Contents

Market Overview

Macro Review

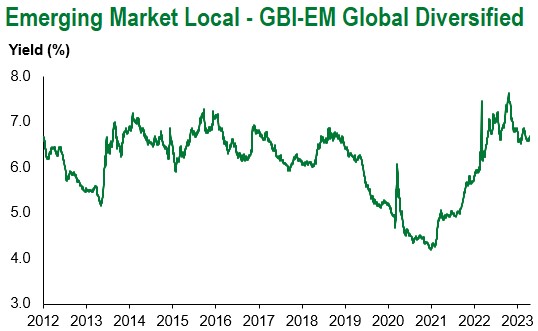

U.S. money markets traded in a peculiar fashion. The differential between the 1 month and 2 month T-Bills exceeded 100bps last week. The debt ceiling crisis became more concerning with uncertainty around April tax receipts and U.S. 5-year CDS rose above 50bps, just as the 1-year broke above 100bps. There is something about the summer of 2011 in the air. The second theme was 1Q corporate earnings. They are now declining from a year ago, having started strong. Broadly, revenues are stair-stepping higher in nominal terms, but EPS is being gobbled up by higher costs. The appearance of a soft landing has some further evidence behind it. There is still a sense that the market got carried away with impressive JPM results. Nevertheless, this all ties in with leading indicators forecasting trouble ahead. After all, the yield curve remains extremely inverted (2s10s is -63bps) and the New York Fed’s recession model puts the odds of a recession over the next 12 months at 57%. GS recently upgraded their recession probability from 25% to 35%. Elsewhere, New Zealand and Malaysia’s CPI fell, but UK inflation remains stubbornly high (like Poland). However, the growth engine of EM (and global growth) was robust, and a number of sell-side houses upgraded China’s 2023 GDP to above 6.0% (notably JPM and BOA). China’s 1Q GDP came in at 4.5%, which was particularly strong and retail sales were just as upbeat. In aggregate, we are still seeing a lackluster demand outlook in DM and a services-led recovery in China which points to a muted outlook. This is helpful for EM local currency bonds. Perhaps the largest signal was from the National Bank of Hungary (NBH) where the Deputy Governor said the Central Bank could soon begin the process of rate normalization. Policy makers are expected to cut the top rate of the corridor by a “significant margin”, beginning with the one-day deposit rate (18.0%) and converging this to the policy rate (13.0%). It would make sense for the NBH to be one of the first EM central banks to cut rates after hiking 1,240bps over the past twelve months. However, this is politically driven as the prospects of a technical recession are rising, rather than responding to disinflationary forces. Inflation appears to have plateaued at 25% after all.

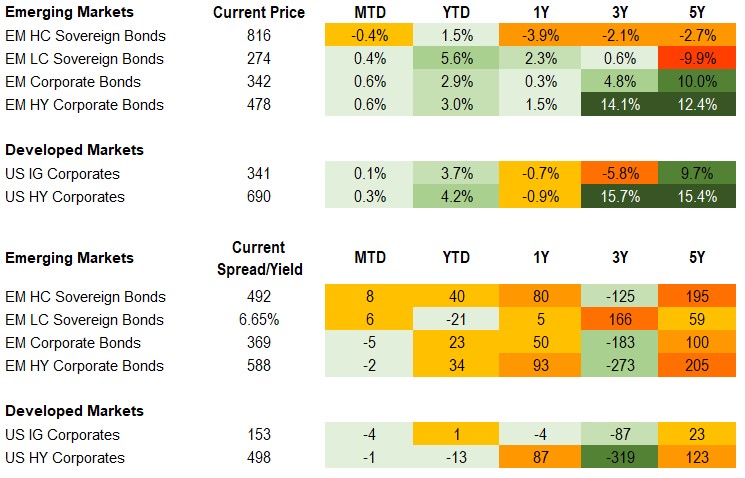

EM Credit Update

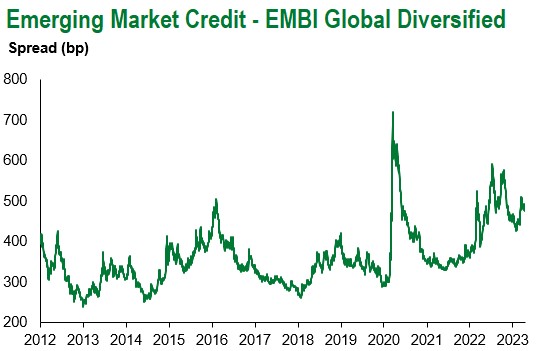

Emerging market sovereign credit (cash bonds) ended the week down 0.8% with spreads 14bps wider. Sovereign outperformers were Bolivia, El Salvador and Zambia, while Argentina, Egypt and Ethiopia underperformed.

The Week Ahead

Key news items next week relate to U.S. GDP, the Bank of Japan policy meeting and Euroarea GDP. Given the focus on the last Employment Cost Index, we can expect this to be a volatile trading event, just as U.S. Treasuries have traded frenetically around various leading indicators over the past week. By Friday, we will also have U.S. PCE inflation data, which should reflect a similar story to headline CPI some ten days ago. Needless to say, firm ECI and PCE data would quickly validate a 25bps hike at the next FOMC in early May, even if such an event is priced to perfection. Across EM, interest rate decisions are due out of Colombia (13.25%), Hungary (13.0%) and Turkey (8.5%). Poland’s inflation through March rose to 16.1%, however with strong base effects this is expected to decline to c.14%. Polish retail sales are also expected to contract by 6.2%. Mexico’s bi-weekly inflation should show a similar trend, along with Brazil. Finally, amidst these events, China will furnish its Manufacturing PMI data.

Highlights from emerging markets discussed below:

Minister of Economy, Sergio Massa, facing headwinds amid political infighting, inflation acceleration and ongoing drought and High bar for President Lasso to trigger early elections despite comments in Financial Times (FT) interview

Fixed Income

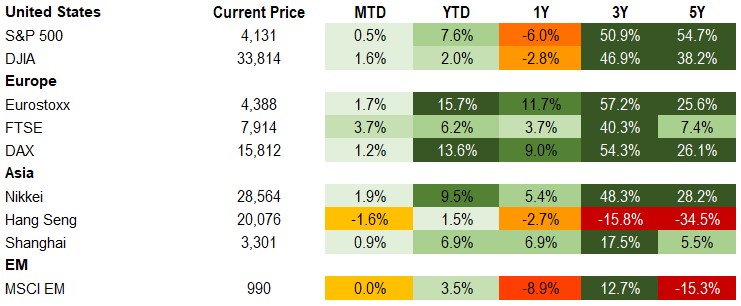

Equities

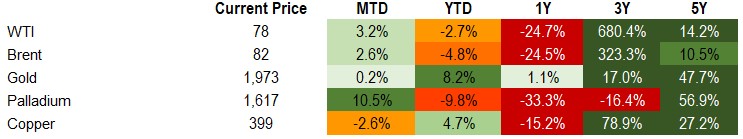

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of April 21, 2023 (mid-afternoon).

Emerging Markets Weekly Highlights

Minister of Economy, Sergio Massa, facing headwinds amid political infighting, inflation acceleration and ongoing drought

Event: March CPI printed at 7.7%, up from 6.6% in February and 70bps above expectations, bringing the annual rate to 104.3%. At the same time, speculation around IMF program amendments and Massa’s role as Minister of Economy emerged. The Central Bank of Argentina (BCRA) hiked rates 300bps to 81%. Later in the week, President Alberto Fernandez announced that he would not run for reelection.

Gramercy commentary: We’ve seen and continue to expect bouts of near-term volatility associated with economic and political uncertainty. It is likely that IMF targets will be further amended. However, any adjustment in the timing of disbursements would require additional policy efforts, particularly on FX, which is politically challenging. Speculation of further devaluation temporarily halted farmers’ liquidation of crops complicating already fragile conditions but liquidation gradually resumed by the end of the week as Massa’s near-term hold on his position appeared to stabilize. BCRA’s swift response to the higher inflation print does not hurt the situation but at this point, does minimal to quell concern. On the political front, divisions within the ruling FdT coalition keep uncertainty elevated. Fernandez’s decision not to run was widely expected. The FdT’s ultimate candidate selection is the more relevant, and still unknown, fact. While the path to the primary vote in August and election in October appears increasingly noisy, our base case continues to envisage a more constructive political and policy configuration, which is supportive of asset price recovery comfortably above current levels.

High bar for President Lasso to trigger early elections despite comments in Financial Times (FT) interview

Event: Ecuador’s embattled, market-friendly President, Guillermo Lasso, appeared to suggest in an FT interview that he would consider using his constitutional right to dissolve the opposition-dominated National Assembly and trigger early elections rather than allow legislators to impeach him two years before the end of his term.

Gramercy commentary: The impeachment process against President Lasso in the National Assembly is based on corruption allegations which he rejects vehemently, and that have been characterized as weak/unsubstantiated by independent observers. While we believe Lasso is likely to aggressively defend himself and that he will use all of the tools at his disposal to prevent the opposition from collecting the 92 votes in the 137-seat legislature needed to remove him from power, we think he would stop short of triggering early elections via the so called “Muerte Cruzada” constitutional mechanism. The left-wing populist party of former President Rafael Correa is the only political force that stands to benefit from early elections and is in a great position to return to power in the event an early election takes place. Even the powerful indigenous organizations that are heavily invested in ousting Lasso have publicly spoken against the idea of early elections that could bring Correismo back to power in the near-term. The same applies across the rest of Ecuador’s political spectrum. This gives President Lasso certain political leverage, but we think it is unlikely he would be able to prevent impeachment. In that scenario, putting aside his political ego, we are of the view that Lasso would like to avoid facilitating Correismo’s return to power and would prefer to step down, giving his Vice President, Alfredo Borrero, a chance to finish the term until 2025.

Emerging Markets Technicals

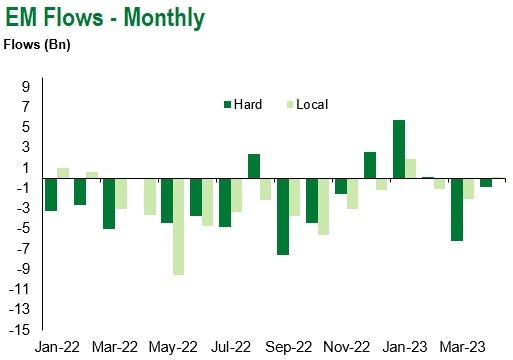

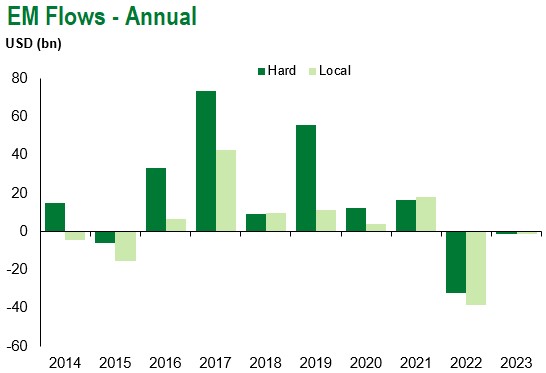

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of April 21, 2023.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.