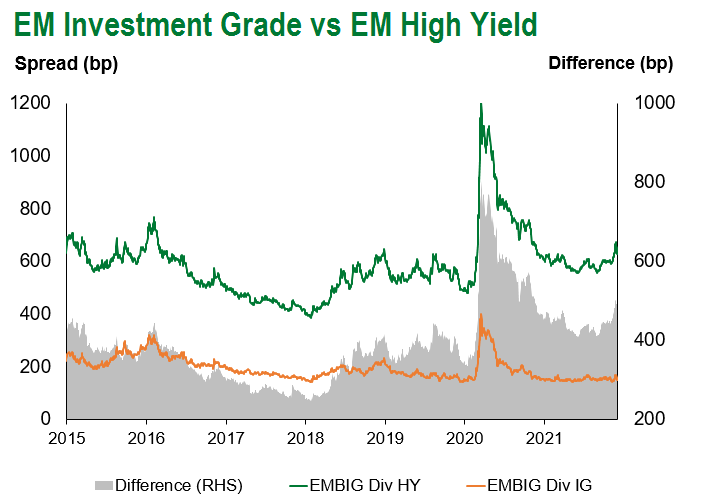

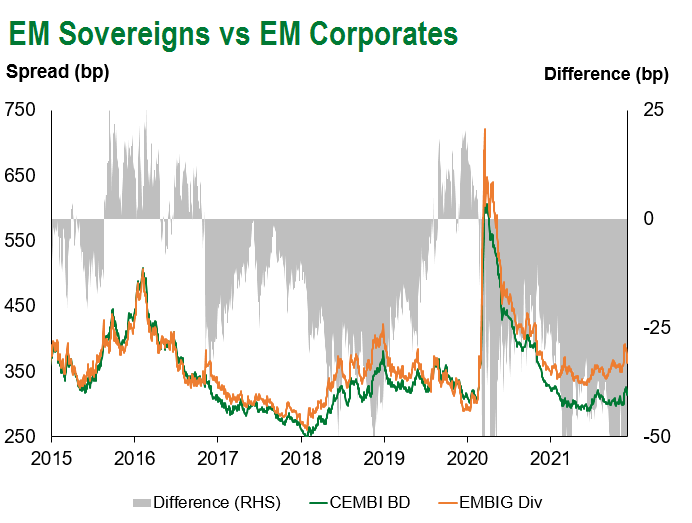

Emerging market sovereign credit ended the week up 0.5%. With IG +0.1% and HY +1.0%, as IG spreads rallied 18 bps and HY was some 30 bps tighter, as U.S. Treasuries widened 10-18 bps. Argentina, Ivory Coast and Jordan outperformed, while Sri Lanka, Tunisia and Slovakia lagged.

The Week Ahead

Major G10 central bank meetings will dominate next week with the FOMC, BOE, BOJ and ECB. However, the list of EM central banks is significantly longer, with Chile (2.75%), Colombia (2.5%), Egypt (8.25%), Indonesia (3.5%), Mexico (5.0%), Philippines (2.0%), Russia (7.5%), Taiwan (1.125%) and Turkey (15.0%). From a volatility perspective, Turkey will be the key central bank to watch given three episodes of FX intervention over the past fortnight. After Chinese inflation data, the next batch of releases will cover retail sales, industrial production and FAI growth. Thereafter, a small handful of inflation prints are due from Argentina, India and Romania.

Highlights from emerging markets discussed below include: Virtual meeting between Presidents Biden and Putin confirms preference for diplomacy over military action in resolving tensions around Ukraine, China November inflation and credit data combined with RRR cut point to incremental improvement in growth pressures and Peru Congress rejects impeachment motion while governability challenges remain high.

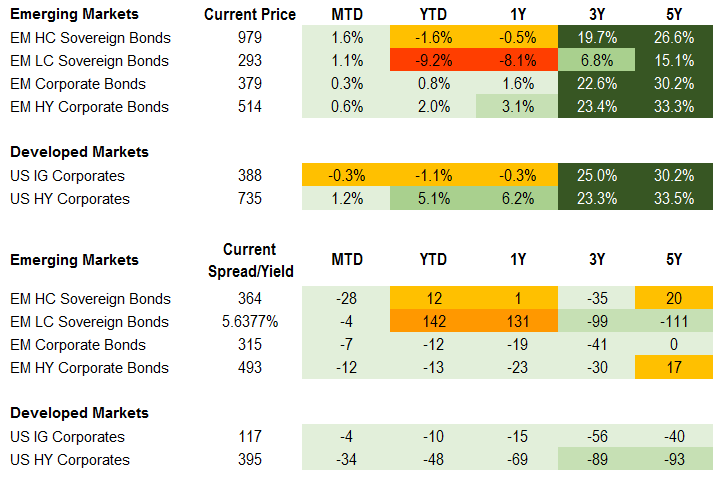

Fixed Income

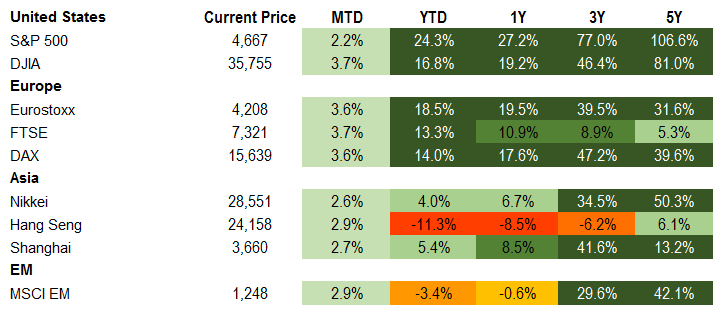

Equities

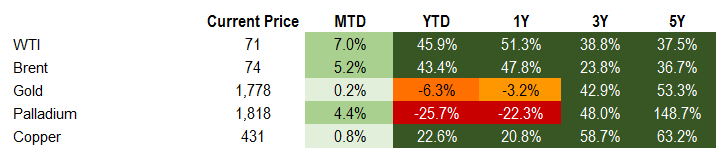

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of December 9, 2021 (mid-afternoon).

Emerging Markets Weekly Highlights

Virtual meeting between Presidents Biden and Putin confirms preference for diplomacy over military action in resolving tensions around Ukraine

Event: Presidents Biden and Putin held a virtual one-on-one meeting this week focused on the situation in and around Ukraine and other hot geopolitical spots globally.

Gramercy Commentary: The meeting between the two military superpowers’ Heads of State did not produce any major breakthroughs in their challenging diplomatic relationship. However, it did send a constructive signal about a mutual preference for using diplomacy to tackle the key thorny geopolitical issues, including Ukraine. Thus, market concerns about potential military escalation between Russia and Ukraine should continue to ease, supporting a recovery in both countries’ market assets. As argued in recent editions of EM Weekly, we have been of the view that such market concerns were overdone, driven by risk perception in the West about a possible Russian invasion in Ukraine that tends to be far greater than its actual probability. Given the enormous complexities of the U.S.-Russia geopolitical rivalry in general and as it relates to Ukraine in particular, addressing the main “red lines” of both sides will be a prolonged and convoluted process, prone to periodic flare ups. However, a real-world escalation involving overt military action by Russia in/on Ukraine and a corresponding response by U.S./NATO, remains an unlikely fat-tail event for the time being, in our view. From that perspective, we tend to see market sell-offs driven by such concerns as buying opportunities for Russian and Ukrainian assets and we believe both credits are positioned to perform well in 2022 from current valuations.

China November inflation and credit data combined with RRR cut point to incremental improvement in growth pressures

Event: The gap between PPI and CPI prints last month narrowed to 10.6% ppt from 12.0% ppt with PPI edging down and CPI increasing moderately. In sequential terms, CPI moderated to 0.4% m/m from 0.7% m/m while PPI dropped to 0% m/m from 2.5% m/m. Monthly manufacturing inflation dipped into negative territory while food price pressure persisted. On the credit side, total social financing growth increased slightly to 10.1% y/y from 10.0% in October while the credit impulse also improved driven by government and corporate issuance and to a lesser extent, household lending. The PBoC also announced another 50 bps reduction in the RRR for banks which follows the 50 bps cut in July as well as a 200 bps hike in the FX RRR to ease appreciation pressures on the yuan.

Gramercy Commentary: The slight adjustments in the data this month point to a plateauing of the stagflation elements present in recent months. While Omicron and other variants may drive volatility in data through the winter months, we envisage more material alleviation of PPI pressure as 2022 progresses combined with supportive policy measures which improve dynamics for mid/downstream profit margins and headline activity. We expect currency strength to persist in the near-term on still robust external flows albeit for the trade surplus to ease throughout the year.

Peru Congress rejects impeachment motion; governability challenges remain high

Event: Congress ruled against the motion put forward to debate impeachment of President Castillo on illicit campaign financing and controversial appointments with 46 votes in favor, just shy of the 52 votes needed.

Gramercy Commentary: We expect continued political noise and challenges amid a highly polarized government in the near-term. While the distancing between Castillo and ideological ruling party head, Vladmir Cerron, and the cabinet reshuffles in prior months boded well for some moderation, tensions persist. While the looming threat of impeachment poses a check and balance against more radical policy endeavors, the congressional support needed to successfully vacate Castillo is inadequate (46 votes vs. 52 needed for debate and 87 for impeachment) and the constant internal battles, impeachment motions, and lingering policy uncertainty hinder the growth and investment outlook. If Castillo embarks on another cabinet reshuffle in the centrist direction, potentially with a new PM, the outlook could begin to improve more materially.

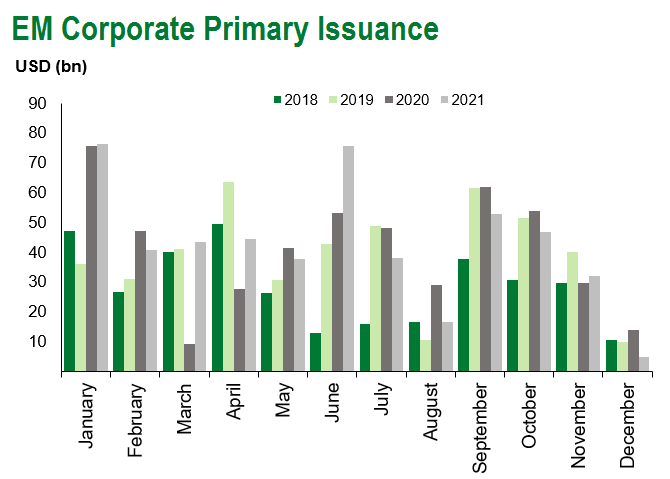

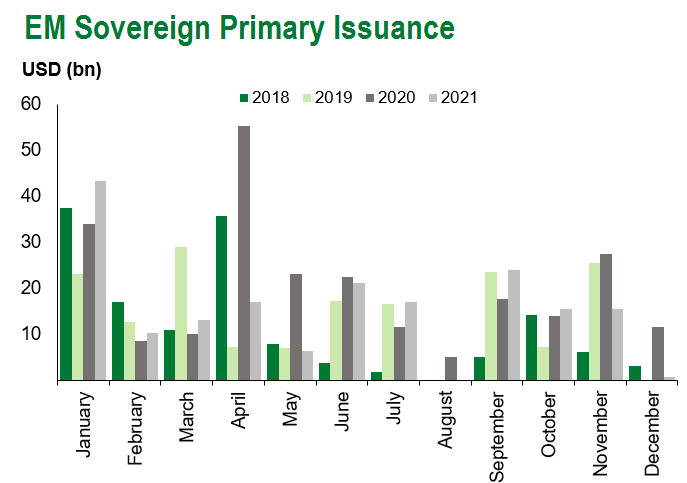

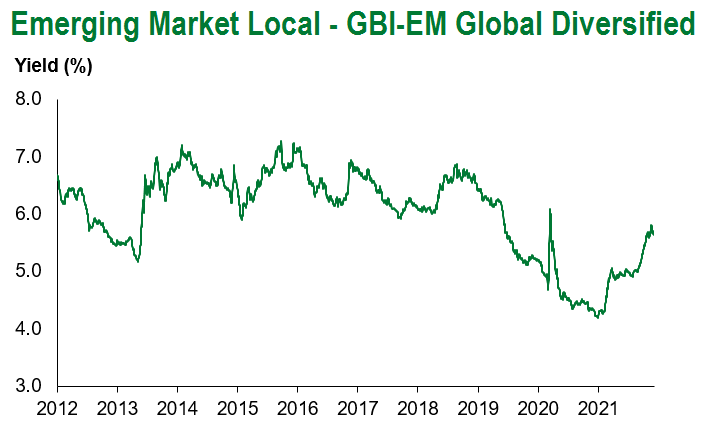

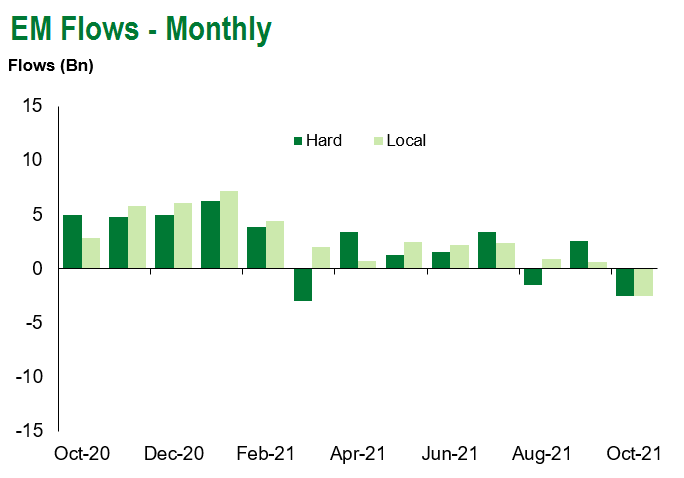

Emerging Markets Technicals

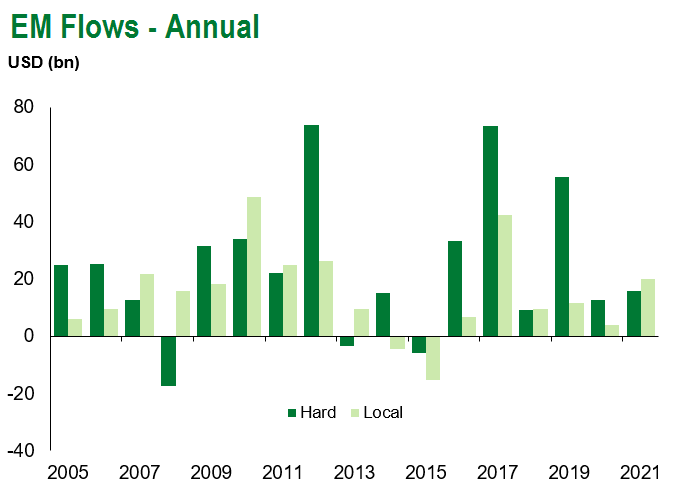

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of December 9, 2021.

COVID Resources

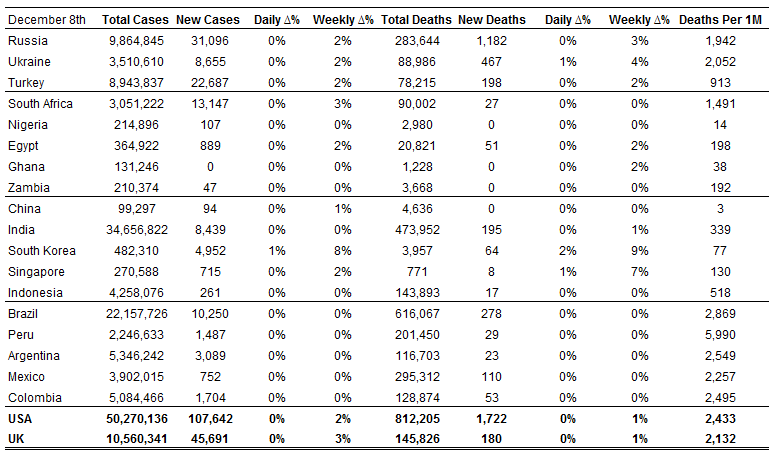

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of December 8, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.