June marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

This week global markets were pressured by a combination of mounting concerns about economic weakness and the shadow banking liquidity crisis in China as well as higher DM rates. The FOMC minutes from the last policy meeting revealed that officials still see upside risks to inflation, which could require further tightening. Market pricing for the September and November meetings changed only slightly and the consensus narrative continues to expect the Fed will hold rates, but remain data dependent for the rest of the year. In China, liquidity problems at Zhongzhi, a relatively obscure local asset manager, fanned fears about financial contagion and triggered urgent reactions by the authorities. Meanwhile, the People’s Bank of China reduced its 1-yr medium-term lending rate by 15bps to 2.5% as well as the 7-day reverse repo rate by 10bps to 1.8%. The move came against a backdrop of continued soft inflation, credit, and activity prints for July. Additionally, state banks stepped up FX intervention, which helped reverse pressure after the CNY touched 7.3 versus the USD earlier in the week. In EM, Argentina’s important primaries delivered an outperformance of outsider candidate Javier Milei with 30% support compared to polls which had shown his backing at less than 20%. The center-right opposition Juntos por el Cambio (JxC) garnered 28% of votes and the ruling coalition Union por la Patria (UxP) at 27%. Right-leaning Patricia Bullrich comfortably secured the JxC candidacy over more centrist Horacio Larreta with a 6pt lead while Sergio Massa was confirmed as the ruling UxP candidate. In the primaries aftermath, the Central Bank of Argentina (BCRA) devalued the official FX rate by 20%, hiked the official policy rate by 2100bps, while MinFin Massa committed to fiscal conservatism and a primary balance in 2024. This was followed by Milei’s swift communication with the IMF, reiteration of intentions of deep fiscal adjustment and honoring of debts.

EM Credit Update

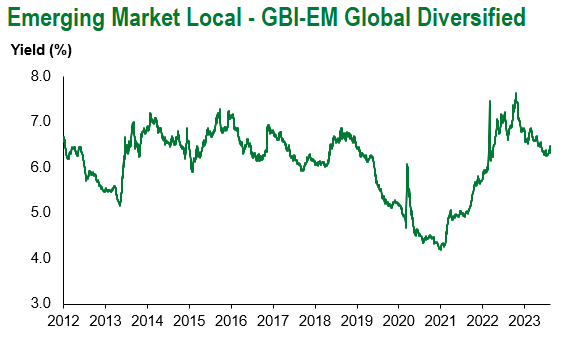

Emerging market sovereign credit (cash bonds) ended the week 1.8% lower with spreads 22bps wider. Corporate credit was also 0.8% weaker this week with spreads 9bps wider. Sovereign outperformers over the week included Honduras, Ecuador and Namibia, while Argentina, Pakistan and Sri Lanka underperformed. Amid concerns about China economic weakness and higher DM rates, EM local debt lost 1.7% this week.

The Week Ahead

Next week will be dominated by the Fed’s annual meeting in Jackson Hole and anything Chair Powell and his colleagues have to say about data dependency and the DM rates path going forward. Macro and shadow banking developments in China will also be closely monitored. In EM, important snap Presidential and Legislative elections in Ecuador will be in focus amid a highly volatile security situation in the aftermath the assassination of Fernando Villavicencio, one of the leading Presidential candidates. Luisa Gonzalez, a proxy candidate for exiled left-wing former President Rafael Correa, and security hardliner Jan Topic appear best positioned to advance to a competitive second round in October, but surprises are possible given poor track record of political polls and large share of undecided voters.

Highlights from emerging markets discussed below: China cuts rates; Argentina’s PASO reflects demand for change and Ecuador’s Presidential Elections.

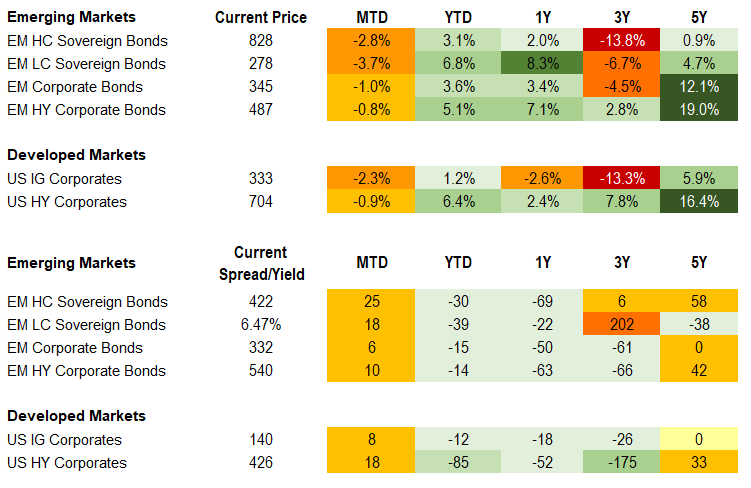

Fixed Income

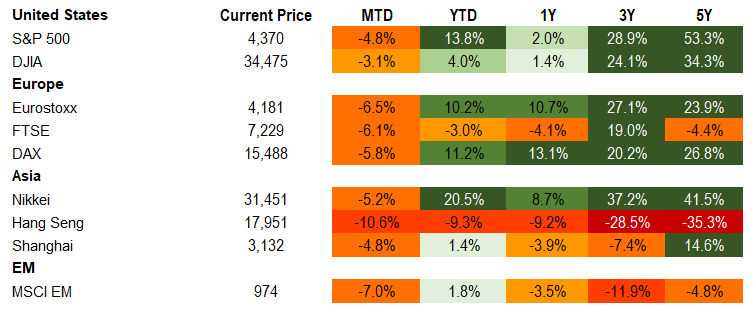

Equities

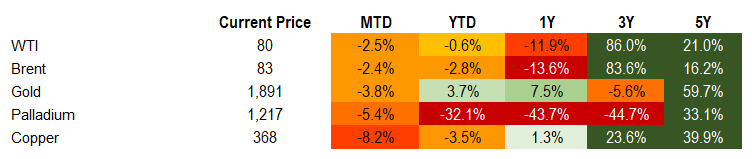

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of August 18, 2023 (mid-afternoon).

Emerging Markets Weekly Highlights

China cuts rates as data remains weak

Event: The People’s Bank of China reduced its 1-yr medium-term lending rate by 15bps to 2.5% as well as the 7-day reverse repo rate by 10bps to 1.8%. The move comes on the back of continued soft inflation, credit, and activity prints for July. Additionally, the 2Q monetary policy report this week reiterated policy adjustments to facilitate growth while warning against CNY depreciation, stating that excessive moves in the exchange rate would be prevented with the intent to keep the rate broadly stable. A step-up in FX intervention via state banks helped reverse pressure after the CNY touched 7.3 earlier in the week.

Gramercy commentary: We see the measures in line with expectations for reactive stimulus measures and intervention. The still largely ad-hoc stimulus measures and weak growth should continue to pull sell-side 2023 growth forecasts below 5%, but they will likely remain comfortably above 4.5% at this juncture barring accelerated deterioration in the property sector or local government distress. Markets will continue to watch for a more meaningful pick-up in stimulus as well as the evolution of plans to address structural deficiencies heading into key policy meetings later this year.

Argentina’s PASO reflects demand for change

Event: During last weekend’s primary election, outsider candidate, Javier Milei, outperformed with 30% of the votes compared to polls which had shown his backing at less than 20%. The center-right opposition Juntos por el Cambio (JxC) garnered 28% of votes and the ruling coalition Union por la Patria (UxP) received 27% of the votes. Right-leaning Patricia Bullrich comfortably secured the JxC candidacy over the more centrist Horacio Larreta with a 6pt lead and Sergio Massa was confirmed as the ruling UxP candidate. The initial market reaction was in line with our expectations with bonds down 10-15%. There was a partial reversal as markets digested the fact that the election remains an open race. The BCRA devalued the official FX rate by 20%, policy rates were hiked by 21 pts and Massa committed to fiscal conservatism and a primary balance in 2024. This was followed by Milei’s swift communication with the IMF, reiteration of intentions of deep fiscal adjustment and honoring of debts.

Gramercy commentary: The outcome of the PASO points to a strong rejection of the status quo, a call for change, and a policy shift to the right, which on the surface should be constructive for markets and help support a “buy the dip” mentality. However, the very fragile macroeconomic situation amid the transition period and a tight race leaves uncertainty very high. Milei’s radical policy stances (dollarization, abolishment of the BCRA, etc.) combined with the lack of clarity over his ability to govern effectively due to his erratic approach and questionable willingness to listen to advisors, leaves substantial execution risk in the event of his presidency. While all three coalitions could remain competitive into a first-round on October 22nd, we see a run-off on November 19th between Bullrich and Milei as slightly more likely. Evolution of campaign strategies, voter transfer, and JxC unity remain key factors that could impact that view. In the event of an improved turnout, as is often the case between the PASO and the first round, Bullrich and Massa should benefit. Coalition building between Bullrich and Milei in the event of their respective victories could help to reduce execution risks while Massa has incentives to continue to move to the center as reflected by recent policy actions. The devaluation, rate hike, and fiscal commitments should help to solidify IMF board approval of the pending $7.5 billion disbursement scheduled for vote on August 23rd. While volatility is likely to remain elevated between now and October, our base case continues to envisage a stabilization plan underpinned by pragmatic policy making, supporting medium-term recovery values above current levels.

Momentum in Ecuador’s Presidential Elections appears to shift in favor of non-Correista forces ahead of the first round on Sunday

Event: Snap General and Presidential Elections in Ecuador triggered by President Lasso’s decision back in May to dissolve the National Assembly will take place this Sunday, August 20th. Eight candidates are competing in the Presidential race. If no candidate secures either a simple majority or 40% + 10pts lead over the runner-up, there will be a runoff for the Presidency between the top two candidates from the first round on October 15th. The new President and National Assembly will serve out the rest of Lasso’s term until early 2025 when regular Presidential and Legislative elections will take place for the full four-year terms. Voting on Sunday comes in the wake of the high-profile political assassination of Fernando Villavicencio, a prominent anti-Correa activist and Presidential Candidate who was murdered on August 9th at a rally in Quito.

Gramercy commentary: Despite the lack of polls in the days since Villavicencio’s assassination given the 10-day pre-election “blackout period”, the shocking event seems to have significantly changed the electoral dynamics. Luisa Gonzalez, a proxy candidate for exiled left-wing former President Rafael Correa, is still likely to win the highest share of votes on Sunday. However, her chances of securing an outright victory in the first round appear slim, to the relief of markets. This means that the Correista candidate will likely head to a second round scheduled for October 15th that promises to be competitive and keep alive the credit-positive scenario that a non-Correista president will finish Lasso’s term. The candidate that appears to have benefitted the most from the latest developments is Jan Topic, a 40-yr old self-described “security expert” and “elite professional soldier” who claims to have served in the French Foreign Legion and has no prior political experience. Topic’s primary focus is fighting crime, by far the most important issue for the general population in these elections, which should provide him with an edge over the other candidates. He should also benefit from his “outsider/non-establishment” image and likely ability to capture some populist support that would have otherwise gone to the Gonzalez/Correista ticket, making him well positioned to advance to the runoff in October. Other candidates that could compete for second place on Sunday include Otto Sonnenholzner, a centrist former VP of President Lenin Moreno, Christian Zurita, who took over assassinated Villavicencio’s ticket and is a popular anti-Correa investigative journalist, and populist Daniel Noboa. Yaku Perez, the indigenous leader who almost beat Lasso for the runoff in 2021, appears to have lost momentum. Our base case is that Gonzales and Topic are likely to advance to the second round and that the new National Assembly could be less populist leaning than the one dissolved by Lasso in May. This political configuration should be supportive for market sentiment and sovereign asset prices, in our view, despite ongoing economic and fiscal challenges. However, with around a third of the electorate still “undecided” and a poor historical track record of election polls in Ecuador, we are also prepared to deal with surprises come Monday. Parallel with the General and Presidential elections, a national referendum proposing a ban on oil exploration in Yasuni National Park in the Amazon region of the country will also take place. Investors will be paying close attention to the result of this referendum as, if the ban is approved, PetroEcuador could stand to lose as much as ~50K barrels per day from its Yasuni field, which is equivalent to ~15% of total current production and up to 1% of GDP (~$1.25bn) in potential fiscal revenue loss. However, we note that any government that comes after the election will have a strong incentive to drag their feet and/or try to dilute the referendum’s outcome, given the potential economic costs.

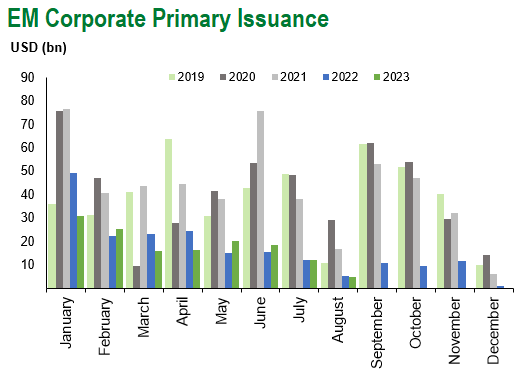

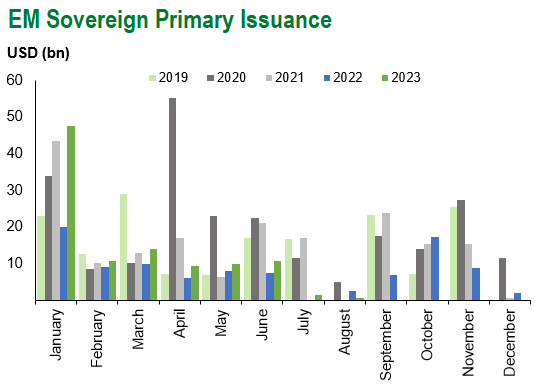

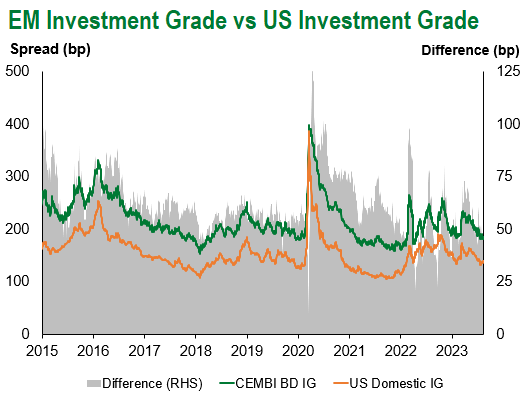

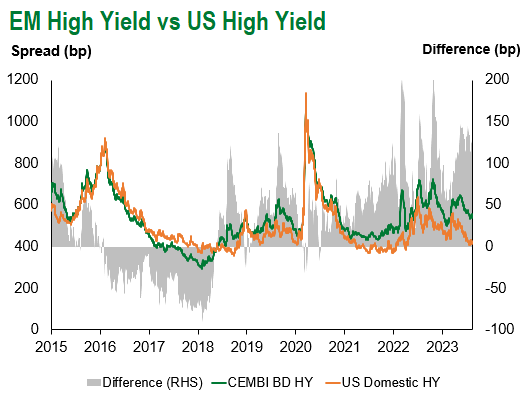

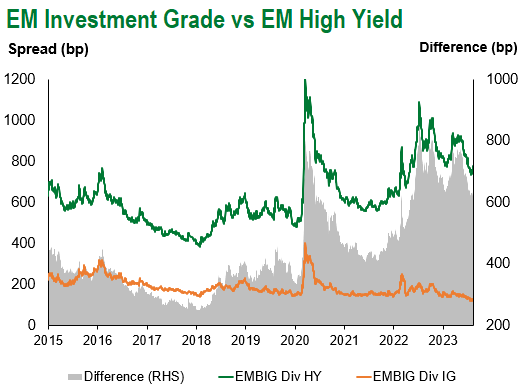

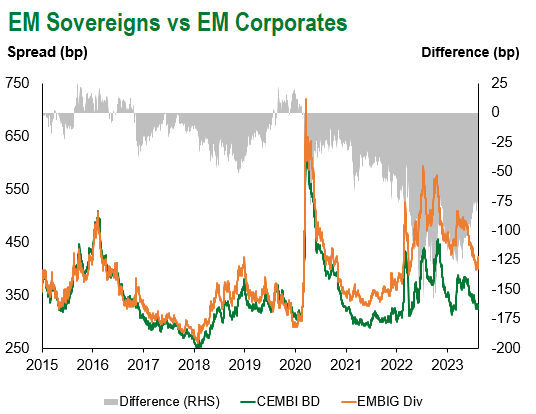

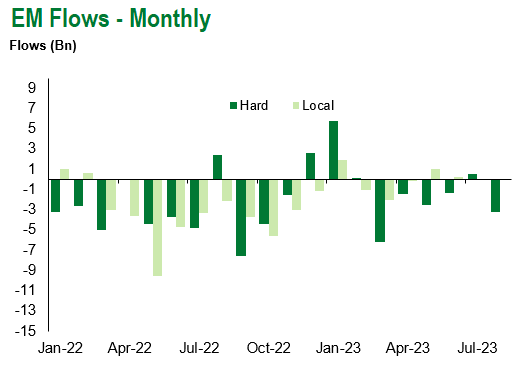

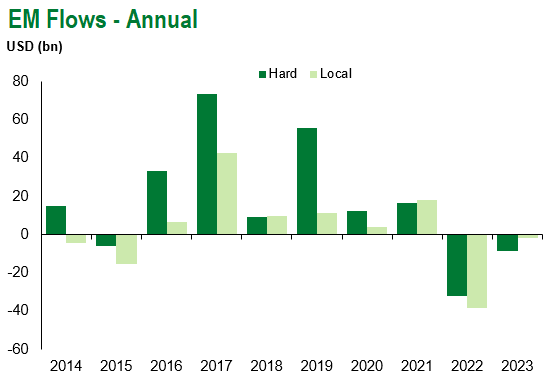

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of August 18, 2023.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.