Contents

Market Overview

Macro Review

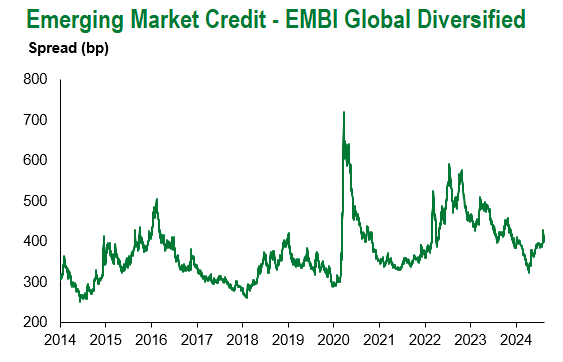

Markets continue to normalize after the JPY blip last week. The VIX fell back to a low of 14.8 ten sessions after hitting one of the highest intra-day points on record when the fear-gauge rose above 65pts. Instead, the theme of the past week was around an acceptable U.S. CPI reading, which consolidated the disinflationary narrative after the decline in PPI, although strong retail sales re-questioned the soft-landing narrative. Critics will still challenge whether PPI is a reliable forward-looking proxy for CPI, but retail sales was trickier to explain. Needless to say, the market notched this as a victory and U.S. Treasuries rallied over the week. The next key data release is non-farm payrolls on September 6th, after the Jackson Hole Symposium, which ought to support the view of an interest rate cut by the Federal Reserve on September 18th. The debate is whether 25bps is favored over 50bps. There was better progress on service inflation around the world, and in particular in the UK, as services inflation dramatically fell to 5.2% in July from 5.7% in June. There were other surprises with Germany’s Zew investor expectations index declining to 19.2 (from 41.8), which recorded the largest monthly decline since the gas shock in summer 2022. The Japanese Prime Minister, Fumio Kishida, also announced that he would step down next month. Across EM, Brazil’s Lula suggested Venezuela should hold a new election, which President Biden initially supported until the White House walked the comments back. Lula is also seeking to influence the new Brazilian Central Bank Governor, just as the Senate hearings are soon to commence. Mexico’s Sheinbaum is rumored to be appointing new CEO’s at Pemex and CFE. Turkey’s current account for June was a surplus and comfortably beat expectations at $407m. Finally, Ukraine’s incursion into Russia appears more successful than initially thought, but the focus is on the upcoming restructuring which is imminent as the voting deadline approaches next week.

EM Credit Update

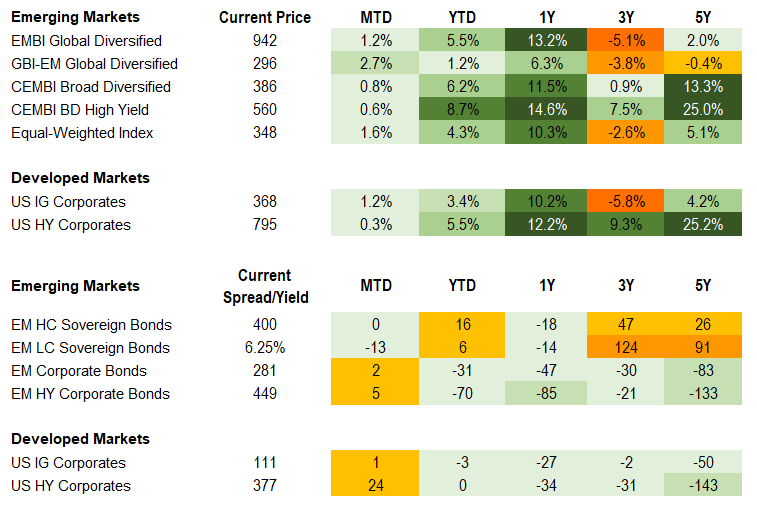

Emerging market sovereign credit (cash bonds) ended the week up 0.8%, with credit spreads 9bps tighter. Sovereign outperformers were Ghana, Ecuador and Argentina, while Ethiopia, Ukraine and Tunisia underperformed.

The Week Ahead

The key event of next week is likely around the Democratic National Convention on August 19th-22nd. On Thursday, the Jackson Hole Symposium will commence, and Chair Powell will ultimately provide some guidance on the September FOMC decision. Aside from minutes out of the Federal Reserve, ECB, Reserve Bank of Australia and Mexico’s Banxico, the key interest rate decisions are due out of the Riksbank and China with the MLF 1-year and 5-year rates. Other EM interest rate decisions are due from Indonesia (6.25%), Thailand (2.5%), Turkey (50%) and South Korea (3.5%). Across LATAM, there is more focus on Chile and Peru with GDP releases.

Highlights from emerging markets discussed below: Choice of new Thai Prime Minister signals policy continuity and Guatemala passes 2024 supplementary budget.

Fixed Income

Equities

Commodities

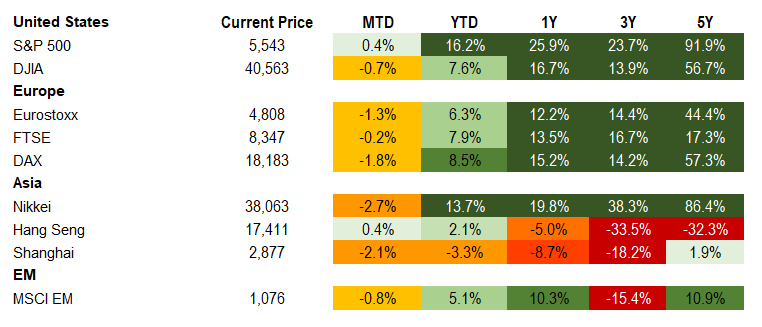

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of August 16, 2024 (early-morning).

Emerging Markets Weekly Highlights

Choice of new Thai Prime Minister signals policy continuity

Event: Paetongtarn Shinawatra, 37, daughter of one of Thailand’s most prominent political figures and former Prime Minister Thaksin Shinawatra, is poised to become the country’s new Government leader.

Gramercy Commentary: Ms. Shinawatra’s likely appointment comes on the heels of the Constitutional Court’s decision earlier this week to remove the previous PM and his Administration from office on the grounds of breached constitutional ethics standards. Her taking over as Head of Government supported by an 11-party conservative coalition in Parliament points to economic policy continuation, focused on growth-supportive fiscal policies and tackling high levels of household debt amid lackluster GDP growth trend of only around 2% YoY over the last decade. Investors will be monitoring for signs of renewed domestic turmoil, a frequent occurrence in Thai politics in the past few years, with the Constitutional Court having last week disbanded the main opposition party (Move Forward) that controls the most seats (150) of any party in the Thai parliament’s 500-member lower house.

Guatemala passes 2024 supplementary budget

Event: With a 2/3 majority, Congress passed a roughly $1.9bn budgetary increase for this year, which has been under discussion since the start of Arevalo’s term in January

Gramercy Commentary: This is incrementally constructive for governability and spending execution which are historically constraints for the country. This should allow for more broad-based budget execution through the remainder of the year bringing the deficit closer to the 2.6% of GDP maximum target for 2024 albeit likely still shy of it. The focus will now move to the 2025 budget, which is due to be presented to Congress on September 2nd. If political cooperation extends beyond the fiscal arena, there could be an opening for progress on key institutional reforms which could lift GDP potential and trigger rating upgrades over the medium term.

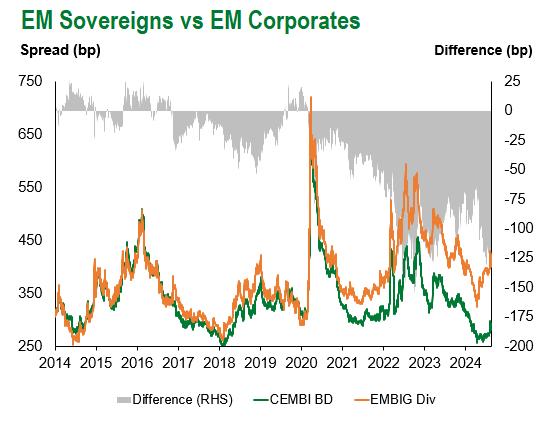

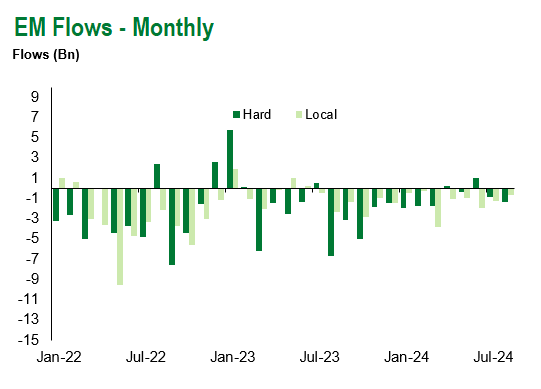

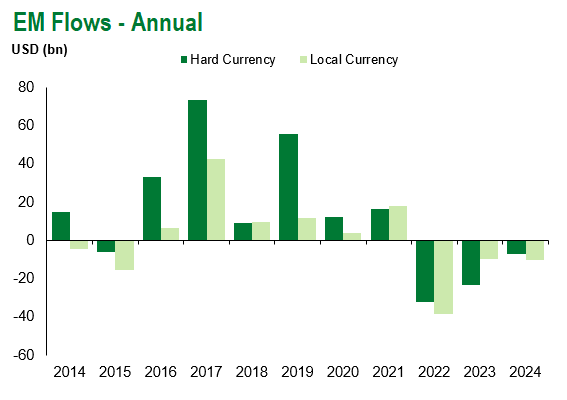

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of August 16, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.