Contents

Market Overview

Macro Review

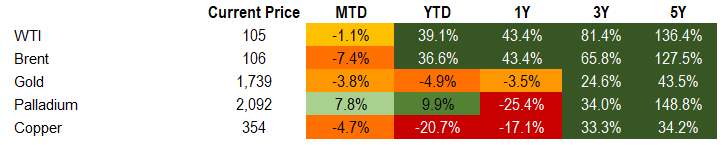

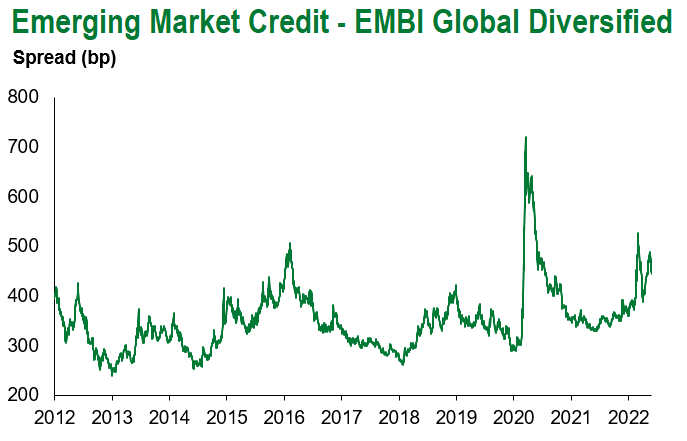

Oil briefly re-priced on recession risks. On Tuesday, the slump in crude oil was so large that it moved by 3.5 standard deviations, which is the ninth largest move over the past five years. The Bank of England also flagged how market expectations had deteriorated, which triggered a collapse in GBP. However, Governor Bailey has the added challenge of responding to a chaotic political crisis as Prime Minister Johnson resigned. The half-baked resignation means that he is not leaving office immediately and has intentions to stay on until autumn. Political paralysis fuelled volatility in British assets, and this indeed became an EM theme as well. As Argentina’s Finance Minister resigned (Guzman), Batakis was appointed and calmed markets by confirming with the IMF that she is committed to the program signed by her predecessor. Ecuador’s administration is similarly enduring a cabinet reshuffle after Lasso palmed off impeachment threats. Meanwhile, FOMC minutes pointed to an already hawkish Fed where a July hike of 50 or 75bps is almost a foregone conclusion. This over-simplified conclusion ought to be balanced against US Treasury volatility that remains at unprecedented levels. A developing theme in EM is where downside inflation surprises are slowly emerging in LATAM (Colombia), which is contrary to Asian economies where the rate lift-off is only just beginning (Chinese stimulus taps remain on after all). Malaysia hiked 25bps, but lift-off is expected out of the Philippines and Thailand in August. Then, outsized, even super-sized, hikes are coming out of CEEMEA where Hungary hiked the one-week deposit rate by 200bps, after increasing the policy rate by 185bps only last week. These themes are not clear-cut as outliers include Poland, which under-delivered with a 50bp hike and inflation is still creeping higher in Brazil and Peru. The problem with CEE economies is that while inflation remains stubbornly high, we have begun to see industrial production, retail sales, wages and household credit deteriorate along with weaker PMIs feeding through.

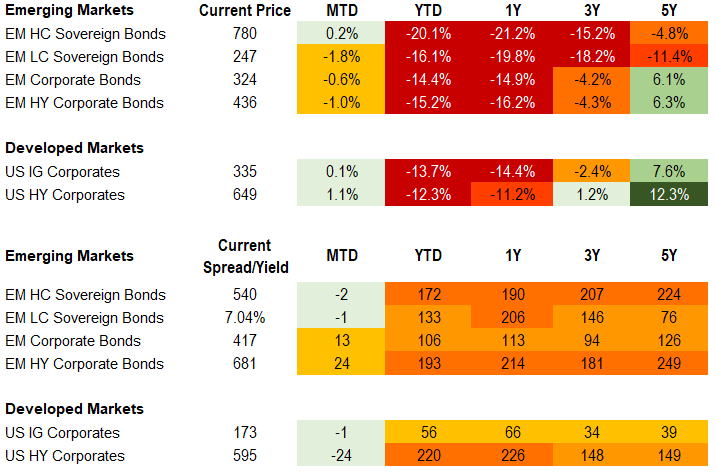

EM Credit Update

Emerging market sovereign credit ended the week down 0.7% with spreads a mere 1bp wider. Outperformers over the week were Tunisia, Namibia and Croatia while Ukraine, Argentina and Ecuador underperformed.

The Week Ahead

Perhaps the most important aspect of the “week ahead” is reflecting on Japan’s former Prime Minister assassination. Secondary events include China’s 2Q GDP, along with industrial production, fixed asset investment and retail sales. Recent PMIs suggest that such releases ought to be upbeat without any immediate cause for concern. Then just as the G20 finance ministerial meetings in Bali conclude, the central bankers from those respective countries will meet. EM interest rate decisions are limited to Chile (9.0%) and South Korea (1.75%). Instead, the market focus will shift to US CPI on Wednesday to understand if there is any slippage after the prior reading of 8.6% (expectations are nevertheless at 8.8%). As for EM inflation, there are releases due out of India, Israel, Poland and Romania. Finally, we also note that Brazil’s BCB long-standing public servant strike finally ended. In turn, the BCB also announced the schedule for releasing the delayed publications. This means there are a number of activity-related disclosures for March and April that will suddenly be published.

Highlights from emerging markets discussed below include: Ghana and IMF begin negotiations in Accra on new program; Argentina’s new Minister of Economy attempts to calm markets; Ecuador President Lasso reshuffles his cabinet after surviving the opposition’s attempt to impeach him

Fixed Income

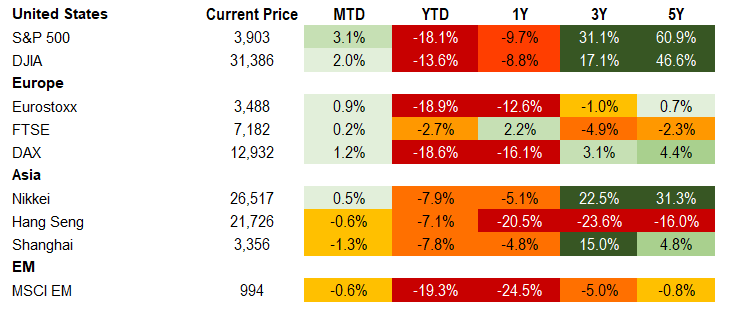

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of July 8, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Ghana and IMF begin negotiations in Accra on new program

Event: The government has formally requested IMF support on its homegrown economic program, with initial negotiations underway in Accra beginning on July 5th scheduled to run through July 13th as per the IMF press release.

Gramercy commentary: We see the decision to move forward with IMF support as a welcomed development in the current backdrop of stalling growth and loss of market access. While talks may not be as smooth and swift as with past programs given politics, initial hesitancy, and debt sustainability questions, we think this is the most constructive path for the credit. Depending on scope of revenue slippage on weaker growth and willingness for further consolidation by authorities, a restructuring could still be avoided. Even in the context of a reprofiling, we see prospects for swift execution with the IMF financing and policy backstop as well as largely private and public commercial debts with limited Chinese loans to slow the process.

Argentina’s new Minister of Economy attempts to calm markets

Event: Over the weekend, Silvina Batakis, former PBA Minister of Economy under Scioli from 2011-15 was appointed to succeed Martin Guzman, after his resignation. Argentine assets and the FX market have remained under pressure with the gap between the parallel and official rate exceeding 130% amid the uncertainty. Meanwhile, Batakis has promised policy continuity and plans to continue with the IMF program.

Gramercy commentary: Guzman’s resignation came after months of speculation around him leaving the Fernandez Administration. Accordingly, this should not necessarily come as a shock to investors. Still, price pressure persists in linkage to concerns of Batakis being ideologically very close to Vice-President Cristina Kirchner and as such, risks deepening of heterodox policies. We believe she may be able to better manage the fractious political dynamics at the margin for a brief period with support of CFK and avoid arrears with the IMF and on external debt, albeit amid a highly strained and fluid political and economic backdrop. Local market maturities remain a challenge but we see an attempt to improve conditions at the margin while largely managing through central bank intervention at the expense of inflation and more difficult conversations with the IMF. While the short-term outlook remains highly uncertain, the prospects for medium term political improvement still remains intact in the context of external bond prices that trade well below estimated recovery values following a restructuring.

Ecuador President Lasso reshuffles his cabinet after surviving the opposition’s attempt to impeach him

Event: In the aftermath of surviving an impeachment motion in the National Assembly last week, spearheaded by the populist Correista opposition, and having reached a truce with indigenous organizations that ended two weeks of street protests, Guillermo Lasso, Ecuador’s right-wing president, replaced four ministers in his government, including Finance Minister Simon Cueva.

Gramercy commentary: The recent escalation in domestic political noise came at the most inopportune moment, coinciding with the risk aversion spike in global markets triggered by DM central banks’ hawkish shift that transpired in late June and rising concerns about global recession risks. This, combined with Ecuador’s complicated credit reputation and prominent high beta status, contributed to the sovereign’s transition from the best to one of the worst performing EM sovereign credits YTD in a matter of days. At current valuations, the market appears to be pricing in negative scenarios involving Lasso’s ousting and derailing of the IMF program. We think this is overdone as the political noise crescendo seems to be behind us. Meanwhile, highly respected Finance Minister Simon Cueva was replaced by another market-friendly name in former Guayas province, Governor Pablo Arosemena, a personnel change not related to the recent protests. However, markets remain skeptical about governability prospects by the market-friendly Lasso Administration amid strained relations with a populist-leaning National Assembly and lingering risks of renewed political volatility. As such, despite a generally favorable macroeconomic backdrop, including much higher than budgeted oil prices and excellent rapport with the IMF, a gradual normalization from distressed sovereign valuations will require tangible progress on restoring stability in the country. This would hinge on upcoming talks between the government and protest leaders as well as a delicate balancing act between continuation of fiscal prudence and meeting social demands amid a complicated global environment.

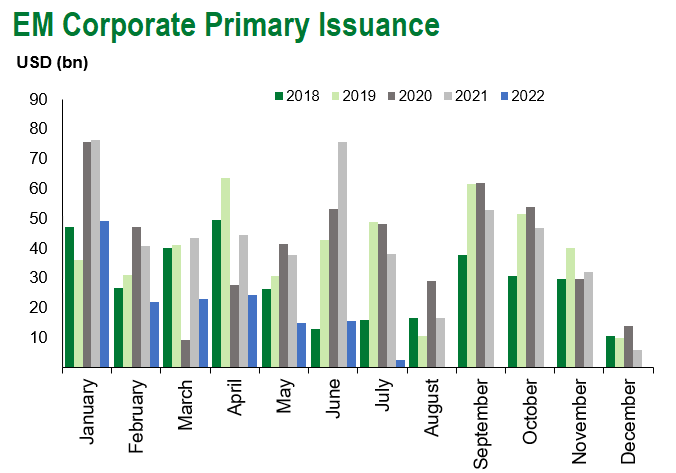

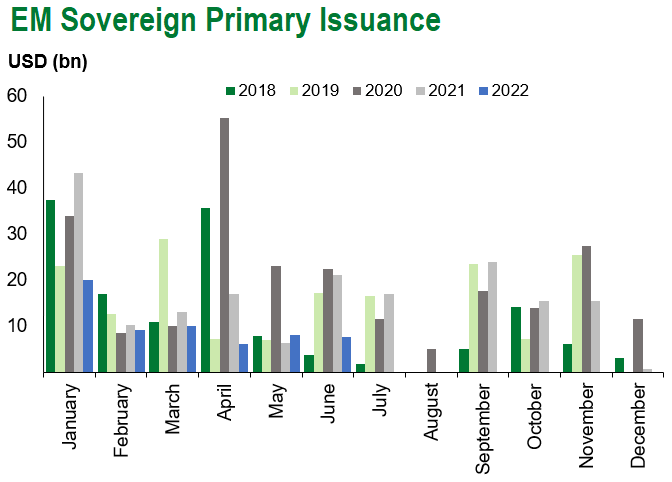

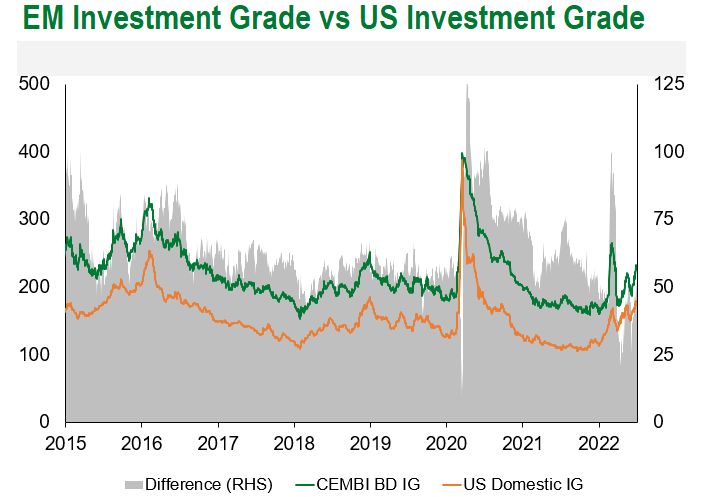

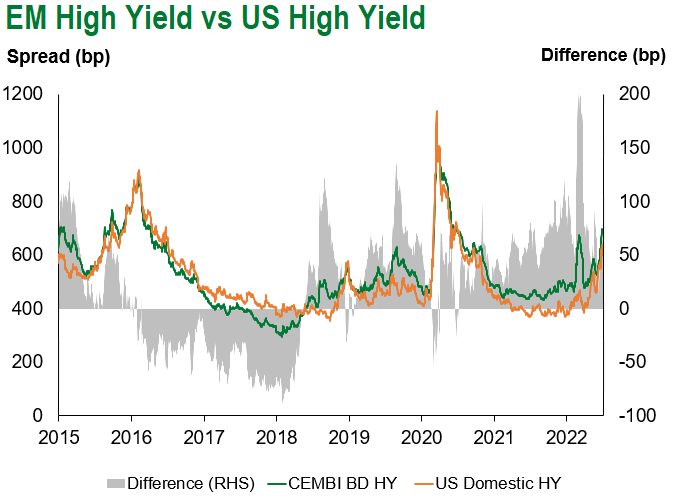

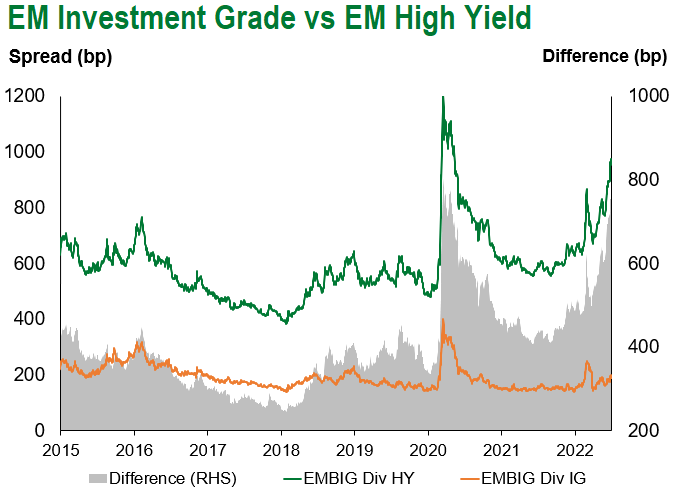

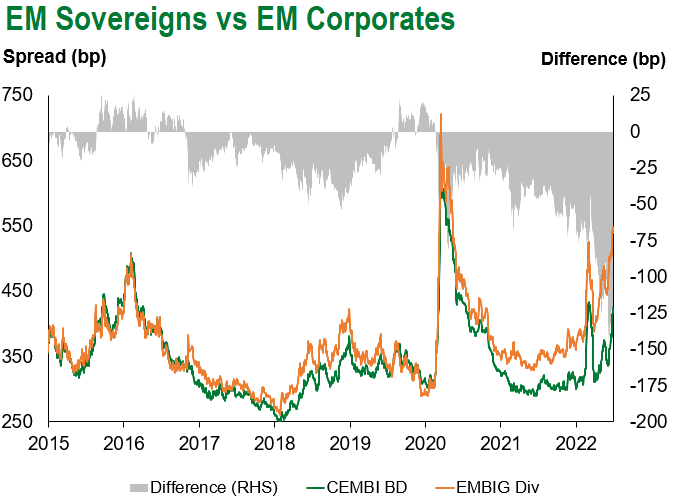

Emerging Markets Technicals

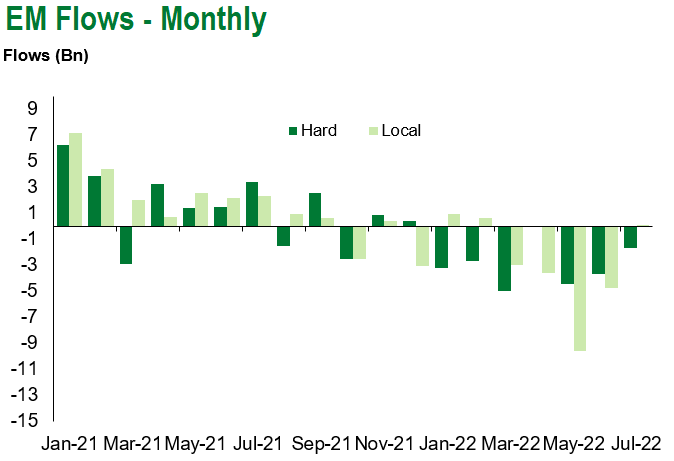

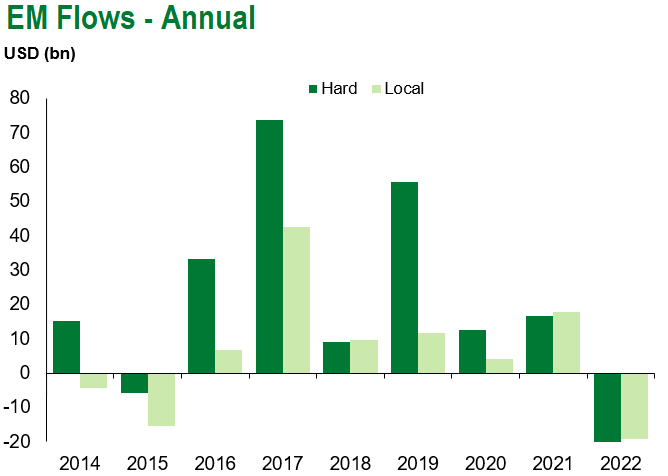

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of July 8, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.