Authored by:

Robert Koenigsberger, Managing Partner & Chief Investment Officer

Mohamed A. El-Erian, Chair

Petar Atanasov, Director & Co-Head of Sovereign Research

Kathryn Exum, Director & Co-Head of Sovereign Research

January 17, 2023

Decoding the Global Macro Environment: A Top-down Perspective and the Related Implications for Emerging Markets Heading into 1Q 2023

After a challenging 2022 in which we witnessed one of the largest dislocations, in terms of both depth and breadth, we remain constructive on the medium to long-term prospects in our markets. Whereas 2022 was challenging for both sides of the “60/40” portfolio, we believe the 40% fixed income component of portfolios will provide compelling returns both in absolute and relative terms going forward and thus, emerging market debt should be an important return driver of fixed income portfolios. Further, we believe private credit/asset backed lending in emerging markets will continue to provide equity-like expected returns but benefit from strong risk mitigation factors including seniority, credit quality and collateral packages. Lastly, we expect special situations to continue to provide compelling non-correlated returns.

We feel good about the bold call we made last quarter wherein we said:

“We expect a stabilization at or around current levels in our asset class which we believe could provide a very attractive entry point to increase exposure for expected outsized returns over 12-24 months. We acknowledge the bumpy flight/turbulence that may be ahead, but we believe the non-recoverable mistake here is to miss the flight altogether.”

We remain constructive and believe we are positioned as such, yet, after a 10%+ recovery in Q4 in emerging markets debt, we are “tightening the seat-belt” by selectively taking profits on Q4 trades, raising cash, and again considering put-spread hedges. We are doing so merely to assess the impact of both the new issue market and exogenous drivers of volatility as well as to remain nimble and dynamic with our asset allocation and security selection.

Top-Down Observations

For the vast majority of investors, including in emerging markets, 2022 was mostly about sharp changes in policy interest rates in advanced economies and, more generally, the dramatic shift in the global liquidity regime as central banks scrambled to contain inflation that proved much higher and more persistent than they anticipated. In 2023, investors will be navigating what remains of this interest rate risk while also having to deal with the now more important credit/earnings risk factor associated with the slowing global economy.

Let’s start with the good news. After reaching levels not seen in some 40 years, inflation has started coming down in most advanced economies and will continue to do so in the early months of the new year. When it comes to the world’s most influential central bank, this likely translates into the end of the Federal Reserve’s notably front-loaded hiking cycle. Having said that, markets disagree with the majority view on the Fed’s policymaking committee when it comes to both the peak of the rate cycle and the timing of subsequent interest rate hikes. The eventual reconciliation of these two differences are potential sources of market volatility as the interest rate risk gives way to risks associated with the growth outlook.

All three systemically-important economic regions – China, the Eurozone and the United States – are slowing down simultaneously, but for different reasons. Thus, the concern is not just about low global growth but also recessionary conditions.

The immediate uncertainty surrounding China’s growth outlook is due to the complexity of exiting its zero-COVID policy while mRNA vaccine immunity remains too low. The longer-term uncertainty relates to the need to revamp the country’s growth model now that the changed globalization process no longer constitutes an important tailwind for the country’s economic and financial development.

The Eurozone is dealing with the deepest set of supply disruptions, particularly as they pertain to the supply of gas and other energy sources. Rewiring these supply chains and improving inventory management is a multi-year issue, especially at a time when, after some initial hesitancy, the European Central Bank (ECB) has been forced to embark on its own aggressive interest rate hiking cycle.

The threat to U.S. growth comes from policies and, in particular, a Fed scrambling to contain inflation and re-establish its policy credibility and reputation. Many economists and market participants worry that the Fed, having fallen behind due to its protracted mis-characterization of inflation as “transitory” and then being initially too timid in adjusting its policy stance, will overdo it and tip the economy into a recession. While the consensus is that this recession will be “short and shallow,” fragilities in the economy suggest that, while hoping the U.S. avoids a recession, it is advisable to keep an open mind on how it will evolve should it materialize. This is particularly important as the migration of inflation drivers from the goods sector to services increases the threat of inflation proving sticky above the Fed’s 2% inflation target.

This global macro-outlook has three main implications for investors. First, major growth uncertainties mean that investors need to think much more carefully about how best to navigate credit and corporate earnings risks. Second, they need to do so at a time when certain individual valuations, especially in emerging markets and other segments with long-standing structural mismatches, have already over-adjusted to these risks while many major markets as a whole remain expensive. Third, there is a tail risk of the simultaneity of interest and credit/earnings risks unleashing market malfunctions in those segments where leverage and debt are excessive and valuations are still lagging realities on the ground.

Judging from this top-down analysis, 2023 is likely to be a year where highly-differentiated investment approaches, careful name selection, smart structuring, and timely reactions will be particularly important in delivering high risk-adjusted returns. It is likely to be a year that will see risk mitigation potentially return to well diversified portfolios as interest rate risk exhausts itself. And, it is likely to be a year that puts a premium on a bar-belled approach to emerging market investing as opposed to a passive one that is inherently vulnerable to the possibility of debt distress in certain countries facing acute external and internal headwinds.

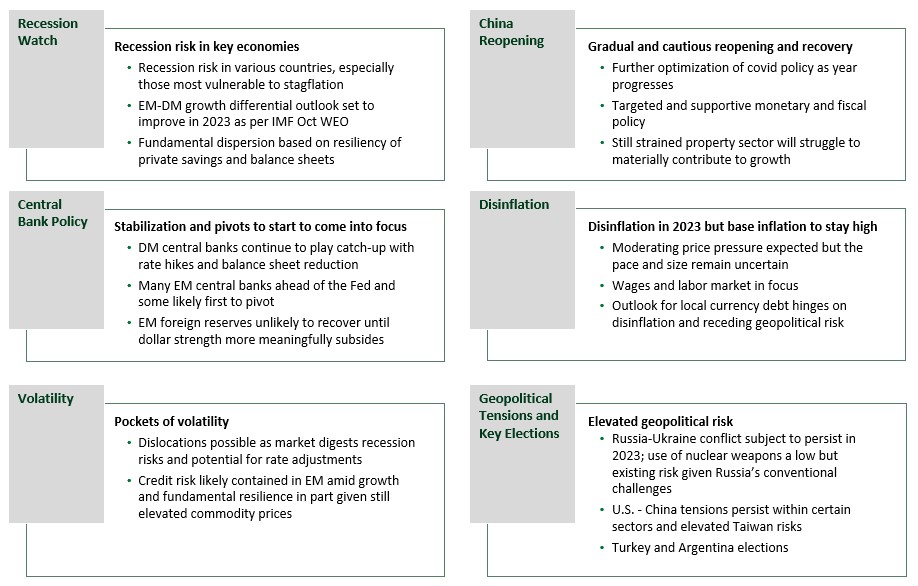

Themes Influencing Investment Decisions in 1Q 2023

Source: Gramercy. As of January 9, 2023. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any forecasts made will come to pass. There can be no assurance that investment objectives will be achieved. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Recession Watch

Economic activity weakened in 4Q as major global central banks continued to hike policy rates and withdraw liquidity while price pressure persisted. Global PMI extended its path into contractionary territory through November led by the U.S. and Europe as well as China which remained constrained by COVID restrictions and its struggling property sector. As highlighted throughout this year, net commodity exporters with low linkages to CIS and Europe, largely in Latin America and Africa, have had more resilient growth dynamics with net commodity importers facing the greatest headwinds. From a sector perspective, industrial and goods sectors, particularly in Asia, remained more pressured while services and consumer sectors continued to benefit from recovery, albeit with waning momentum.

Looking ahead for this quarter and the new year, we expect growth to continue to face headwinds from financial tightening, particularly in the U.S., along with energy constraints, specifically in Europe, keeping the chances for recession high. Our base case envisions a mild U.S. recession (that is not necessarily akin to typical recessions) where activity contracts moderately, disinflation occurs, allowing for eventual stabilization and evolution of the policy adjustment but labor market destruction may not be as significant as in past contractions. This along with nearshoring, sticky services pricing and other factors should keep inflation above the Fed’s current target of 2.0% this year.

In China, activity should gain momentum in 2023 relative to 2022 where domestic consumption increases as looser COVID policies take hold. We think that authorities will adopt similarly supportive fiscal and monetary policies to offset a still weak property sector bringing growth to around 4.5% with room to the upside in the event pent-up demand amid COVID relaxation or property sector recovery exceeds expectations.

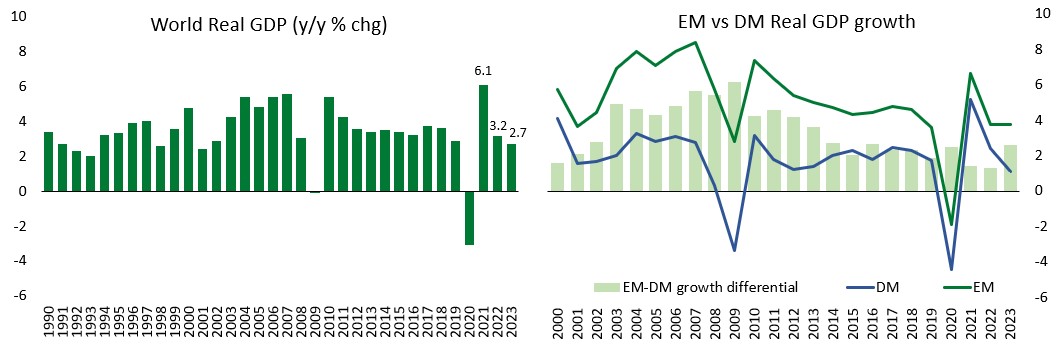

Overall, signs of credit resiliency remain with solid corporate balance sheets although savings erosion has picked-up. Importantly for the EM asset class, the EM-DM growth differential is set to improve next year (by 130bps to 2.6% pts as per IMF WEO assumptions), despite likely subpar global growth below the IMF forecast of 2.7% (vs. historical 30yr avg of 3.7%). Please see Exhibit 1.

Exhibit 1: EM-DM convergence to pick-up pace despite subpar global growth

Source: IMF, Data is most current available as of December 31, 2022.

Disinflation dynamics likely to gain momentum from still elevated levels

Markets already witnessed some initial tangible signs of disinflation in 4Q when a few EM economies reported decelerating price increase trends and/or lower than expected monthly inflation prints in consecutive months. We expect this trajectory to gather steam in early 2023 as more economies in EM and some DM jurisdictions start to see “peak inflation”. Absent any new material shocks to the global macroeconomic environment, gradual disinflation from still elevated levels should be supported by favorable base effects but also by fading inflationary impacts from the consecutive shocks in recent years, the global pandemic and the war in Ukraine. Also, ongoing relaxation of “zero-COVID” policies by the Chinese government should help in that regard.

The inflation outlook in DM will remain the key driver of market sentiment as we look forward to 1Q. As inflation forecasts for the Eurozone have been revised higher by the ECB, Europe is the most likely source of negative inflation news flow. However, EU political leaders recently reached an agreement that has remained elusive for many months, capping the price at which the block buys natural gas. The capping mechanism is set to come into effect around the middle of 1Q23 and should provide welcome relief on EU consumer price dynamics just as weather conditions start to improve. We are also expecting an improving inflation backdrop in the UK as the Bank of England (BOE) lifted interest rates to the highest level in 14 years. On the other side of the Atlantic, during 1Q23, investors will be looking for confirmation that U.S. CPI inflation has also peaked after a string of constructive surprises to downside materialized at the end of 2022.

As inflation headwinds begin to retreat, monetary policy pivots likely to come into focus

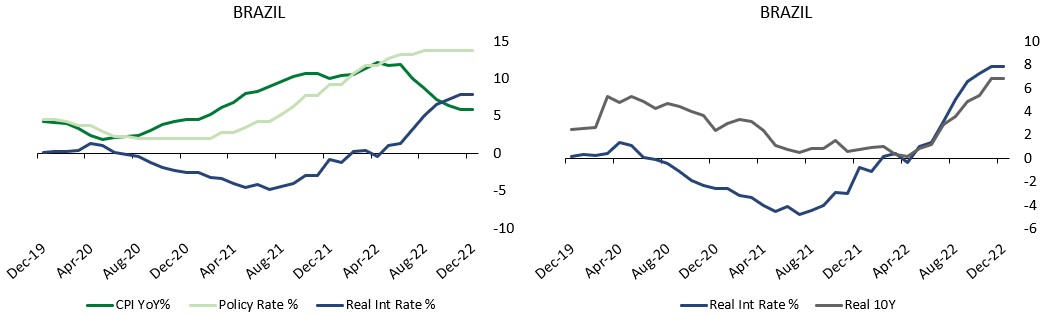

In an effort to tame inflationary pressures within their domestic economies and pre-empt tightening of global financial conditions by the systemic central banks, economic policymakers in many jurisdictions within the investible EM universe have delivered aggressive monetary policy tightening in recent quarters. As disinflation likely starts to settle in, those EM economies that benefitted from competent and credible economic policy management throughout the high inflation environment of the post-pandemic/Ukraine war period and built-up high nominal interest rate buffers could be in a position to pivot toward easing monetary policy, thus supporting economic activity. The best such example in EM comes from Brazil (please see Exhibit 2) where the authorities have delivered close to 1200bps of rate tightening since 2021 and are well positioned to start cutting rates in 2023, subject to fiscal developments under the newly elected Lula Administration that took office on January 1, 2023 and their impact on the inflation outlook.

Exhibit 2: Select EM jurisdictions enter 2023 with high real interest rate buffers and potential to start cutting rates as the year progresses.

Source: Bloomberg, Central Bank of Brazil (BCB). Data is most current available as of December 31, 2022.

From a global perspective, a pivot to a less hawkish monetary policy signaling by the systemically important institutions and a potential respite in USD strength as the Fed dials down its rhetoric could “lift many boats” in EM. This being said, we think that dovish pivots in DM will be gradual and subject to considerable variation as some systemic central banks continue to play catch-up with rate hikes and balance sheet reduction. Given the more challenging inflation outlook that we discussed in the previous section, we expect the ECB to sound most hawkish among its peers in 1Q, signaling strong willingness to deliver further rate hikes, remaining in restrictive territory for as long as necessary to tame inflationary pressures, and starting quantitative tightening. This could drive sporadic episodes of more pronounce risk-off tone in markets during the quarter. However, provided U.S. inflation does not surprise to the upside, next quarter could be a period when markets start to price more meaningfully a Fed pivot to slower paced and smaller magnitudes of rate hikes throughout 2023, which would be a constructive development for EM assets, all else being equal.

China Reopening

Last quarter, we wrote that we saw the conclusion of the Party Congress as a gateway to relaxation of zero-COVID policy. While accurate, we have been surprised with the speed of unwinding of measures thus far including: elimination of mass PCR tests and requirements for public venues as well as more refined designation of high-risk jurisdictions. Authorities are attempting to ramp-up health care facilities and vaccinations amid more widespread circulation of the virus. This follows bouts of unrest against the stringent measures the government has deployed through COVID waves since the start of the pandemic. This, combined with further property measures announced in 4Q, including extension of developer loans for up to one year, stabilization of financing from asset management products, issuance of special loans for guaranteed buildings to accelerate completion of overdue projects, support for M&A of stranded projects, and extended time for banks to reduce exposure to the sector, sets the stage for stronger growth in 2023. Following the Central Economic Work Conference in 4Q, which focused on targeted growth-oriented policies, we think that the NPC in March is set-up for release of a solid growth target around 5%. As international travel restrictions are lifted, we see tourism-oriented countries within the region, such as Thailand, as beneficiaries. Key goods exporters to China such as Malaysia should also benefit.

Turning Focus to Pivotal 2023 Elections: Argentina & Turkey

Argentina’s electoral period should begin to heat-up in the latter part of the first quarter as candidate announcements are made ahead of the June registration deadline and August primary vote, also known as the PASO. Within the opposition coalition, Juntos por el Cambio, the possible contenders include Horacio Larreta, current Governor of the City of Buenos Aires, Patricia Bullrich of the radical wing, and former president Mauricio Macri. There is elevated uncertainty over the possible ruling Frente de Todos (FdT) coalition candidates as current President Alberto Fernandez remains highly unpopular and Vice President Cristina Kirchner has stated she does not intend to run. While Sergio Massa, current Minister of Economy and long-time politician, could be the FdT candidate, he faces challenges in bringing inflation down and sustaining growth this year. Given the fragile macroeconomic backdrop and low support for the current government, our base case is for an opposition victory in October with improved governability that sets the stage for a constructive shift in policymaking as well IMF and debt management, which should be supportive for Argentine asset prices.

Turkey is set to hold presidential and parliamentary elections before the end of June 2023, with the most likely dates from mid-May to mid-June, in our view. As such, 1Q23 will be a critical period for determining the outcome of what could be the most consequential elections in Turkey’s modern history. Although in late 2021 and early 2022 it appeared that President Erdogan might be losing voter support and could be headed for a potential exit after the elections, he has managed to recover considerable ground recently and the momentum seems to have shifted back in his favor. Unprecedented currency volatility and cost of living increases seem to have been somewhat offset by the aggressive use of fiscal and monetary space by the Erdogan Administration to assuage voter concerns and provide a policy induced short-term boost to economic activity and consumer demand. Turkey’s unique position as interlocutor with both Russia and Ukraine and Erdogan’s active role on the geopolitical scene amid the ongoing conflict in Turkey’s immediate neighborhood has also supported the President’s domestic political standing as reflected by his steady recovery in the polls.

For its part, the six-party opposition coalition has not been free of political bickering and some high-profile PR-mistakes and 1Q23 will likely prove to be a vital time for the anti-Erdogan alliance to agree upon a competitive candidate to stand against Erdogan. In an important pre-election twist that we expect will play out over 1Q, Ekrem Imamoglu, the popular Istanbul Mayor from the main opposition party, CHP, was sentenced by a court in December to more than two years in prison for “insulting public officials”; the verdict will be appealed by Mr. Imamoglu in front of higher courts. This has likely introduced an additional layer of complexity in the political dilemma in front of the opposition alliance led by CHP, whose long-time leader Kemal Kilicdaroglu appears keen to run against Erdogan. On one hand, given valid concerns about the lack of independence of Turkey’s judicial system, if in 1Q23 Imamoglu gets the opposition nomination, there is risk that an unusually speedy appeals process could conclude before the elections and disqualify him from running (in case the guilty verdict gets confirmed). On the other, this could be an excellent opportunity to galvanize potentially increasing discontent by voters who see Imamoglu’s legal problems as a political sham designed to distract attention from Turkey’s acute macroeconomic imbalances and unprecedented cost of living increases under the current economic policies of the Erdogan Administration.

Ahead of what we expect to be one of the most consequential elections in emerging markets for years, opinion polls have consistently showed Imamoglu prevailing over Erdogan in a hypothetical second round run-off election scenario. However, uncertainty surrounding the legal proceedings against the Istanbul Mayor and a combination of aggressive domestic economic stimulus and smart geopolitical maneuvering by Erdogan appear to have shifted the political momentum back in favor of the incumbent in recent months. In such a highly dynamic domestic political context, the outlook for Turkish market assets remains clouded by increasingly dense cloud of uncertainty and hinges heavily on political developments in early 2023.

No basis for peace talks in Ukraine during 1Q23, conflict could re-escalate as winter recedes

Russia’s internationally unrecognized annexation of four Ukrainian regions in late September 2022 and the subsequent significant territorial gains in those same regions by Kyiv’s forces in the last quarter of 2022 have left the two sides without any tangible common ground for peace negotiation; as such, we expect the conflict to linger in the near future and certainly throughout the first quarter of 2023. Relatively isolated regional fighting amid the current harsh winter conditions in Ukraine could quickly intensify as milder weather arrives toward the end of 1Q23. We do not anticipate material changes in the significant financial and military support that Ukraine has been receiving from its Western allies during the 10 months of the conflict thus far, which should enable Kyiv to continue fighting with the objective to retake all territories that were under Ukrainian control prior to the start of the Russian invasion in February 2022. As Russian defenses appear to have consolidated lately, we expect any further progress in Ukraine’s counteroffensive in the South and East of the country to be difficult and slow. A such, we do not anticipate major breakthroughs from a military and/or peace perspective in 1Q23.

Investment Strategy Review and Outlook

Multi-Asset Strategy

We believe the strategy is well positioned to participate in the potentially significant upside we believe we will see in the next 12-24 months while still providing downside protection on this likely bumpy journey to recovery.

We continue to prefer hard currency over local currency but see great opportunities in local currency into 2023 as soon as we experience the USD peaking. We favor corporates over sovereigns from a fundamental perspective but like certain stressed EM sovereign issuers from an opportunistic point of view given very appealing valuations in expected restructuring outcomes. We also favor quality high yield corporates (HY) with attractive valuations but are now leaning more towards investing our cash into high quality long-end investment grade (IG) issuers having massive convexity after the recent UST selloff.

We will not hesitate to redeploy cash if and when markets pull back. That being said, we believe the current barbell of hard currency emerging markets debt and capital solutions on one side and opportunistic credit, special situations and cash on the other side will continue to permit us to preserve capital in down markets and substantially participate in up markets.

Emerging Markets Debt

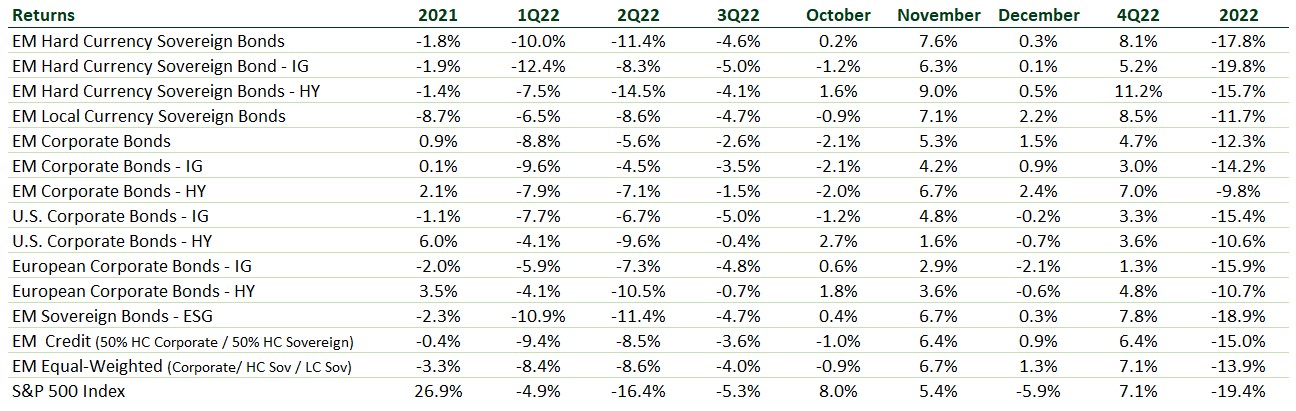

2022 was a year to forget with emerging markets performance negatively impacted by the perfect storm of a faster than expected tightening in global financial conditions (U.S. 10-year Treasury widened by 214bps), a major geopolitical conflict in Eastern Europe with Russia’s invasion of Ukraine in mid-February and a significant slowdown in one of the world’s leading growth economies (China) driven by an aggressive COVID containment policy. Please see Exhibit 3.

-

- As we expected, and in-line with our positioning, corporates outperformed sovereigns (hard and local currency) and HY outperformed IG. HY corporates, driven by lower duration, solid fundamentals and high carry, posted the best performance in 2022. Hard currency IG sovereigns, the EM sub-asset class with the highest duration, unsurprisingly performed the worst.

- On a relative basis versus developed markets, EM IG corporates outperformed both U.S. IG and EUR IG in 2022. Similarly, EM HY corporates also outperformed both U.S. HY and EUR HY.

Exhibit 3: Global Market Index Returns

As of December 31, 2022. Source: JPMorgan, Bloomberg. Past Performance is not necessarily indicative of future results.

After an extremely tough year, we expect 2023 to be more positive with EM’s high carry, a relatively stable rate environment and a China reopening story to support high single digit to low double digit returns for the asset class. While uncertainty remains regarding the macro backdrop, with potential recessions threatening the outlook in key economies, we remain cautiously constructive on EM debt given the level of drawdown already experienced in 2022, strong fundamentals and a good technical picture. As such, we believe that current levels provide a good entry point for investors wanting to participate in the upside we anticipate over the next 12-24 months. Nonetheless, active management is critical to manage the risks posed by the uncertain external environment.

-

- Going into 2023, more supportive technicals, resilient fundamentals and compelling valuations should mitigate the potential for further outflows.

- According to JP Morgan data, EM bond funds experienced significant outflows of approximately U.S. $90bn in 2022 (split relatively evenly between hard currency and local currency). This level is close to previous cyclical bottoms and suggests that investor positioning in EM is likely to be at multi-year lows. This means that the flow picture could be skewed to the upside in 2023.

- An anemic primary issuance market in 2022 led to a reduction in the size of the EM fixed income market for the first time in over two decades. While 2023 is expected to be a slightly stronger year in terms of primary issuance (at least for EM corporates where the projection is 50% higher than in 2022), net financing is expected by the broader market to be negative for a second year in a row at ($43bn) for EM sovereigns and ($70bn) for EM corporates.

- From a fundamental perspective, we believe EM corporates have the healthiest balance sheets in over 10 years, providing a significant buffer for navigating inflationary pressures and/or growth concerns. EM net leverage is 1-2x lower than DM comparables with EM corporate IG and HY net leverage of 1.0x and 2.2x, respectively (vs. 2.4x and 3.8x for U.S. IG and HY, respectively). We expect credit metrics to remain stable in 2023 as many EM economies start to turn the corner on inflation and growth expectations are stable for most EM economies.

- Despite better fundamentals, we believe EM corporates have been overly penalized for being in the wrong zip codes. As such, investors are currently paid 2.0x more to own EM HY vs U.S. HY and 3.6x more for EM IG vs U.S. IG.

- Sovereign fundamentals are more dispersed than corporates because there has been a transfer of resources from public to private. As a result, sovereign debt burdens have grown heavier across the board with the extent of deterioration varying depending both on the scale of measures implemented and their effectiveness. While a greater level of differentiation is needed for sovereigns due to these factors, sovereign valuations have largely priced in weaker fundamental conditions with a historic number of sovereigns trading at distressed levels. EM sovereign HY offers 311bps over U.S. HY (versus a 5-yr average of 174bps).

- We believe the coming quarter will be important from a global risk sentiment perspective as looming recessions in the U.S. and Europe will make investors grapple with the question of how bad those recessions could be. While macro uncertainty is likely to remain high on the back of mixed economic data, relatively stable rates, a more positive technical picture, resilient fundamentals and compelling valuations are likely to support attractive returns in 2023.

- Given this confluence of factors, EM’s high carry should dominate the return outlook in 2023. In this context, we prefer corporates over sovereigns given better fundamentals and technicals and HY over IG given valuations. EM local has become tactically attractive after two years of negative returns and EM central banks that may be first to pivot.

Capital Solutions

We identify a number of trends that will continue shaping the asset class in the following months, as well as new market dynamics that we will need to monitor and could present attractive opportunities to continue our deployment momentum. The higher interest rate environment that characterized the last few quarters did not slow down the momentum of our investment cycle. The primary issuance in the public markets took a severe downturn this past year and we expect volatility to continue in the year ahead. We believe private credit/asset-backed lending continues to offer compelling investment opportunities for investors as well as attractive funding alternatives for borrowers who need to bridge the downturn in public markets. The investment thesis has evolved over the last year. It went from a spread differential to public securities priced to perfection, to one of asymmetric returns based on cash plus equity-like upside with robust downside protection. This is the case because private credit remains one of the few alternatives to finance corporates’ medium and long-term business plans. Additionally, given current market conditions and more limited access to local bank financing in many emerging market countries, we have come across several attractive investment opportunities in bigger, more developed companies that yield similar returns to what we have normally seen in smaller and medium enterprises in the past few years.

During the past couple of months, financing opportunities ranged from portfolios of credit card loans to the resurgence of the travel industry post COVID through airport concessions. Similarly, the team continued funding the credit platform activities in agribusiness in Brazil as well as inventory financing and factoring in Peru. During 2022, the Capital Solutions team closed more than 14 transactions, maintaining a high deployment rate throughout the year. Our robust pipeline presents opportunities that are diversified in both industry type and geography. The flow of transactions we see gives us a good opportunity to capitalize existing trends, as well macro themes that we expect to see in 2023, like a potential peak in the hiking cycle. We continue adding floating rate assets to our portfolio and focusing on tightening our underwriting standards to further protect the downside by seeking, when possible, lower LTV’s and the addition of uncorrelated collateral.

From an ESG perspective, our updated policy continues to be an integral part of our underwriting process and post-closing monitoring of the credits. Our investments follow a thorough ESG due diligence, that may include third-party consultants who guide us on conducting a gap analysis with the IFC performance standards and, jointly with our borrowers, developing an action plan to address any identified issues. Additionally, we will continue making efforts to switch from a “negative screening” to a “positive screening” approach to deal sourcing and underwriting, where we will aim to target companies that generate positive social, environmental, or financial benefits to their local space and/or the global community.

Alternative Credit

Since May of 2020, when Gramercy published “Emerging Markets Debt Relief and The Paradigm of Non-Payment”, we have taken a rather cautious approach to underwriting EM sovereign risk. At the time, we argued that holdover challenges from the Global Financial Crisis – including weak balance sheets, limited fiscal and monetary maneuvering space and insufficient external buffers – made EM sovereigns particularly vulnerable to the impending stimulus challenges of the COVID pandemic. Last year, global commodity shocks coupled with global interest rate normalization further strained sovereign balance sheets, leading to a record number of sovereign defaults in the 2020 to 2022 period with over $200bn in face value. As a result, sovereign bond prices plummeted with over 40% of total sovereign bonds trading below 80ct on the dollar by mid-2022.

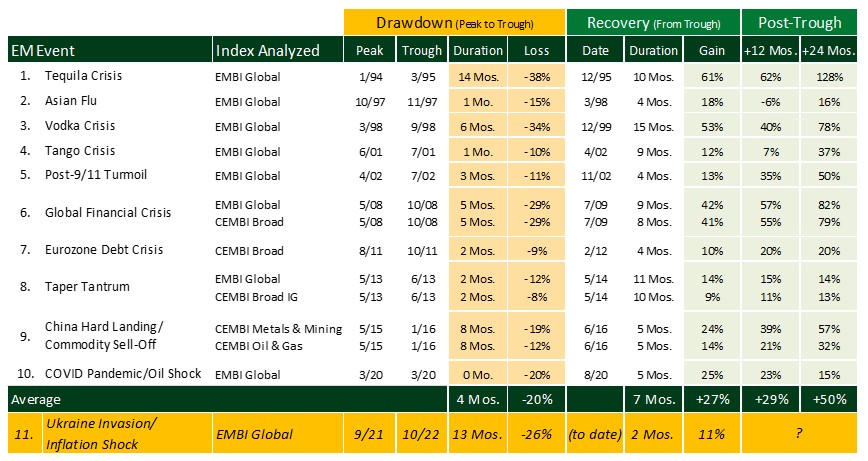

Clearly, this is not the first time emerging market credit has experienced significant price declines. Since the mid-1990s, emerging market credit has experienced 10 major dislocations with an average drawdown of 20% that occurred over an average of four months. The recovery period typically required seven months, delivering an average gain of 27% from trough-to-peak. When observed over longer recovery periods, post-trough returns have delivered 29% (over 12m) and 50% over 24m. Please see Exhibit 4.

Exhibit 4: A selection of the largest EM debt drawdowns and the related recoveries.

As of January 3, 2023. Source: Bloomberg, JPMorgan. Past performance is not necessarily indicative of future results. All performance is quoted as index total returns. JPMorgan Emerging Markets Bond Index Global (EMBIG Index) tracks total returns for U.S. Dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index start date is Jan 1, 1994. The CEMBI Broad Index is the most comprehensive investable universe of corporate bonds, tracking total returns of U.S. Dollar-denominated debt instruments issued by corporate entities in Emerging Markets countries.

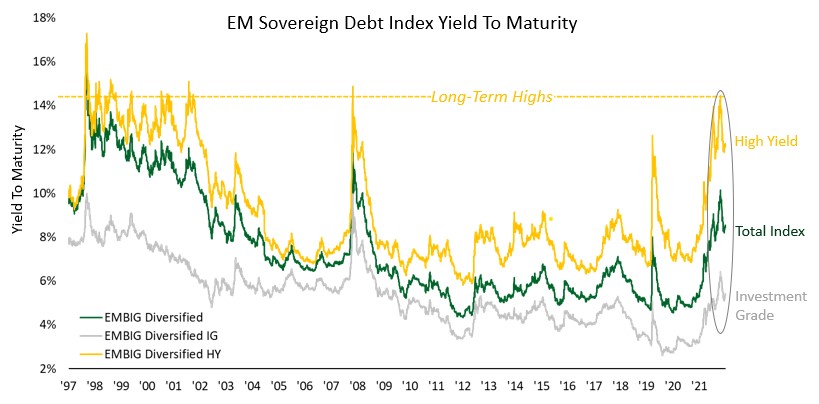

The investment team believes that the current dislocation in EM sovereign credit is analogous to previous dislocations. By the start of Q4 2022, EM sovereign bonds dropped -26% from peak to trough over the preceding 13 months. While the dislocation has been broad based, high yield sovereigns have borne the brunt of the pricing pressure. For example, the yield to maturity in the EMBI Global Diversified HY Index is trading close to the maximum levels seen in the Global Financial Crisis and close to all time ‘wides’. Please see Exhibit 5.

Exhibit 5: Yields as high as we’ve seen in decades, especially in the HY opportunity set.

As of December 6, 2022. Source: Bloomberg, JPMorgan. The Emerging Market Bond Index Global Diversified (EMBIG Diversified) and its relevant sub-indices provide full coverage of the USD-denominated EM sovereign bond asset class with representative countries, investable instruments (sovereign and quasi-sovereign), a diversified allocation scheme and transparent rules.

When looking at stressed/distressed sovereign credit, we seek assets that are cheap compared to a consensual restructuring that we believe we can help achieve, not just cheap because prices have declined. When looking at dislocated sovereign credit, we look to ensure that the element of distress arises from liquidity constraints rather than fundamental concerns and that the dislocation should normalize after two years.

Gramercy continues to seek out compelling sovereign ‘plus’ platform opportunities like those we already have in Colombia, Mexico and Angola. These platforms typically offer pure sovereign credit risk, but deliver excess alpha by giving up modest liquidity concessions. Gramercy also continues to source investment opportunities in compelling litigation claims against EM governments. In these special situations, we usually look to unlock value through arbitration management and/or innovative settlement solutions. As we start 2023, the Alternatives team will look to deploy capital within these selective, sovereign opportunities.

Special Situations

We are pleased that the ICSID arbitration panel decision recognized Peru’s breach of its treaty obligations to U.S. investors and awarded compensation to Gramercy, whose investors include millions of pensioners, unions, universities, endowments and foundations that have patiently waited many years for this outcome.

The arbitration tribunal ruled in Gramercy’s favor on its main claim and rejected Peru’s objections to the tribunal’s jurisdiction and the admissibility of Gramercy’s claims. In addition, the tribunal awarded Gramercy approximately $100 million in damages and costs, which is significantly more than the approximately $861,000 Peru offered under its 2014 Supreme Decrees. The base financial award will continue to accrue compound interest at a rate of 7.22% until full payment.

The tribunal found that, despite directions from Peru’s highest constitutional court to pay the long-matured bonds at their properly updated value, Peru’s Ministry of Economy and Finance established a payment formula and bondholder compensation process that were arbitrary and unjust, did not comply with the constitutional court’s instructions, and were designed to minimize the amounts payable to bondholders. The tribunal also established that several aspects of the Ministry’s payment formula had no reasonable justification, that Peru’s witnesses and experts could not explain key elements of the formula, and that the Ministry’s approach could be explained only by the improper goal of reducing the amounts that bondholders would receive.

Additionally, the tribunal found that the payment process gave the Ministry unfettered discretion over how bondholders would be paid that was not justified by any rational standard, singled out Gramercy for unfair treatment, and improperly curtailed the rights to which all bondholders were entitled under Peruvian law. The tribunal held that Peru had failed to accord Gramercy the minimum standard of treatment required under the Treaty and international law.

The tribunal agreed with Gramercy that the agrarian reform bonds are a protected form of Peruvian public debt; that the Treaty covered U.S. financial investors like Gramercy; that when Gramercy invested in the bonds it could legitimately expect that Peru would honor them without needing to resort to the courts or to arbitration; and that Gramercy’s investment in these bonds created a secondary market that contributed to Peru’s economic development more generally.

Elsewhere, our litigation finance investments are performing as-expected and proving to be uncorrelated.

We are currently underwriting a material pipeline of litigation finance opportunities including international arbitration, mass torts with ESG and impact characteristics and factoring of litigation settlements. We will look to risk mitigate these opportunities with insurance wrappers to protect our invested capital.

Conclusion

The dislocation of 2022 was one of the most material we have seen in EM for 25+ years. Historically, recoveries that have followed these drawdowns have been very impressive and painful to miss. We believe that recovery started in Q4 2022 and will continue in 2023. The journey may be bumpy, but if proper asset allocation and security selection are employed (fastening of seat-belt) to respect the dispersion of outcomes that we expect, then the destination warrants the volatility. We intend to embrace the volatility by running core, long portfolios and by adding risk in oversold markets and then reducing that exposure when markets recover/become over-bought. Much of this volatility will be amplified by the combination of illiquidity in markets and everyone looking to buy or sell at the same time. As such we believe that providing liquidity by being a buyer in dislocated markets and a seller in over-bought markets will provide additional return to our portfolios. This is yet another way to plan the trade and trade the plan.

Happy New Year!

About Gramercy

Gramercy is a dedicated emerging markets investment manager based in Greenwich, Connecticut with offices in London, Buenos Aires, Miami and Mexico City, and dedicated lending platforms in Mexico, Turkey, Peru, Pan-Africa, Brazil, and Colombia. The firm, founded in 1998, seeks to provide investors with attractive risk-adjusted returns through a comprehensive approach to emerging markets supported by a transparent and robust institutional platform. Gramercy offers alternative and long-only strategies across emerging markets asset classes including multi-asset, private credit, public credit, and special situations. Gramercy is a Registered Investment Adviser with the SEC and a Signatory of the Principles for Responsible Investment (PRI), a Signatory to the Net Zero Asset Managers initiative and a Supporter of TCFD. Gramercy Ltd, an affiliate, is registered with the FCA.

Contact Information:

Gramercy Funds Management LLC

20 Dayton Ave

Greenwich, CT 06830

Phone: +1 203 552 1900

www.gramercy.com

Joe Griffin

Managing Director, Business Development

+1 203 552 1927

[email protected]

Investor Relations

[email protected]

This document is for informational purposes only, is not intended for public use or distribution and is for the sole use of the recipient. It is not intended as an offer or solicitation for the purchase or sale of any financial instruments or any investment interest in any fund or as an official confirmation of any transaction. The information contained herein, including all market prices, data and other information, are not warranted as to completeness or accuracy and are subject to change without notice at the sole and absolute discretion of Gramercy. This material is not intended to provide and should not be relied upon for accounting, tax, legal advice or investment recommendations. Certain statements made in this presentation are forward-looking and are subject to risks and uncertainties. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account information currently available to us. Actual results could differ materially from the forward-looking statements made in this presentation. When we use the words “believe,” “expect,” “anticipate,” “plan,” “will,” “intend” or other similar expressions, we are identifying forward-looking statements. These statements are based on information available to Gramercy as of the date hereof; and Gramercy’s actual results or actions could differ materially from those stated or implied, due to risks and uncertainties associated with its business. Past performance is not necessarily indicative of future results. This presentation is strictly confidential and may not be reproduced or redistributed, in whole or in part, in any form or by any means. © 2023 Gramercy Funds Management LLC. All rights reserved.