Contents

Market Overview

Macro Review

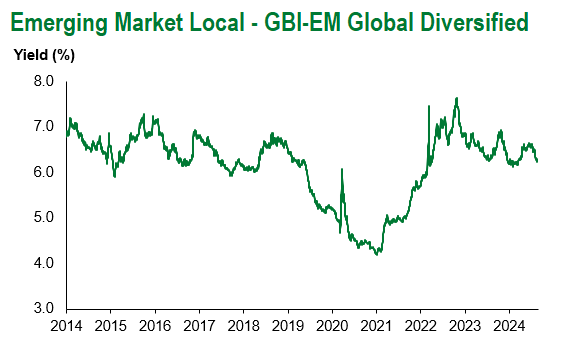

Chair Powell’s remarks at Jackson Hole guided to easing policy rates in September. Chair Powell could not have been more explicit, in that he stated that “the time has come for policy to adjust” and the direction of travel is clear. The dollar traded down to a one-year low, EMFX rallied sharply, U.S. Treasury yields declined 3-7bps on Friday and stocks recovered after trading softly over the week. It marked a change from the delayed BLS data that triggered macro volatility on Wednesday. There was an almost 20-minute delay in the BLS employment data that was verified at -818k and implied that the average monthly NFP would have fallen from +242k to +174k. It was the worst reading since 2009 but after a brief period of volatility the market recovered, and instead focused on the Democratic National Convention and Jackson Hole Symposium. Fed fund futures are now pricing in over 100bps of interest rate cuts into year-end after weaker data, therefore it is a question of whether too much is priced in or whether this is rightfully causing dollar weakness. The new bout of USD weakness left EMFX having its best month this year, as low yielders outperformed significantly. Specifically, IDR, MYR and CZK have now appreciated more than 4% this month.

EM Credit Update

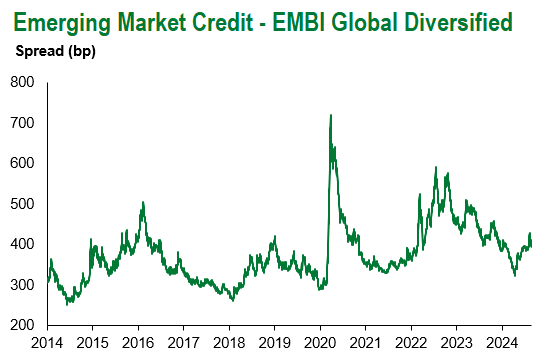

Emerging market sovereign credit (cash bonds) ended the week up 0.5%, with credit spreads 4bps tighter. Sovereign outperformers were Ethiopia, Tajikistan and Gabon, while Sri Lanka, Argentina and Ukraine underperformed.

The Week Ahead

Next week the U.S. PCE report will offer a gauge of where the Federal Reserve is at, before the last NFP before the September interest rate decision. The Euro-area data is set to show further disinflation in August, but the question is around the stickiness of the services category. Poland’s August inflation report will be a well telegraphed event, with some focus on EM interest rate decisions from the People’s Bank of China with the one-year MLF rate (2.3%), Hungary (6.75%), Israel (4.5%) and Kazakhstan (14.25%). Other Chinese data releases cover industrial profits and PMIs. India will also furnish its GDP reading for 2Q.

Highlights from emerging markets discussed below: IMF external sector report reflects receding imbalances and Indonesia presents benign 2025 budget; protesters delay vote on election law.

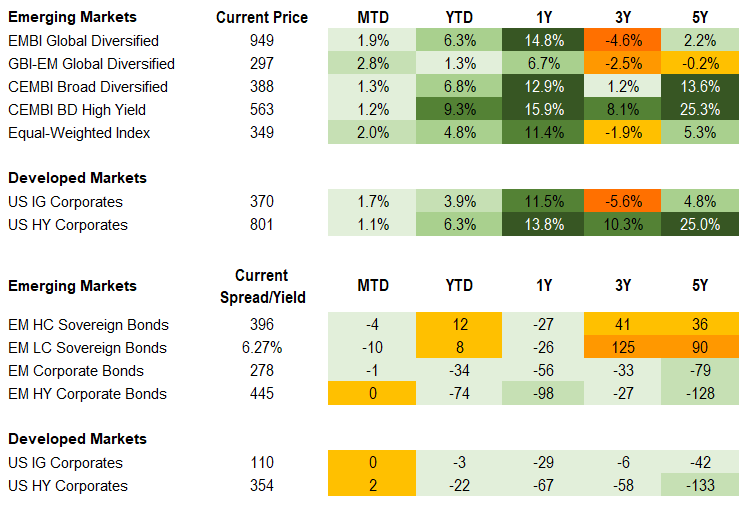

Fixed Income

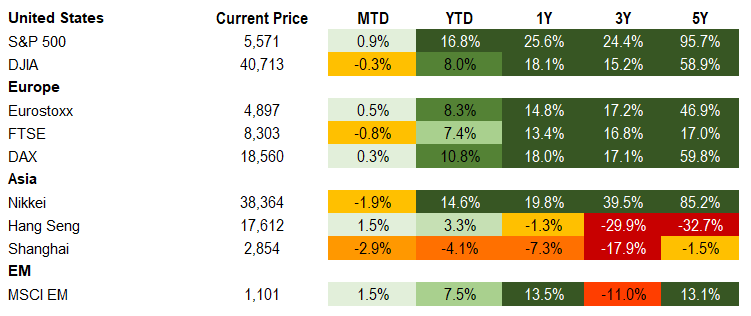

Equities

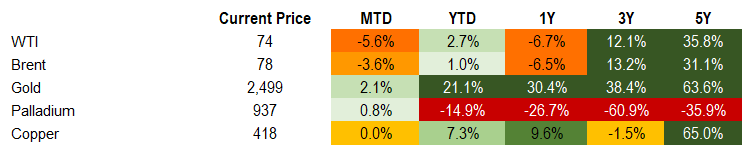

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of August 23, 2024 (early-morning).

Emerging Markets Weekly Highlights

IMF external sector report reflects receding imbalances

Event: The IMF’s annual assessment of external positions of 30 major economies (~90% of global GDP) found that net capital inflows to EM recovered in 2023 from 2022, but remain in negative territory. The global current account balance narrowed as outsized surpluses post-pandemic eased. While the report forecasts a continued narrowing as current account deficit countries fiscally consolidate and commodity prices further moderate, risks are plentiful amid varied execution of fiscal consolidation and geopolitical fragmentation and conflicts. Differentiation across countries resulted in mixed FX trends last year while the Fund determined that ten economies’ external positions were stronger in 2023 than medium term fundamentals (ex: India, Malaysia, Mexico) and nine countries had weaker external positions than medium term fundamentals implied (ex: Argentina, Turkey, Saudi Arabia). From a 2023 REER valuation perspective, the Fund assessed the USD as overvalued.

Gramercy Commentary: We view the reports relatively sanguine assessment of global external balances as neutral to constructive for EM, particularly amid prospects for gradual normalization of U.S. interest rates. With this being said, the report highlighted risks, such as commodity price fluctuations, geopolitical volatility, and inconsistent policy implementation, still need detailed country-specific analyses to adequately identify winners and losers.

Indonesia presents benign 2025 budget; protesters delay vote on election law

Event: The announced preliminary budget target for 2025 of 2.5% of GDP with a growth assumption of 5.2% signals a commitment to fiscal prudence and likely adherence to the fiscal deficit cap at 3% of GDP. Later in the week, thousands protested Government efforts to prevent smaller parties from running in the upcoming November 27th regional elections as well as an amendment to age requirements, which would allow outgoing President Jokowi’s youngest son to run as Governor in Central Java.

Gramercy Commentary: We expect the sovereign balance sheet to remain relatively robust despite lingering political and social risk that could lead to volatility and spending pressure in the run-up and aftermath of the inauguration of President-elect Prabowo Subianto on October 20th. The country’s moderate debt to GDP of less than 40% as well as an improved current account deficit relative to the pre-Covid period provides some room for increased spending, most likely on soft and human capital infrastructure development while a roughly 1% of GDP of unallocated spending could be utilized in the event of a revenue shortfall.

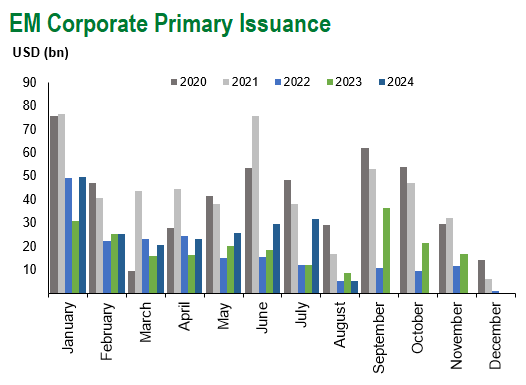

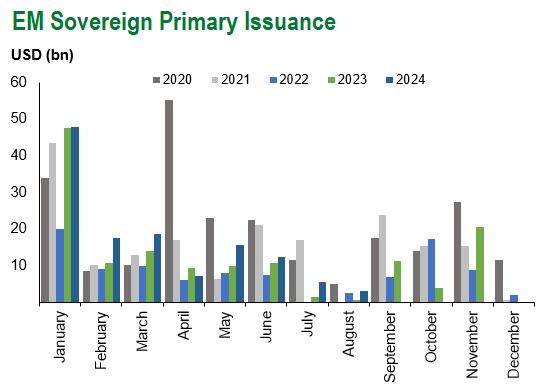

Emerging Markets Technicals

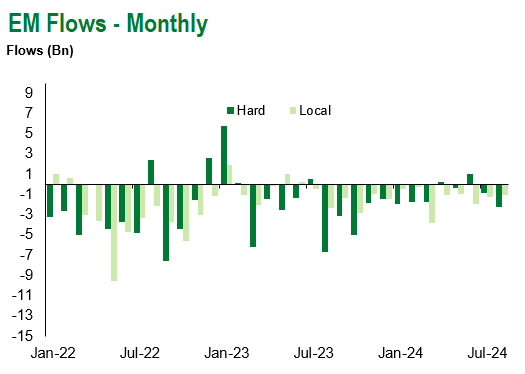

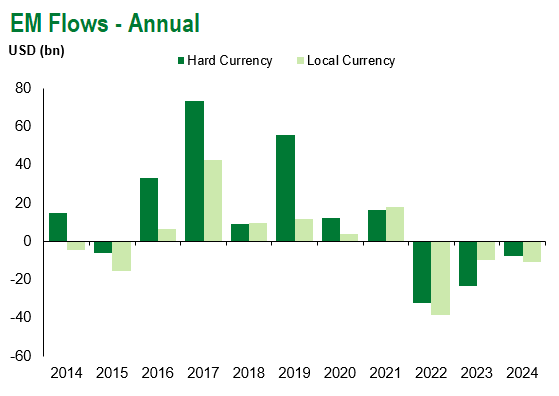

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of August 23, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.