June marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

Softer U.S. inflation restored some market appetite, only to be overshadowed by a weak U.S. Treasury auction. Moody’s also raised the alarm on the U.S. banking sector once again. The Moody’s news caused U.S. bank stocks to fall 4% on Tuesday and Italian banks sold-off 8% on Wednesday after the government announced a one-off windfall tax on banks amounting to 40% of excess net interest margin in 2023. Meanwhile, China’s CPI declined in July for the first time since November 2020. In fact, it is the first time since February 2020 that both CPI and PPI declined which is a clear sign that deflationary pressures are occurring amid weakening demand. This ultimately followed weak export data, which fell 14.5% as imports dropped 12.4%. The reaction to the weakness in Country Garden and more broadly around local government debt in China also had a knock-on effect on Asian equities. This in turn re-priced European equities lower as the contagion, while limited, was still felt, but also as hawkish Fedspeak dominated the week. The Fed’s Mary Daly was quick to dampen hopes around the softness of Thursday’s U.S. CPI release, instead noting that the Fed has “more work to do” to combat rising prices. The concern remains on high gasoline prices, even if airfares are down 15% over two months, given WTI oil prices rallied 17% in July. Commodities continued to rally over the past week as geopolitical tensions remained elevated with drone attacks in the Black Sea and Saudi Arabia’s intention to extend its voluntary production cut. This lifted crude oil prices to YTD highs. Equally, strike action at LNG terminals in Australia pushed seaborne prices up considerably. European gas prices rose 28% on Wednesday, just as Citi forecasted that prices could rise to €62/MWh from €35-40/MWh if strike action persists until January. Elsewhere, the U.S. Government is considering lifting sanctions against Venezuela and PDVSA bonds. The National Bank of Georgia cut the policy rate by 25bps again, taking interest rates to 10.25%, although Georgia was among a handful of the smaller emerging markets to begin loosening policy before Brazil and Chile. Saudi Arabia’s GDP also surprised to the downside and decelerated 2Q with a contraction of -0.1%. Finally, Moody’s upgraded Zambia to Caa3 from Ca and extended the review period for Egypt by another three months as it continues to assess foreign liquidity buffers.

EM Credit Update

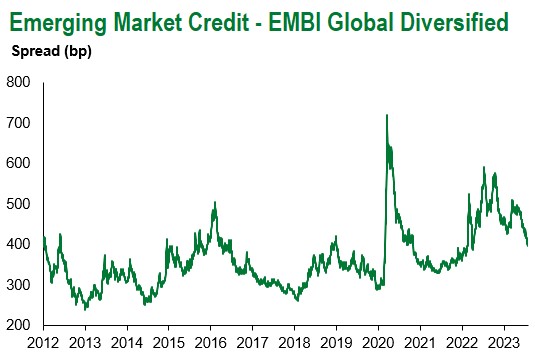

Emerging market sovereign credit (cash bonds) ended the week up 0.4% with credit spreads 12bps tighter. Credit spreads held up well in spite of volatility in U.S. Treasuries after a weak 30-year auction on Thursday. The 30-year auction tailed by 2bps as the new $23bn instrument cleared at the highest yield since 2011. Sovereign outperformers were Pakistan, Tunisia and Ghana, while Zambia, Ethiopia and Bolivia underperformed. Gabon issued a blue bond where the principal of the bond was insured against expropriation, acting as an effective guarantee, and allowed the sovereign to price the 2038 bond at 6.097%, relative to its 2031 bonds at 10.3%.

The Week Ahead

The upcoming week will feature FOMC minutes, U.S. retail sales and key G10 inflation releases. After a benign U.S. inflation release, similar data will be due out of the UK, Japan and Sweden. Key EM inflation releases are due out of Argentina and India. EM interest rate decisions are limited to China (1yr MLF rate is 2.65%) and the Philippines (6.25%). Beyond that, elections and primaries are around the corner. Argentina’s PASO is on Sunday, followed by Guatemala’s second round and Ecuador’s first round on August 20. On this theme but later in August, Gabon’s first round is on August 26.

Highlights from emerging markets discussed below: Argentina PASO in focus this weekend, A candidate in Ecuador’s presidential election assassinated at a campaign event, Pakistan parliament dissolved and Imran Khan arrested, Egypt surprised with a 100bps rate hike and China’s Country Garden is one step closer to defaulting.

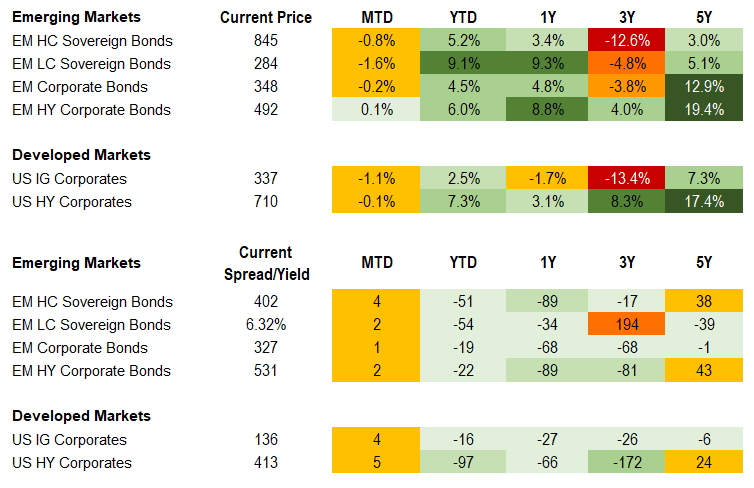

Fixed Income

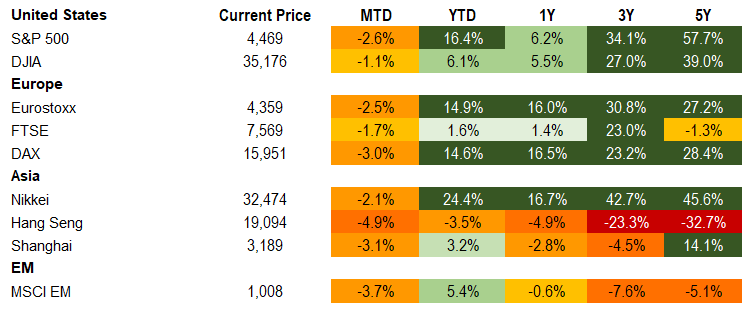

Equities

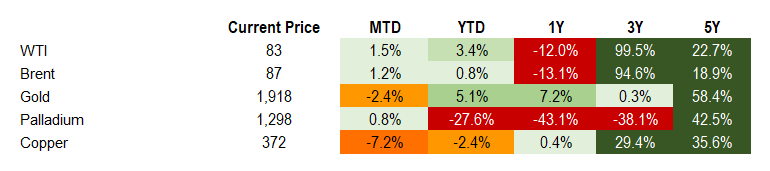

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of August 11, 2023 (mid-afternoon).

Emerging Markets Weekly Highlights

Argentina PASO in focus this weekend

Event: This Sunday, Argentina will hold primary elections (PASO) for the presidency and several provincial governorships, including the Province of Buenos Aires, defining the main coalition candidates and providing initial voter preferences ahead of the first-round Presidential vote in October. The results should be available Sunday evening and digested by the markets on Monday morning. The median of June-July polls shows the opposition coalition Juntos por el Cambio (JxC) in the lead with just under 34% support, followed by the ruling coalition Union por la Patria (UxP) around 29% and outsider candidate Javier Milei’s La Libertad Avanza with approximately 20% backing. Markets have responded well in the run-up to the vote on speculation of outperformance of JxC and underperformance of Milei.

Gramercy commentary: Polls have been poor predictors of recent elections, thus leaving room for surprise on the back of this weekend. This, combined with the recent trends against Milei and in favor of the opposition, have helped fuel the optimism in Argentine assets. An outsized opposition victory should be well received by investors with possible upside in the event of a Patricia Bullrich victory who is seen as further to the right than centrist Horacio Larreta. With that being said, we see both opposition candidates having differing, albeit beneficial, attributes for execution of a stabilization plan. Milei outperformance would create the most uncertainty and volatility while a very close election would likely see bonds move sideways initially with the focus in the aftermath on key factors such as PxC unification, voter turnout and voter transfer. A close race remains counterintuitively feasible despite the very challenging macroeconomic backdrop due to the ruling coalition’s general unification behind market friendly Economy Minister Sergio Massa and his ability to muddle through thus far, avoiding an even deeper crisis.

A candidate in Ecuador’s presidential election assassinated at a campaign event

Event: Fernando Villavicencio, one of the eight candidates in Ecuador’s Presidential Election, was assassinated on August 9th at a rally in Quito.

Gramercy commentary: Villavicencio’s murder comes less than two weeks before the first round of snap Presidential Elections triggered by President Guillermo Lasso and could have major political and credit implications. Mr. Lasso has declared a state of emergency, authorizing the military to mobilize and patrol the streets in the coming days, but has confirmed that elections will take place as planned on Sunday, August 20th. Fernando Villavicencio was one of the main center-right candidates, polling at second place in some polls behind Correista frontrunner, Luisa Gonzalez, and having as high as 12-13% of voter intentions. His assassination could change the trajectory of the presidential race that is likely to go to a runoff in mid-October between the top two candidates from the first round. Security and crime, already top issues for voters, are likely to be a more prominent factor in decision-making on election day. Frontrunner Luisa Gonzalez, who is supported by exiled former President Rafael Correa, does not seem to enjoy strong “law and order” credentials among the general population. Accordingly, her chances of winning outright in the first round have likely diminished even further. In addition, Villavicencio was a prominent critic of Correa and his policies. His murder could trigger a consolidation of the anti-Correista vote in the second round, which will be welcomed by markets. For his part, Correa denounced the assassination and labeled it further proof that Ecuador has become a “failed state” under President Lasso. The next administration will be in office only until regular general elections in 2025 but its economic policies will be highly significant for the sovereign credit trajectory amid a more challenging external financing environment and less benign commodity price backdrop for Ecuador, a dollarized economy and major oil exporter.

Pakistan parliament dissolved and Imran Khan arrested

Event: Prime Minister Shehbaz Sharif dissolved Parliament just ahead of completion of this legislature’s term this week. Typically, elections would be held within 90 days. However, the new census may result in a delay in elections from this fall to early next year. The caretaker PM has not yet been selected. This follows last weekend’s arrest of key opposition figure and formerly ousted PM, Imran Khan.

Gramercy commentary: We see the developments as incrementally supportive for a muddle-through scenario, possibly increasing the bandwidth for policy execution to better ensure remaining disbursements of the SBA agreement with the Fund later this year and in 1Q24. Key signposts to monitor include selection of the caretaker PM and their willingness and ability to execute on policy initiatives, their management of the social backdrop in the context of a constrained opposition, and lingering uncertainty over timing of the election.

Egypt surprised with a 100bps rate hike

Event: The Central Bank of Egypt surprised markets with the timing of a 100bps hike in its policy rate this week to 19.25%. This is in the context of still very elevated inflation of 36.5% YoY as of July. That being said, monthly rates have started to ease, dropping back below 2%. The EGP has remained stable at around 30.8 pounds per dollar.

Gramercy commentary: We see the move as a constructive step in the right direction towards an eventual agreement with the IMF on the pending review under the existing EFF program. Further efforts are likely needed on privatizations, clearing of FX arrears, and clarity over exchange rate policy. Our base case remains for an eventual deal, which likely combines first and second program reviews and disbursements later this year.

China’s Country Garden is one step closer to defaulting

Event: Country Garden missed coupon payments this week on its USD notes and now has a 30-day grace period to cure these coupons. Ahead of the USD notes, there are onshore notes due as well as a large maturity wall at the end of 2023.

Gramercy commentary: The China property sector continues to be volatile. The missed coupon payments of Country Garden, one of the nation’s largest developers, shows the challenging liquidity situation of many property developers. The Chinese government had signaled its support for the sector, but concrete measures have not been announced yet. Whether the company can cure these missed coupons depends on its willingness and ability to prepare the necessary capital. Clearly its struggle may impact homebuyers and investor sentiment and may even accelerate the government’s response.

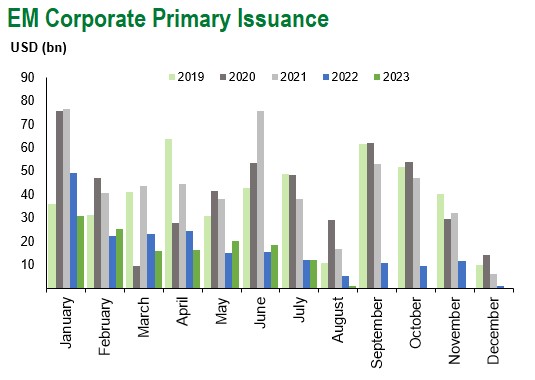

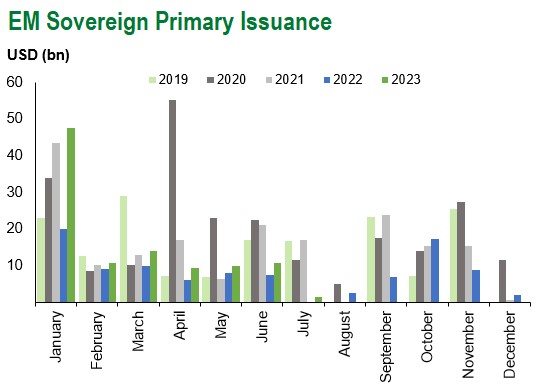

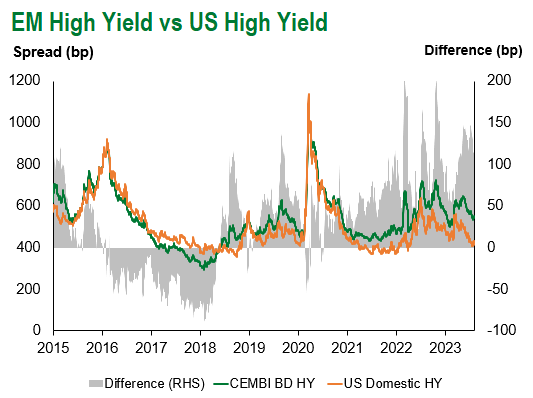

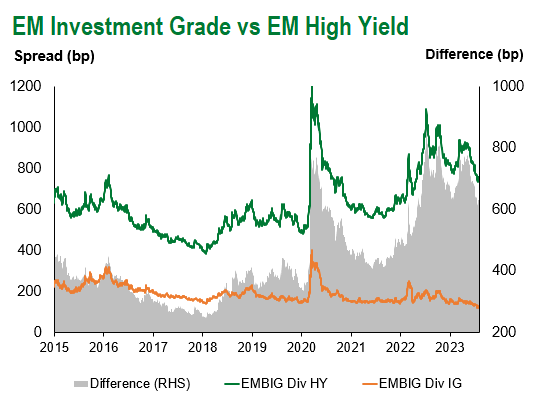

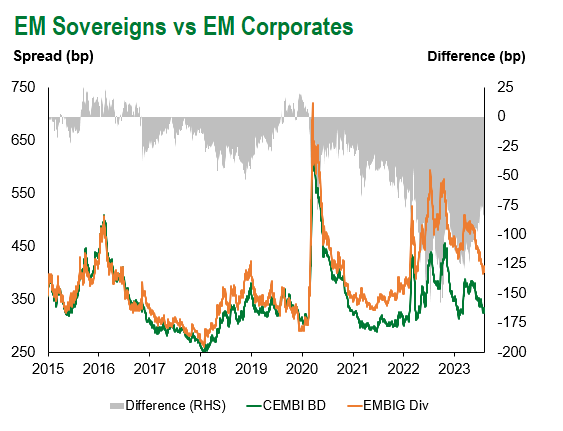

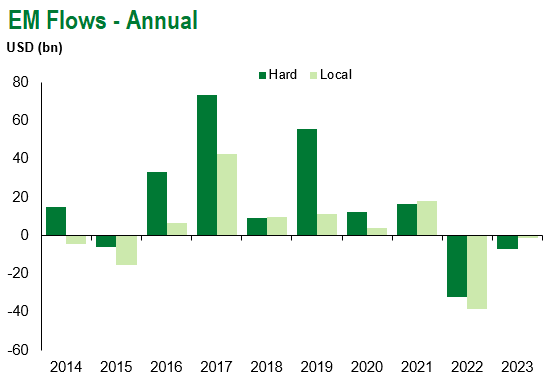

Emerging Markets Technicals

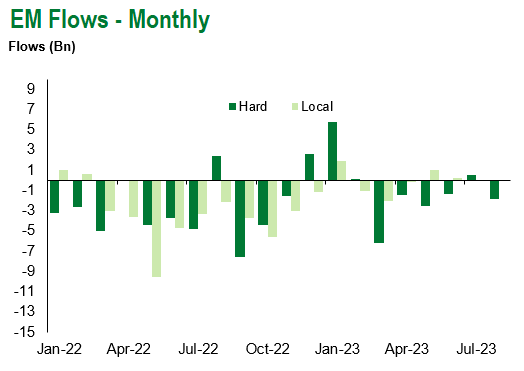

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of August 11, 2023.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.