June 2023 marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

Lower CPI inflation triggered a cross-market rally. It wasn’t enough to price in a July cut, but the market can breathe easy for a moment and instead focus on the Federal Reserve easing in September. The S&P 500, Nasdaq, Dow Jones, EuroStoxx 600 and Magnificent 7 all rose to all-time highs. Unsurprisingly, the VIX declined to its lowest level since January. In the aftermath of the U.S. CPI report, the market was quick to price in over two Fed cuts. This was marginally unwound through the latter part of the week as the U.S. dollar weakened to a one-month low. The debate instead shifted to whether the Bank of England or ECB will go ahead in June. Fedspeak over the week was geared toward higher-for-longer and noting that there was still room for improvement in the disinflationary path. Policy initiatives out of China were aimed at addressing unsold homes as inventories swelled to eight-year highs, while economic data was mostly upbeat, even if total social financing declined for the first time since 2005. However, the theme of the week was still around U.S. tariffs, which the Chinese are yet to respond to. The PBoC also kept the one-year MLF rate unchanged at 2.50%. Other events across EM saw Argentina and the IMF reach a staff-level deal at the eighth review under the existing program leading to a near-term disbursement. The European Union announced a temporary lifting of Venezuelan sanctions ahead of elections. Elsewhere, Panama’s President-elect signaled openness around reopening the country’s largest copper mine. Finally, Brazil’s President acrimoniously fired Petrobras’ CEO, but volatility in bond prices was short-lived, even if the equity remained down 11% on the week. Meanwhile, the volatility in meme stocks continued to remain extremely elevated after recent posts from Roaring Kitty on X.

EM Credit Update

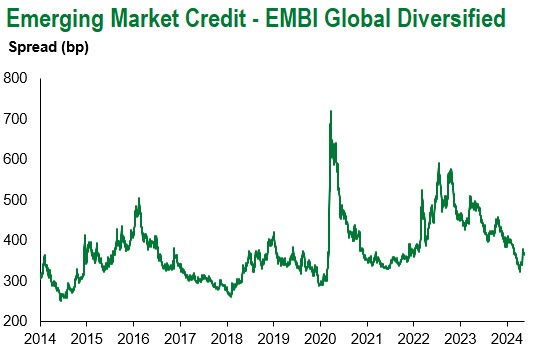

Emerging market sovereign credit (cash bonds) ended the week up +1.05% with credit spreads 4bps tighter. Sovereign outperformers were Zambia, Ghana and Iraq, while Ethiopia, Ukraine and Ecuador underperformed. The Republic of Zambia had reached an agreement with creditors in March and the process advanced this week with a consent solicitation, which is the key voting process for bondholders to exchange into the new instruments and exit default on June 11th.

The Week Ahead

The release of the Fed’s FOMC minutes ought to provide some clarity on the thinking of supply-side factors contributing to a lower inflation path. Away from the U.S., the focus on UK jobs and inflation data may dictate the course of the Bank of England decision in late June. The same is equally true for the ECB with Euro-area inflation data due next week as the Central Bank also gears up for its first cut. The People’s Bank of China will then opine on the one-year and five-year Loan Prime Rates, although these are expected to remain unchanged at 3.45% and 3.95%, respectively. Other key EM interest rate decisions are expected from Chile (6.5%), Egypt (27.25%), Hungary (7.75%), Indonesia (6.25%), Nigeria (24.75%), Philippines (6.0%) and Turkey (50%). Inflation data is then due out of Brazil, Nigeria, Russia and South Africa, while GDP updates will come from Chile, Mexico and Poland.

Highlights from emerging markets discussed below: China credit growth data disappoints, U.S. increases tariffs; government delivers support measures; Argentina receives staff level approval on 8th review; monthly inflation falls to single digits; President-elect Mulino announces a market-friendly cabinet in Panama.

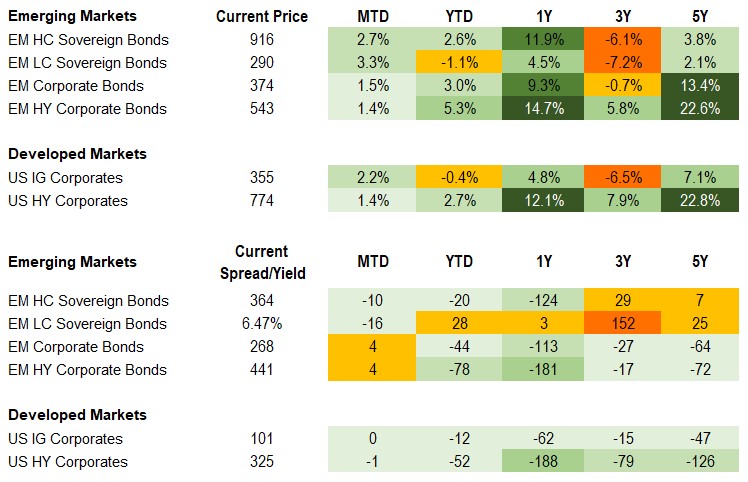

Fixed Income

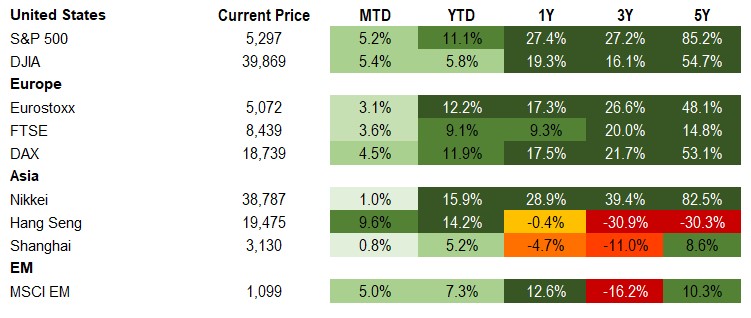

Equities

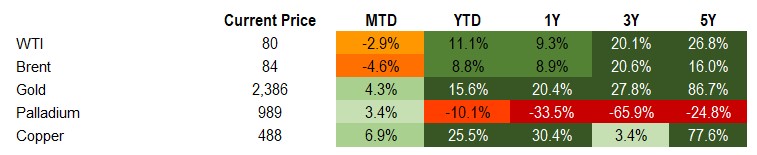

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 17, 2024 (late-morning).

Emerging Markets Weekly Highlights

China credit growth data disappoints, U.S. increases tariffs; government delivers support measures

Event: Credit data was weaker than expected with M1 contracting 1.4% y/y in April while total social financing dipping to 8.3% y/y from 8.7% y/y. The slowdown was broad-based and led by household loans. Industrial production data surprised to the upside while retail sales and fixed investment were softer than expected. On Tuesday, the U.S. announced anticipated tariff increases across a variety of Chinese products as part of the 301review process. Rates will increase for steel and aluminum products, electric vehicles, EV batteries and critical minerals. In the aftermath of the week’s data and tariffs, authorities launched this year’s first 1 trillion yuan issuance of long dated special sovereign bonds on Friday and announced property measures including 300bn yuan in PBOC funding to support home purchases as well as lower down payment requirements for homebuyers and removal of the mortgage interest rate floor.

Gramercy Commentary: The soft credit data and mixed high frequency growth data combined with increasingly electorally oriented U.S.-China policies in 2H reinforces the need for continued supportive economic measures. At this stage, we expect Beijing to react in a relatively contained manner to the tariff hikes while keeping in mind that the action signals an evolution in approach to policy away from the previous intention to cooperate in the area of climate. We anticipate China’s authorities will continue to implement incrementally supportive economic measures in response to weak economic data with the broader home-buying program as a constructive step to begin to more meaningful lower inventory.

Argentina receives staff level approval on 8th review; monthly inflation falls to single digits

Event: The IMF and Argentine authorities reached a staff level agreement on the 8th review of the EFF program. The press release struck a constructive tone noting that all performance criteria were met with margins while continued efforts are underway to improve the quality and fairness of the fiscal consolidation, refine monetary and FX frameworks, and unlock bottlenecks to growth. Upon board approval, the Government will receive roughly $800mm. Later in the week, April monthly inflation printed in single digit territory at 8.8% down from 11% the month prior while annual inflation was 289% y/y. BCRA lowered its policy rate another 10% points to 40% in response.

Gramercy Commentary: The successful completion of the IMF review as well as easing monthly inflation are positive developments for the economic team and Milei. While single digit monthly inflation is a significant milestone, a very elevated annualized rate continues to weigh on the economy. Beyond continued improvement in the inflationary backdrop, investors’ focus remains on the fate of the omnibus and fiscal bills in Congress, evolution of Milei’s popularity, and clarity on monetary and FX policy.

President-elect Mulino announces a market-friendly cabinet in Panama

Event: Panama’s incoming President José Raúl Mulino revealed his cabinet appointments this week, including Felipe Chapman as Minister of Finance and Frank Ábrego as Security Minister. Several other names affiliated with various political parties signal a “national unity Government” approach by Mulino, which could help him with governance within a fragmented political environment.

Gramercy Commentary: As we wrote in our comment last week, with elections in Panama out of the way, investor focus has shifted to President-elect Mulino’s choices for the key market-relevant positions in his Administration due to take office on July 1st. The appointments of both Chapman and Abrego send a credit-positive signal that corroborates the Mulino Administration’s market-friendly bias, in our view. Chapman, former Chairperson and CEO of Panama’s Stock Exchange, is a well-known figure by the local and international investor community. In due course, his top priority will be to present specific initiatives to tackle the country’s fiscal and pension system challenges. The credibility of those proposals will likely determine if the sovereign will be able to preserve its coveted IG credit rating from Moody’s and S&P, having already lost it from Fitch. We believe the rating agencies will give Panama the benefit of the doubt during 2H 2024, but the new Administration’s main challenge will be advancing tough fiscal reforms in a fragmented national assembly. Abrego, the new Security Minister, has a military background. His main task will be to limit illegal migrant flows through the so-called Darien gap, the dangerous jungle crossing between Colombia and Panama, that are set to hit a record for the fifth straight year, according to a UN report released this week. High migrant crossings through Panama, predominantly from Venezuela, have contributed to overwhelming the U.S. southern border, a huge political issue in American domestic politics in an election year. Mulino has pledged to shut down migration routes to the U.S., which would ensure significant goodwill by the next U.S. Administration.

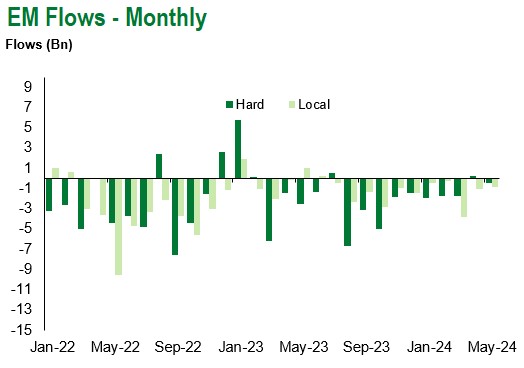

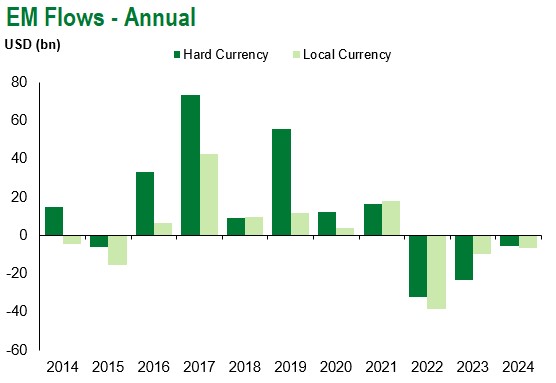

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 17, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.