Contents

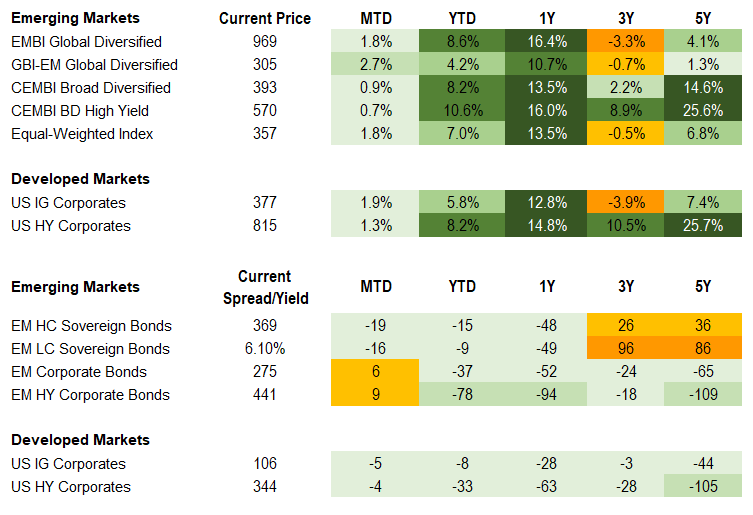

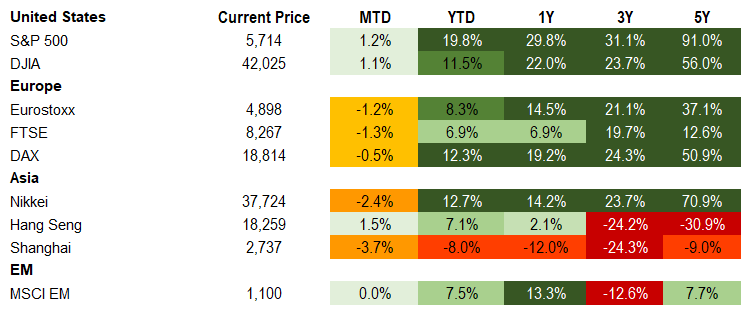

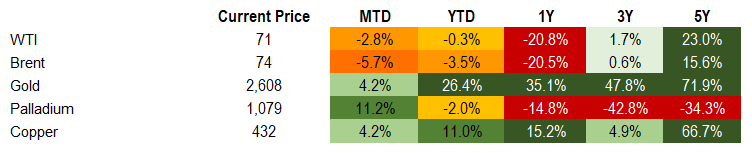

Market Overview

Macro Review

The Federal Reserve’s easing cycle began with a 50bps interest rate cut. Policy rates were reduced to 4.75-5.0%, and the dot plot signaled a year-end rate of 4.25-4.50%, implying another 50bps of rate cuts in November and December. That’s very acceptable, but the market is now asking for more and had priced-in 70bps of cuts by year-end toward the end of last week. Chair Powell repeatedly framed the decision as a “recalibration”, stating that “there is no sense that the committee is in a rush” and added that this should not be interpreted as “new pace”. The market doesn’t believe him. The decision was also an 11-1 vote with Governor Bowman becoming the first Fed official to dissent since 2005. In many respects, the larger cut also came amid a dovish shift to the Fed’s inflation and unemployment projections compared to June. This was qualified by the 2025 PCE inflation that was lowered two-tenths to 2.1% and the unemployment forecast that was raised two-tenths to 4.4%. The balance of risks has objectively shifted from inflation to unemployment, even if Governor Waller tried hard to dial this back on Friday. The FOMC reaction was mostly positive, and markets shifted from a soft-landing to no-landing. Brent oil briefly moved above $75/bbl on Thursday and finished up over 4% last week as the tailwind from the Fed rate cut and escalating tensions in the Middle East supported sentiment. The S&P 500 was unstoppable and clocked a 39th all-time high for the year. The Atlanta Fed’s GDPNow was also indicative of a no-landing scenario with GDP trending at 3.0%. The VIX declined substantially to 16 on its triple-witching day, and volatility of the U.S. Treasury bonds (MOVE index) fell below 100pts for the first time since July. We can thank the Bank of Japan for holding interest rates unchanged and not tightening policy, although this did trigger weakness in JPY that accompanied a weaker USD. In turn, EMFX strongly outperformed. The Brazilian real was one of the strongest performers, closely followed by the Malaysian ringgit and Indonesian rupiah. The only pause for concern was gold’s rally to an all-time high.

EM Credit Update

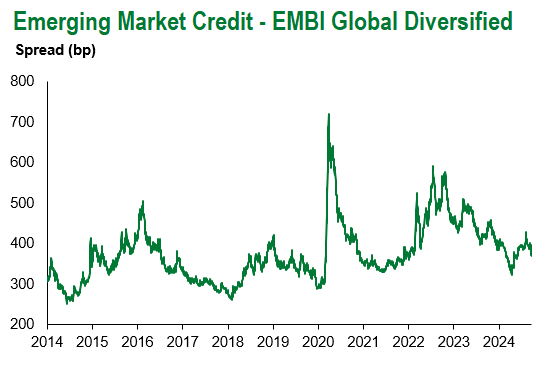

Emerging market sovereign credit (cash bonds) ended the week up 0.8% with credit spreads 16bps tighter. Sovereign outperformers were El Salvador, Argentina and Kenya, while Ethiopia, Tunisia and Tajikistan underperformed.

The Week Ahead

Fed speeches are due from Goolsbee, Bostic and Kashkari as soon as Monday. This ought to govern how risk sentiment trades. It will become an opportune moment to assess a multitude of Fed views after the recent FOMC, just as Governor Bowman said it was too early to declare victory on inflation on Friday. Developed market interest rate decisions are due from Australia, Sweden, Switzerland, while the key EM interest rate decisions are due out of Mexico, Nigeria and Sri Lanka. The People’s Bank of China will also update its one-year medium-term lending facility rate on Wednesday, but the recent loan prime rates were kept unchanged this past week. U.S. President Joe Biden hosts the prime ministers of Australia, India and Japan for a Quad Leaders Summit in his home state of Delaware. Elsewhere, UK and Euro-area flash PMIs will determine European sentiment, and to a lesser extent the annual UN General Assembly in New York. We can also expect some focus on OPEC as it releases its annual World Oil Outlook. Finally, elections over the weekend in Sri Lanka and Czech Republic will be closely watched events.

Highlights from emerging markets discussed below: Brazil’s Central Bank hikes the policy rate by 25bps, Turkey’s holds at 50%; Indonesia and South Africa cut rates by 25bps; and Milei presents balanced 2025 budget to Congress.

Fixed Income

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of September 20, 2024 (early-afternoon).

Emerging Markets Weekly Highlights

Brazil’s Central Bank hikes the policy rate by 25bps, Turkey’s holds at 50%

Event: On the same day that the U.S. Federal Reserve initiated its long-anticipated policy easing cycle by delivering a 50bps rate cut, the Central Bank of Brazil (BCB) hiked its main interest rate (SELIC) by 25 bps to 10.75%. Meanwhile, its Turkish counterpart (CBT) held the policy rate unchanged at 50%, as widely expected.

Gramercy Commentary: BCB’s decision to tighten monetary policy, bucking the global and regional trend in both EM and DM toward lowering interest rates, came as no surprise to markets in the context of stronger than expected performance by the Brazilian economy and medium-term inflation expectations that remain “unanchored” in BCB’s assessment. We expect one or two additional hikes of the same magnitude by year-end by BCB to reassure markets that the medium-term inflation outlook will be re-anchored. The 25bps hike comes as Gabriel Galipolo, nominated by President Lula to replace Roberto Campos Neto as BCB’s President starting in January 2025, is set to be confirmed by Congress in early October. Given that Lula has been pushing for easier monetary policy by BCB, this week’s policy decision as the leadership team is set to be seated should further bolster BCB’s already high institutional credibility, in our view. We see the BRL as oversold relative to its strong fundamentals and expect FX valuations to gradually improve. In Turkey, the on-hold decision by CBT was also expected by market consensus, but we note that the forward guidance has shifted to a slightly more dovish direction amid consecutive major declines in headline inflation numbers. Mehmet Simsek, Finance Minister and architect of Turkey’s ongoing macroeconomic normalization program, spoke about YoY inflation finishing the year in the low 40s%, having declined from its recent peak of 75% in May. While we expect the CBT to remain highly vigilant toward risks to disinflation, we think that collapsing inflation prints should open the door for a rate-cutting cycle by late 2024 or 1Q 2025 that would support Turkish assets, especially in local currency.

Indonesia and South Africa cut rates by 25bps

Event: Bank of Indonesia (BI) and South Africa Reserve Bank (SARB) cut their policy rates by 25bps to 6.0% and 8.0%, respectively. This puts the current real policy rate at 4.1% and1.6%. The rupiah and rand traded well in the aftermath. BI’s forecasts in Indonesia were largely unchanged with a shift to balanced priorities of pro-growth and pro-stability. SARB’s cut was unanimous with growth risks assessed as balanced and inflation expected to remain contained below the midpoint of the target range through the forecast horizon.

Gramercy Commentary: We see the Fed’s larger than anticipated 50bps cut as a window for many emerging market central banks to adjust policy if domestic conditions are appropriate. In the case of both Indonesia and South Africa, positive real rates with recently well-behaved inflation and FX rates have allowed them to commence easing cycles.

Milei presents balanced 2025 budget to Congress

Event: President Milei presented a draft 2025 budget to Congress, which entails a zero-headline balance and a 1.3% of GDP primary surplus as well as a fiscal rule to ensure balance and limit current spending with automatic adjustments if revenue disappoints. Real GDP growth for 2025 is set for 5% while inflation is forecasted at 18.3%. Congressional discussion will begin in the Lower House next week.

Gramercy Commentary: The contours and intent of the budget are constructive despite ambitious assumptions in some areas. The fiscal rule underscores the Administration’s unwavering commitment to consolidation, though it faces implementation in a still weak institutional context. The budget also includes $3.3bn in external issuance for next year. Approval of a 2025 budget and any new IMF financing are the next key political tests for Milei and the economic team.

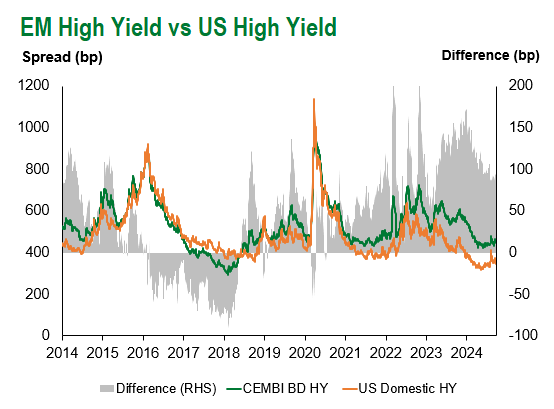

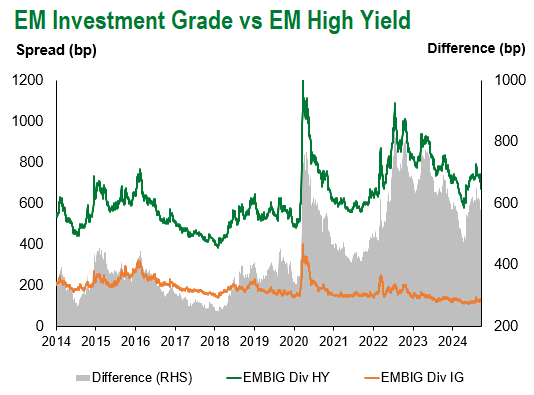

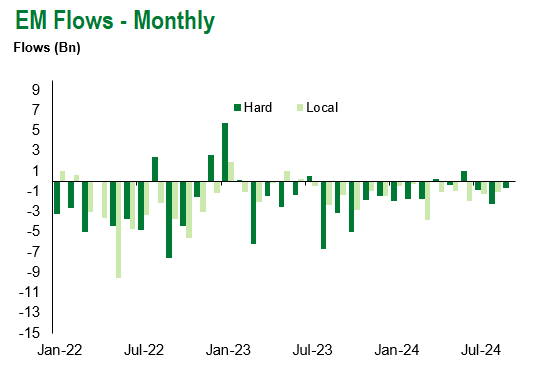

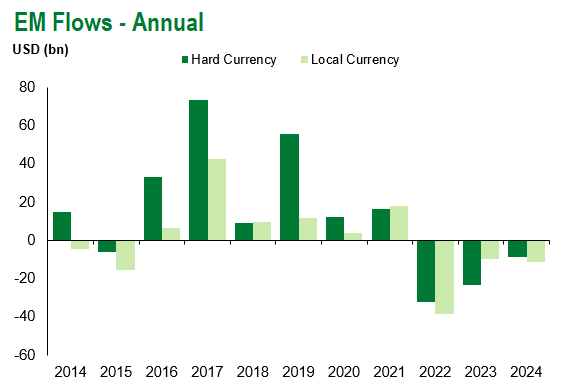

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of September 20, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.