Contents

Market Overview

Macro Review

Turkey’s humanitarian crisis unfolded with two significant earthquakes. The Borsa Istanbul circuit breakers went off five times this week, before the stock exchange was closed until February 15. Meanwhile, President Erdogan announced TL100bn ($5.3bn) in stimulus measures, with spending expected to reach 5.5% of GDP. Elsewhere, Powell’s interview with David Rubenstein, hawkish Fedspeak and the underwhelming 30-year U.S. Treasury triggered sizeable volatility in core rates this week. Powell noted that the disinflationary process had begun but it struck a discord with Larry Summers’ on inflation complacency. Across Fedspeak, Cook suggested that the Fed was not done with raising rates and ought to remain sufficiently restrictive. Waller stated that rates will be higher for longer, while Williams suggested that a terminal rate of 5.0-5.25% was still reasonable. However, after a strong NFP, Bostic expects the FOMC will need to raise interest rates to a higher peak. In short, there is a higher probability of an increase in the December SEP from 5.1% to 5.25% in March, and GS had also reduced the probability of a U.S. recession from 35% to 25%. In Europe, the delayed German CPI unexpectedly fell to 9.2%. This reflects a 5-month low and is the third consecutive decline since the peak of 11.6% in October. This data-point came as the EuroStoxx 600 hit a 10-month high, the DAX rose to a one-year high and the FTSE 100 reached an all-time high in the prior week. This coincided with European natural gas prices falling to a 17-month low. Further volatility was trigged in Sweden after the Riksbank hiked rates by 50bp but signaled QT would begin in April, which saw SEK appreciate 2.4% and government bonds widened 23bp on Thursday. In Asia, Chinese CPI rose by 2.1%, which reflects its fastest pace in three months and follows a spending surge after Lunar New Year celebrations, which was followed by Fitch raising its 2023 GDP forecast to 5.0% from 4.1%. Balloons and espionage remain ancillary factors that haven’t moved markets. The daily drama around the Bank of Japan’s next governor also continued. The new front-runner is Kazuo Ueda, who is a relatively unknown candidate and the debate around whether the Central Bank will scrap YCC will naturally ensue.

EM Credit Update

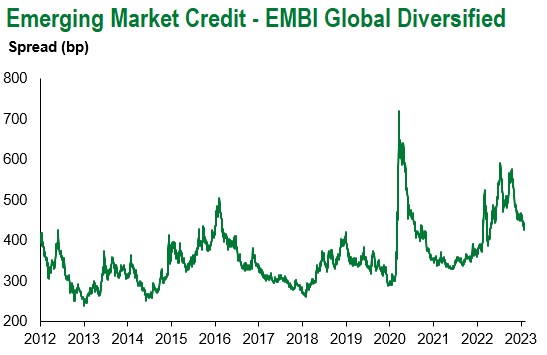

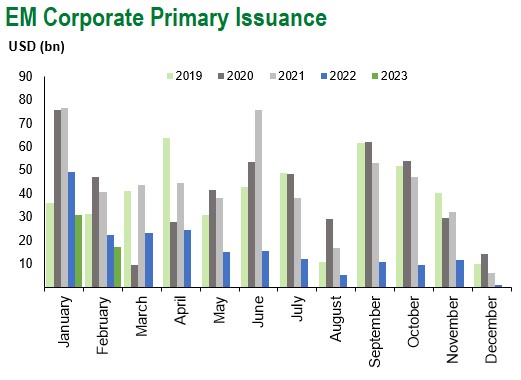

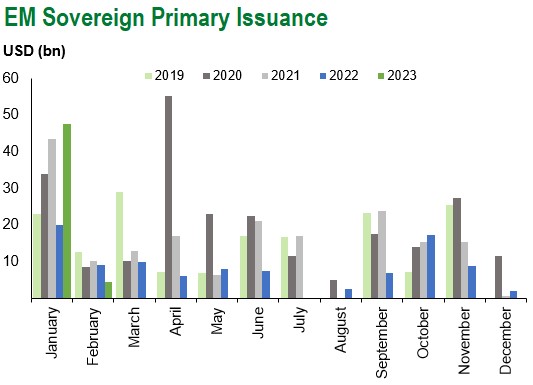

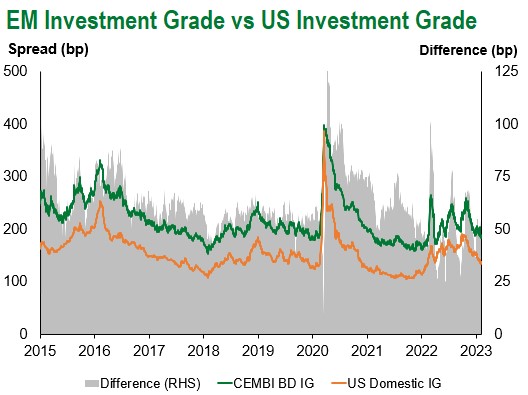

Emerging market sovereign credit (cash bonds) ended the week -1.4% with spreads 10bp wider. The underperformance this week simply offset the outperformance in the first week of February. The main source of underperformance was also linked to U.S. Treasuries that widened 14-20bp. Sovereign outperformers over the week were Pakistan, Papua New Guinea and Pakistan, while Ecuador, Zambia and Ukraine underperformed. EM issuance stepped up again this week and was a notable theme with $22bn in supply.

The Week Ahead

If market participants aren’t following the election in Cyprus on Sunday, then the Superbowl may be an alternative. The BOE may have already signaled it is near the end of the tightening cycle, but data releases covering unemployment, retail sales and inflation will determine the future course. Meanwhile, Euro-area industrial production will follow after German inflation hit a five-month low. Russian GDP is also due but frankly, there is more focus on why oil production was cut by 500k bpd and whether this is a precursor to ramping-up another invasion against Ukraine. EM interest rate decisions are due from Indonesia (5.75%), Philippines (5.0%) and Uruguay (11.5%). Amidst those, U.S. CPI on Tuesday is the main focus, but also comes with EM releases from Argentina, which is expected to come in at a multi-decade high, followed by other releases from India, Israel, Nigeria, Poland and Saudi Arabia. Finally, Turkey’s current account release will offer a better insight into net errors and omissions. The catastrophic earthquake in Turkey could have significant political implications ahead of elections.

Highlights from emerging markets discussed below: Catastrophic earthquake in Turkey could have significant political implications ahead of elections; President Lasso’s unexpected referendum defeat re-ignites market concerns about political risks in Ecuador; Pakistan and IMF hold talks on pending review; Ghana inches closer to domestic debt deal; and Mexico Central Bank (Banxico) retains conservative bias with 50bps hike.

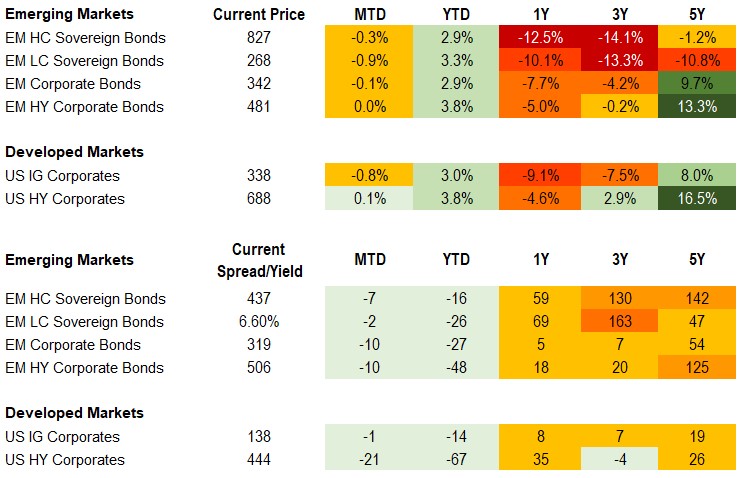

Fixed Income

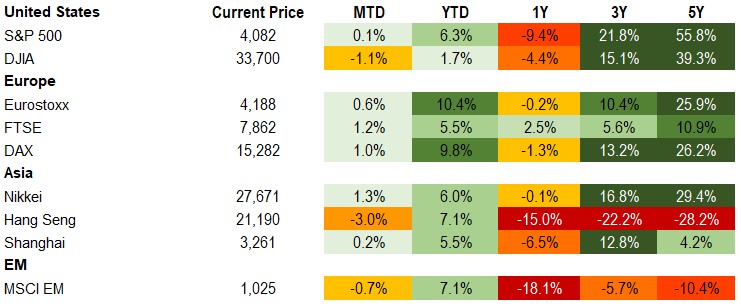

Equities

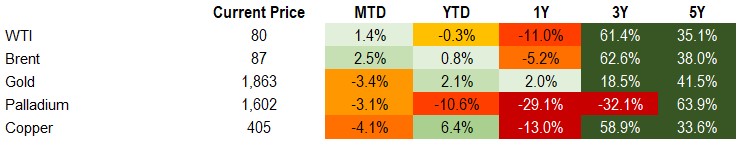

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of February 10, 2023 (mid-afternoon).

Emerging Markets Weekly Highlights

Catastrophic earthquake in Turkey could have significant political implications ahead of elections

Event: Devastating earthquakes hit large regions in southern Turkey and northern Syria, leveling thousands of buildings and causing a humanitarian tragedy with close to 20,000 confirmed casualties and hundreds of thousands injured at the time of writing.

Gramercy commentary: This is the worst natural disaster in Turkey since 1999 when a previous earthquake caused widespread devastation and casualties. Beyond the immeasurable human tragedy, it is likely that the event will significantly alter the political and economic dynamics ahead of critically important Presidential and general elections that are still scheduled for May 14th. The date of the elections has come under question given the significant logistical challenges that will still exist three months from now due to damaged infrastructure and a large number of displaced people in 10 provinces of the country, which have a combined population of close to 15 million of Turkey’s total population of around 80 million. President Erdogan has adopted a hands-on approach to managing the disaster response and announced a state of emergency in the affected areas as well as financial support measures for the victims. While the economic impact remains highly uncertain, it would be reasonable to assume that GDP growth will be negatively impacted in the near-term and inflation, Turkey’s main macroeconomic problem, could see upward pressures given a likely supply shock effect as the areas most affected by the earthquake produce around 25% of food and 40% of clothing consumed in the country. The effects of the natural disaster on the political dynamics are even more uncertain but also likely to be profound. On one hand, major natural disasters tend to favor the incumbent administration, especially if its crisis management and relief efforts in the aftermath of the tragedy are perceived in a positive light by the public. Conversely, a mismanagement of the crisis could backfire politically, especially in the context of the Erdogan Administration’s long-standing close relationship with the construction industry and many questions arising around the quality control and building practices in the devastated areas. Last but not least, from a political perspective, the natural disaster has made it uncomfortable for the opposition to criticize President Erdogan in the midst of his national relief efforts and derailed plans to potentially announce a joint Presidential candidate for the opposition by mid-February.

President Lasso’s unexpected referendum defeat re-ignites market concerns about political risks in Ecuador

Event: On Sunday, February 5, Ecuadorians voted in local elections and a parallel national referendum called by President Lasso’s Administration with eight questions on various political/social topics. All eight questions were rejected by voters and the left-wing party associated with former President Rafael Correa emerged as the big winner in local elections, capturing the mayorships of Quito, the capital, and the main commercial center Guayaquil.

Gramercy commentary: Market expectations pointed to President Lasso prevailing on at least some of the referendum questions, which was seen as a potential avenue toward easing Lasso’s domestic political challenges related to a lack of governability and an extremely difficult relationship with a left-leaning national assembly. Now that the referendum has backfired, investors have grown concerned again about the prospect of a return to power by the populist party of former President Rafael Correa and even the risk of Correa’s potential return to the Ecuador from his exile in Belgium since 2017. We see such concerns as pre-mature at this stage. Although, there are a couple of theoretical scenarios in which Lasso is forced to quit the Presidency that would trigger credit negative early elections in the current context, our base case is that the Administration will be able to finish its term and remain in office until 2025. This should catalyze a gradual reassessment by markets of medium-term political and credit risks in Ecuador, in our view. Our outlook may change if we were to see increasing social pressures on Lasso to step down, especially renewed violent street protests like the ones that erupted in the summer of last year, paralyzing economic and political life in the country.

Pakistan and IMF hold talks on pending review

Event: The Government hosted an IMF mission over the last two weeks where parties negotiated progress on key measures to complete the pending 9th review and associated $1.1bn disbursement. The authorities have allowed for greater FX flexibility, gradually begun to increase energy costs, and put forward actions to achieve fiscal adjustment. Authorities have reported constructive dialogue despite mixed press on the status of the progress. Bonds were up 2-3 pts on the week on speculation of a pending Staff Level Agreement (SLA).

Gramercy commentary: At a minimum, we anticipate a constructive press release to be published by the IMF highlighting the nature of the discussions with the possibility for an SLA. Even if an SLA is not yet announced on the back of this visit, our base case remains for eventual near-term resumption of the program and bilateral financing, which should help to bridge the financing gap between now and the elections taking place likely later this year. With that being said, the balance of payments remains quite fragile which leaves prospects for volatility elevated. A more structural solution is only likely after elections, catalyzing more meaningful recovery in asset prices.

Ghana inches closer to domestic debt deal

Event: The authorities further amended terms on its domestic debt exchange proposal for select creditor groups including PIK and PDI bond components to further garner participation. Meanwhile, the deadline has been extended to February 10th on technical challenges. As of mid-week, a reported 50% of holders had submitted for exchange.

Gramercy commentary: We see the progress as constructive in moving forward the overall debt resolution process and final IMF program approval. While the authorities may announce participation below its 80% threshold early next week, we think progress will continue to be made to address holdouts and at the same time, kick-start the next phase of the external restructuring process. Based on the current pace of events, we continue to expect board level approval of the new $3bn EFF program by the April spring meetings and momentum on external debt into mid-year.

Mexico Central Bank (Banxico) retains conservative bias with 50bps hike

Event: Banxico hiked its policy rate by 50bps to 11% in contrast to the Fed and consensus expectations for a 25bps. This follows recent sticky core inflation prints and contributed to a rally in the peso in the aftermath, retracing much of the week’s depreciation.

Gramercy commentary: We see continuation of orthodox monetary policy as constructive particularly for FX in the backdrop of resilient growth and still elevated inflation. The larger than anticipated hike leaves the door open for a swifter pivot on policy once appropriately based on data and external developments. The board again noted that future upward adjustments to the reference could be of lower magnitude.

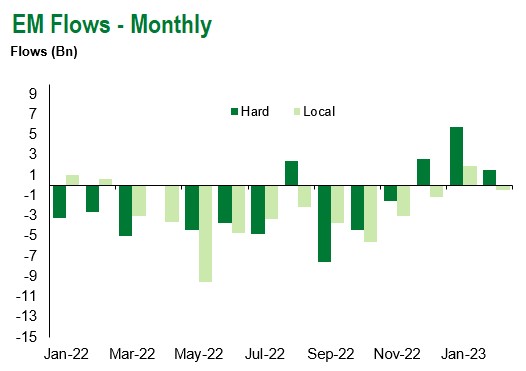

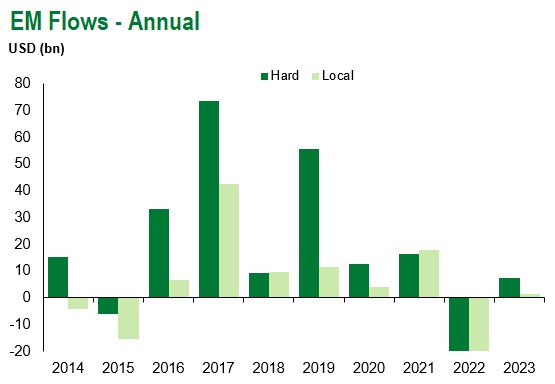

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of February 10, 2023.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.