June 2023 marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

Geopolitical risk escalated over the week. The New York Times reported that Israeli missiles had struck a military air base near Isfahan. The S&P rating agency downgraded Israel to A+ with the rating action reflecting a larger deficit and elevated fiscal risks. In the aftermath, gold retraced the move higher, the VIX spiked above 21pts and the MOVE Index rose closer to 120pts at YTD highs (volatility of U.S. Treasuries). Crude oil moved sharply higher but was still below levels seen before the EIA report showed U.S. inventories at the highest level in nine months. In turn, the S&P 500 declined -4.6% from its all-time high at the end of March to settle closer to 5000 at the end of the week. Given the strength in USD across G10 FX, there were concerns from the Bank of Japan over the weakness in the Japanese yen, but no intervention, unlike the Bank Indonesia in the rupiah. There wasn’t any intervention in the Mexican peso, but it was 6.8% weaker in the minutes after the Israeli strike in Iran, which reflected extraordinary volatility. The theme of the week was around robust U.S. growth, with the Atlanta Fed’s GDPNow for 1Q pointing to an annualized growth rate of 2.9%. Similar strength was displayed with Chinese 1Q GDP at 5.3%. Events in emerging markets were generally quieter with the IMF and World Bank meetings in Washington D.C. Sri Lanka’s privatization of state-owned enterprise stood out, just as Pakistani authorities drew interest in state-owned assets from Saudi Arabia. Ghana’s restructuring proposal was rejected, but the market is still digesting Zambia’s new instruments. Egypt’s Finance Minister is considering extending the maturity profile of its local debt. Across LATAM, Ecuador is turning to the electorate with an anti-crime referendum. There some focus on Argentina’s omnibus bill and the new drafts. Finally, the U.S. rescinded Venezuela’s General License 44 but maintained the Chevron license.

EM Credit Update

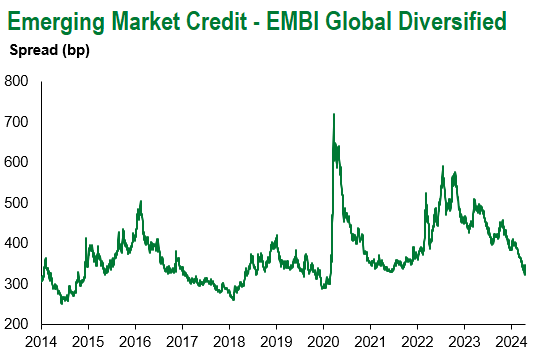

Emerging markets sovereign credit (cash bonds) ended the week down -0.8% with credit spreads 4bps wider. Sovereign outperformers were Ecuador, Argentina and Senegal, while Ethiopia, Ukraine and Ghana underperformed.

The Week Ahead

The key themes of next week are around U.S. 1Q GDP and headline PCE inflation. The recovery in the Euro-Area and the UK ought to show further signs of momentum as PMIs are published. It is also still likely that the PBoC keeps the one-year and five-year Loan Prime Rates unchanged at 3.45% and 3.95%, respectively. The Bank of Japan is also expected to keep monetary policy unchanged. The next focus on EM interest rate decisions is across Hungary (8.25%), Indonesia (6%), Turkey (50%), and Russia (16%). The focus across LATAM is more on economic activity, where Colombia is likely to correct lower after a strong January release, but Peru and Mexico will likely show some resiliency. Brazil’s inflation release could jeopardize the pace of monetary easing if the figure is in line with expectations and shows signs of moderating and a stint of disinflation.

Highlights from emerging markets discussed below: IMF’s World Economic Outlook delivered a more upbeat message and Emerging market banks take full advantage and issue Additional Tier 1 (AT1) instruments.

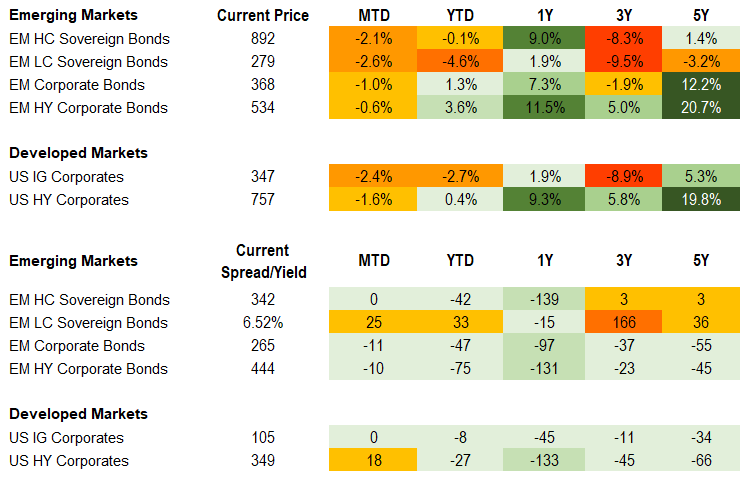

Fixed Income

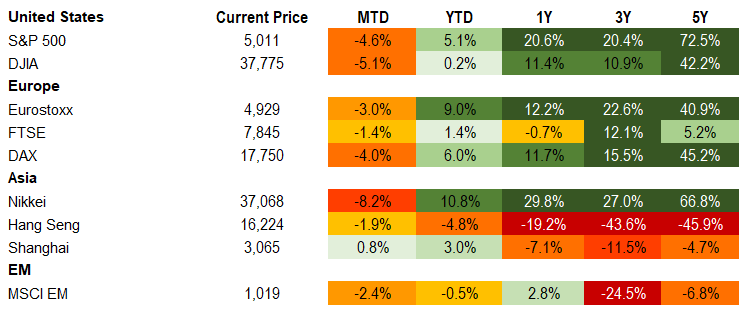

Equities

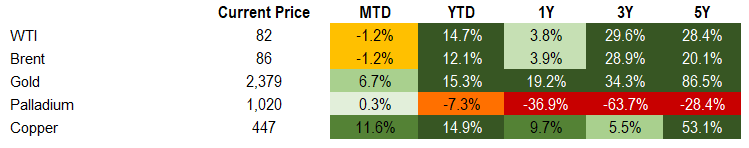

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of April 19, 2024 (late-morning).

Emerging Markets Weekly Highlights

IMF’s World Economic Outlook delivered a more upbeat message

Event: The World Economic Outlook upgraded the global growth forecast by 0.1% to 3.2% for 2024. In particular, there was a noticeable U.S. growth upgrade to 2.7%, which was 0.6% higher than the January forecast. Meanwhile, the IMF downgraded Euro Area growth to 0.8%. Advanced economies are set to grow 1.7% in 2024, while emerging and developing economies are expected to grow 4.2%.

Gramercy Commentary: The EM-DM differential slipped to 2.5ppts, but there was a constructive explanation for it. It might be the lowest differential in the past six quarters, but it is a function of robust growth in advanced economies. The IMF forecasted EM growth to exceed DM by 2.8ppts in April 2023 after all. Since then, DM growth has been revised higher from 1.4% to 1.7%. At the same time, the EM growth forecast was revised up 0.1% to 4.2%. Another interesting facet of the publication was that China’s 2024 growth outlook remained unchanged at 4.6%, but the IMF flagged risks associated with the troubled property sector. In the press statement, the IMF’s Chief Economist commented that China’s 1Q GDP outperformance may prompt an upward revision to the outlook. Should this continue, then we can expect the EM-DM growth differential to pick-up next quarter. There are many reasons to be constructive on emerging markets when considering the details of the IMF report.

Emerging market banks take full advantage and issue Additional Tier 1 (AT1) instruments

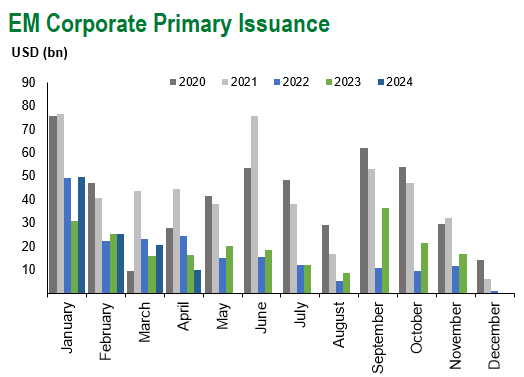

Event: A noticeable trend has emerged where banks have turned to AT1 issuance. Early Q124 earnings releases in global financials point to ongoing stability given resurgent capital markets activity, elevated net interest margins, contained asset quality normalisation and strong capitalization.

Gramercy Commentary: We note that some regions are showing early signs of margin contraction, slowing loan growth in interest rate sensitive sectors (mortgages, real estate, corporate/SME lending – albeit offset by strong consumer/credit card lending) which are likely to continue in 2024. Emerging market bank issuers have taken full advantage of the relative availability of capital and proceeded with AT1 issuance plans. Vakifbank executed the inaugural state bank AT1 in Turkey, issuing $550m PNC5.25 at 10.125% following similar deals from Akbank, TSKB and Yapi Kredi in the last month. We expect to see ongoing Turkish bank capital issuance in 2024 as banks look to build capitalization to weather the ongoing challenges of the macroeconomic adjustment that will weigh on capitalization via FX and asset quality channels. Separately, TBC Bank (Georgia) announced a tender and AT1 new issue following the Bank of Georgia’s PNC5.5 $300m issuance at 9.5%. Motivated by upcoming calls and robust RWA growth supported by trade rerouting and migrant flows related to the Russia/Ukraine conflict in recent years, both are now able to issue benchmark size AT1 instruments. We increasingly expect to see CEE banks, buoyed by recent NIM expansion/profitability gains, look to deploy excess capital into M&A opportunities (including overseas) to help maintain growth ambitions when facing otherwise mature and concentrated domestic markets. Uzbekistan’s banking sector privatization process remains a likely recipient of such interest as seen with acquisitions by OTP Bank and TBC Bank in recent years. We also expect CEE banks to be particularly active in 2024, issuing senior preferred for MREL purposes given regulatory requirements.

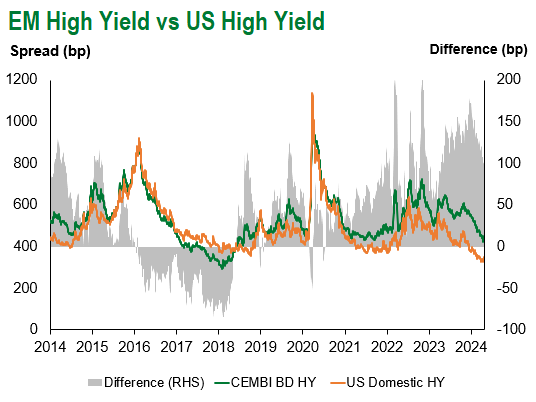

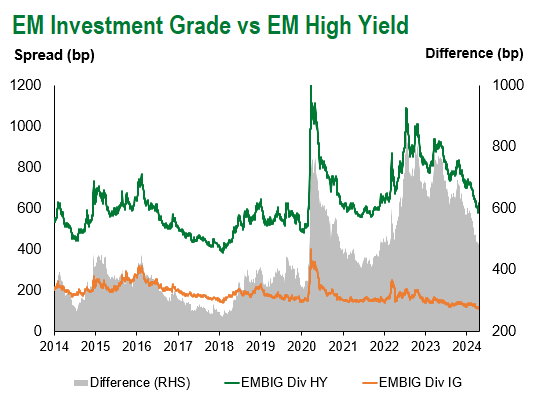

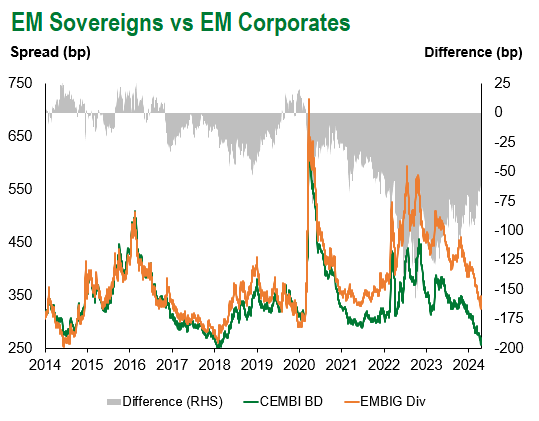

Emerging Markets Technicals

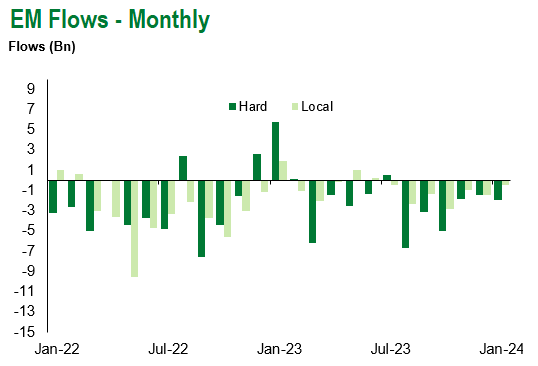

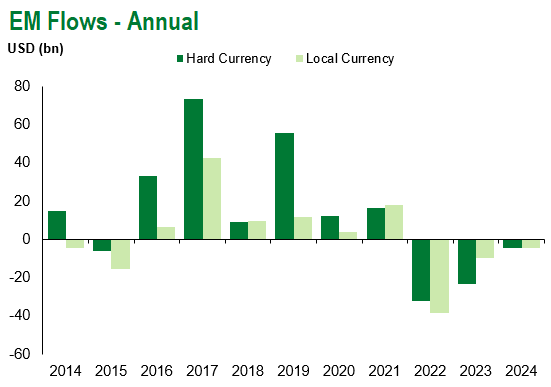

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of April 19, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.