Contents

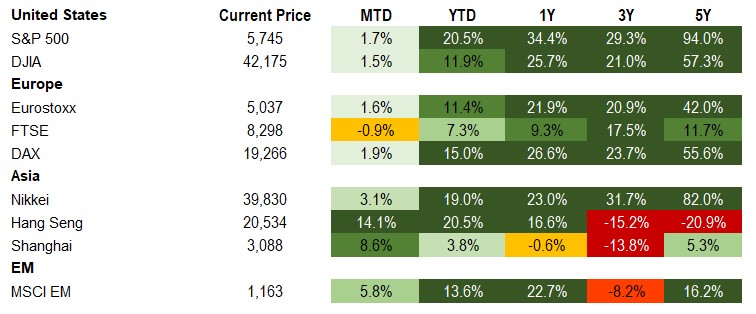

Market Overview

Macro Review

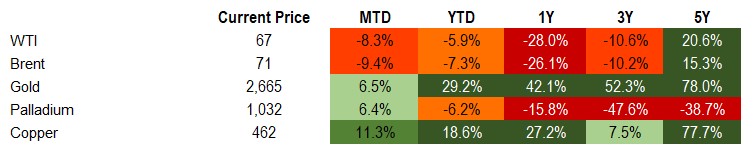

Are the Chinese stimulus measures enough? The market is hungry for answers and while the measures may act as a glide path to achieve 5.0% GDP growth, there is a question as to whether the tools can sustain a real estate recovery without fiscal expansion. For brevity, Chinese authorities have announced eight key measures. These include interest rate cuts across the reserve requirement ratio, seven-day OMO rate, and one-year MLF rate. The property sector measures included a mortgage rate cut and a reduction in downpayment ratios, which is aimed at tackling unsold inventories. A slew of measures aimed at supporting the financial sector and supportive measures for Chinese stocks were also announced. Some of these policy tools had already been announced at the April Politburo and were part of the May 17theasing measures, but on balance it was a credible and supportive development. Indeed, it was the first time since the global financial crisis that Beijing had injected capital into its systemically important banks. The market received this news-flow well with the CSI 300 and Hang Seng ending the week up 16% and 13%, respectively. Less can be said for political developments out of France. The French 10-year OAT yield surpassed its Spanish equivalent for the first since 2007 and the Franco-German yield differential is now above 80bps, which offers some comparisons to the “Liz Truss moment” that the UK gilt market endured in September 2022. The third macro risk factor to contend with was weaker oil. Crude oil (WTI) was some 6% weaker over the week. Saudi Arabia’s pursuit of market share over targeting $100/bbl is a worry as the physical market moves to surplus in 2025. At the same time, geopolitical tensions in the Middle East continued to escalate ahead of Israel’s possible incursion into Lebanon. There appears to be limited progress with a ceasefire thus far. However, the market remained buoyant given looser U.S. financial conditions, yet the risk premia was captured in gold, which was elevated to another all-time high. U.S. stocks via the S&P 500 also recorded its 42nd all-time high this year, just as Japan’s Nikkei recorded another all-time high.

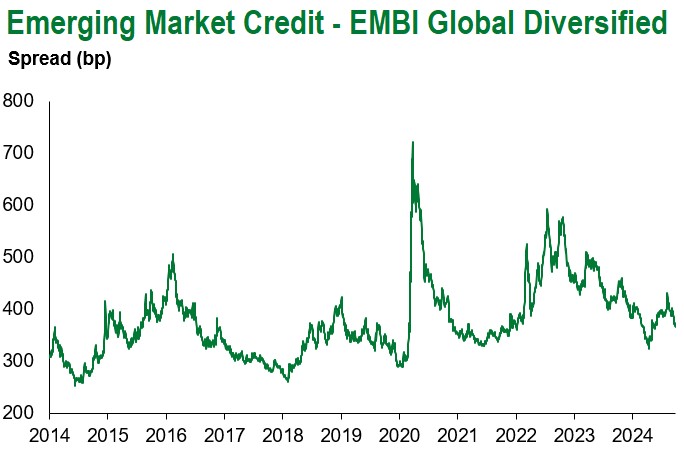

EM Credit Update

Emerging market sovereign credit (cash bonds) ended the week down 0.1%, with credit spreads 4bps tighter. Sovereign outperformers were Sri Lanka, Kenya and Pakistan, while Ecuador, Ethiopia and Tunisia underperformed. Ukrainian risk continues to trade well given progress around G7 releasing $50bn in Russian serves to Ukraine, in addition to $4bn in energy aid from allies and $8bn in military support directly from the U.S. These three features offset Trump’s accusation that President Volodymyr Zelenskyy was refusing to strike a deal to end the war with Russia and casting “aspersions” against him. Also, one of the top performers this week was Sri Lanka with parliamentary elections now set for November 14th. Finally, after the CDS index roll, iTraxx Asia was especially volatile due to the removal of Vanke from the index, which then caused the index spread to drop 24bps to 68bps.

The Week Ahead

Focus next week shifts to U.S. employment data. Expectations for non-farm payrolls are at 140k, with an unemployment rate steady at 4.2% as average hourly earnings are expected to decline from 0.4% to 0.3%. Euro-area headline inflation is likely to dip below the ECB’s 2% target for the first time since 2021. China Caixin PMIs ought to show the Manufacturing reading come in at 50.5 and Services at 51.6, which is broadly flat to the prior month. However, global PMI releases will certainly be a theme. The Czech National Bank cut the 2-week repo rate by 25bps, just as Hungary’s MHB also cut by 25bps and signaled that a cut or hold will be considered at each of the remaining meetings this year (a dovish shift). In Poland, the NBP are likely to keep policy rates unchanged at 5.75%. The same is true in Romania given the fiscal slippage and stronger inflationary pressures. The only other EM interest rate decision is from Colombia (10.75%). China’s Golden Week also begins after the recent stimulus announcements until October 7th. Finally, we’ll have the popcorn ready on Tuesday for the U.S. Vice Presidential debate and Mexico’s President-elect Claudia Sheinbaum inauguration and inaugural speech.

Highlights from emerging markets discussed below: China stimulus spurs speculation over pivot and the Presidential Election outcome raises uncertainty around Sri Lanka’s IMF program and sovereign debt restructuring.

Fixed Income

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of September 27, 2024 (early-afternoon).

Emerging Markets Weekly Highlights

China stimulus spurs speculation over pivot

Event: The PBoC announced a package of interest rate cuts (10-30bps), 50bps reduction in reserve requirement ratio, relaxation of mortgage policy and equity market backing. This was followed by an ad-hoc Politburo meeting later in the week whereby the statement reflected greater urgency for economic support including both monetary and fiscal channels and to stop the decline of the housing market.

Gramercy Commentary: The timing and combination of this week’s measures were unexpected and increase prospects for growth closer to the Government’s 5% target for this year. While it is not yet a bazooka, it is likely a signal for increased momentum of stimulus measures particularly in the context of Fed rate cuts. We think the Politburo statement indicates a desire for a more significant push on fiscal policy into the end of the year with prospects for an upsize in the budget (~1.5trillion RMB) at the next Standing Committee meeting in late October / early November. The scope and effectiveness of additional fiscal support will depend on how it is structured and if it can boost confidence and consumption as well as ease housing and local debt overhangs.

Presidential Election outcome raises uncertainty around Sri Lanka’s IMF program and sovereign debt restructuring

Event: Sri Lanka’s Presidential Elections on September 21st came down to an unprecedented process of counting second and third preferences in ballots after none of the candidates secured 50% of the vote outright. The runoff confirmed Anura Kumara Dissanayake (AKD), a left-wing anti-establishment candidate, as the winner with around 42%, followed by the mainstream opposition with around 33%, and now former president Ranil Wickremesinghe with just around 17%. In one of his first actions as Sri Lanka’s new President, AKD used his constitutional prerogative to dissolve Parliament, in which his party held only three seats, and to call early Parliamentary Elections on November 14th.

Gramercy Commentary: Pre-election, AKD and his party repeatedly spoke about “renegotiating” some conditionality in Sri Lanka’s existing IMF program as well as “preparing an alternative Debt Sustainability Analysis (DSA)”. As such, an AKD Presidency has been seen as the most problematic outcome from a market perspective. If the new President’s pre-election discourse turns into real world policy actions it could jeopardize cooperation with the IMF, delay the still ongoing sovereign debt restructuring process with private sector bondholders, and risk the economy’s impressive recovery from a low base after the acute 2022 political and economic crisis that triggered the sovereign default. President AKD’s willingness and ability to implement policies that would likely be seen as controversial by investors would depend on the size of his party’s representation in the new Parliament post the elections that he has called for on November 14th. We note that in the Presidential vote, AKD increased his share more than tenfold relative to the previous Presidential Election in 2019. In our view, this clearly signals the power of the “protest vote” in Sri Lanka’s current context, including against the IMF reforms championed by outgoing President Wickremesinghe, who bore the brunt of public discontent at the ballot box last weekend.

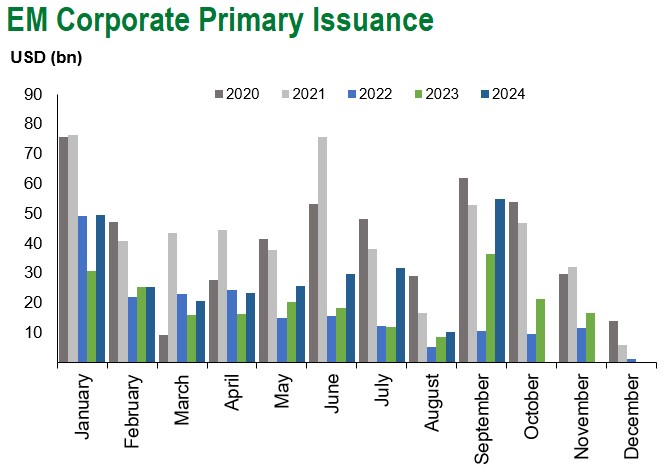

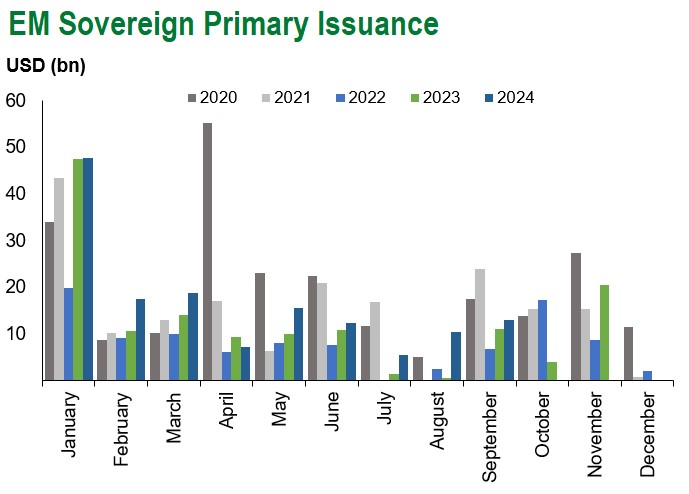

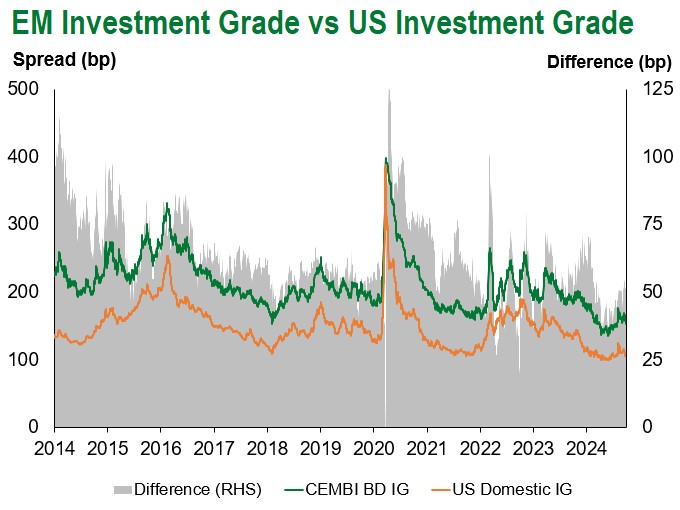

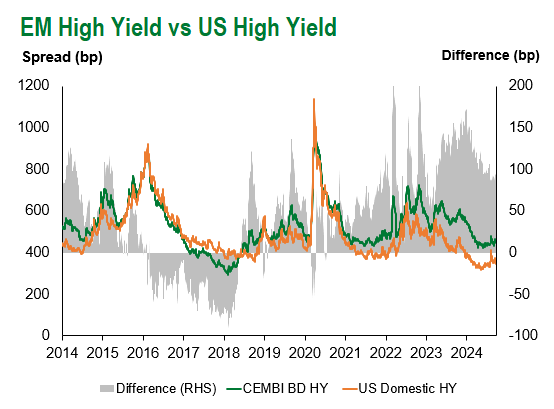

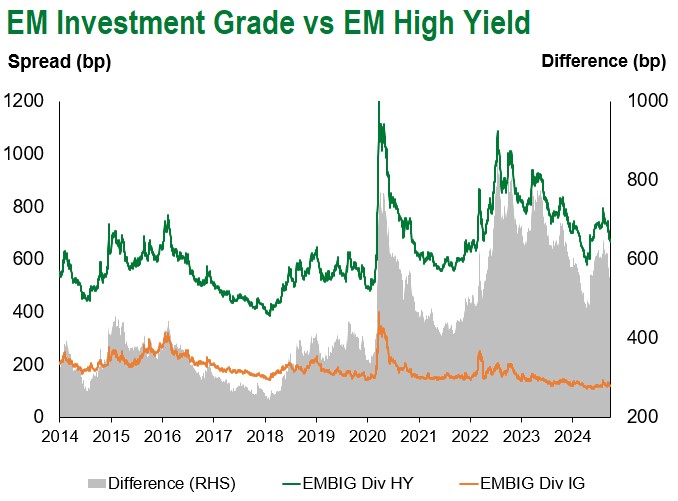

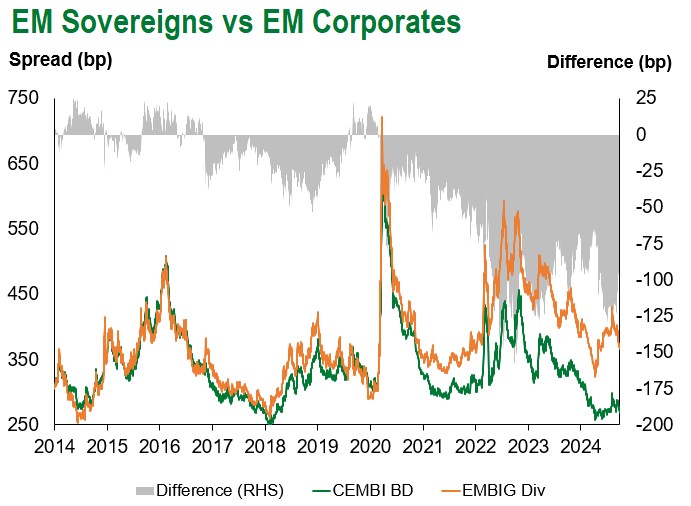

Emerging Markets Technicals

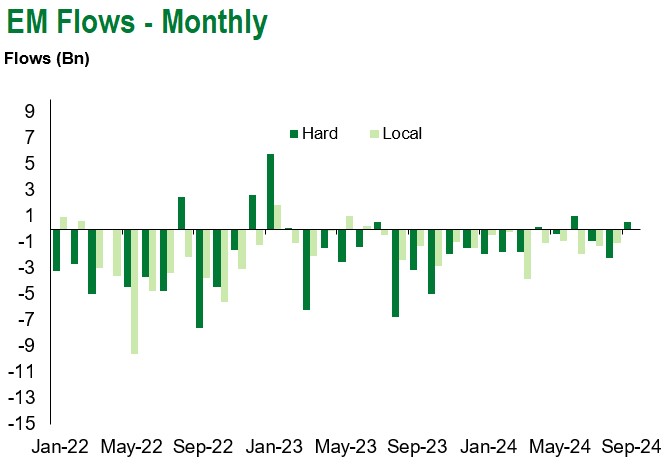

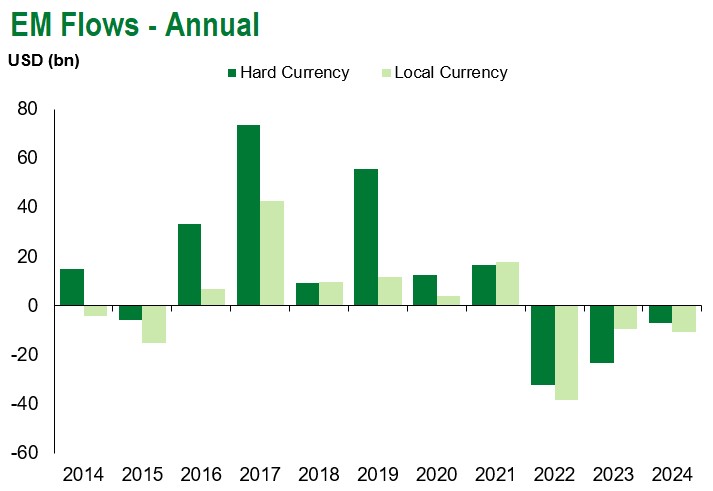

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of September 27, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.