Contents

Market Overview

Macro Review

A week with finely balanced risks. There is still scope for market-friendly Trump appointments, just as Kevin Warsh is seemingly edging out Scott Bessent, who instead may take the top role at the NEC. Another idea would see Warsh replace Jerome Powell as Fed Chair in 2026 and Bessent transition to Treasury Secretary. Elsewhere, Russia’s provocation last Saturday and subsequent escalation briefly weighed on global risk sentiment. These headlines overshadowed the progress around a Lebanese ceasefire, just as the ICC issued an international arrest warrant for Israel’s Netanyahu. Nevertheless, the S&P rallied over each consecutive day last week, just as Bitcoin approached $100k. European natural gas futures hit a one-year high and crude oil priced in a higher geopolitical risk premia. In this regard, gold rose 5% over the week to above $2700/oz. The strong USD caused a large bout of EMFX weakness, along with the EUR that slid to its lowest since October 2023 when markets digested the French budget drama. Part of the Eurozone weakness was driven by dire PMIs on Friday, which triggered large moves in the German bund curve. Both JPM and Barclays are now forecasting GDP growth of just 0.8% in 2024 and 2025 for the Eurozone, which is coupled with high fiscal deficits and unsustainable eurozone debt sustainability, which were key factors in the ECB’s Financial Stability Review. The next potential complication was put forward by Goldman Sachs suggesting near-term upside in crude oil to the mid-$80s on curtailing Iranian supply. However, should the Trump Administration apply 10% tariffs across the board or OPEC raise supply, they would then see oil in the low-$60s (albeit, in 2026). Finally, the looming question is whether OFAC sanctions on Gazprombank will potentially lead to the default of Gazprom on its offshore debt obligations.

EM Credit Update

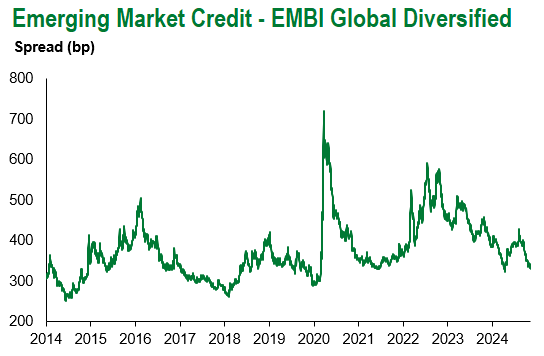

Emerging market sovereign credit (cash bonds) ended the week up +0.4% with credit spreads 3bps tighter. Sovereign outperformers were Sri Lanka, Ecuador and Iraq, while Ethiopia, Tunisia and Suriname underperformed. Two notable themes stood out in EM credit this week. Ukraine rallied to fresh highs as investors continue to add positions. Second, the Adani equity and bond complex came under significant pressure. One of Adani’s renewable subsidiaries had issued a $600m Eurobond, but the transaction was cancelled as the SEC indicted the company and senior executives over alleged bribery. The volatility in Adani equities and bonds was as extreme as it was when Hindenburg published its “short sale” report in January 2022 citing similar concerns.

The Week Ahead

We expect a quieter week ahead of Thanksgiving and Black Friday. A key focal point of the week will be the Fed’s preferred inflation gauge with the PCE index data. Meanwhile, elections in Romania, Namibia, Ireland and Uruguay could have some bearing on regionalized asset prices. Monetary policy decisions are limited to New Zealand, South Korea and Sri Lanka, but NZD will remain in focus given that it hit a two-year low against AUD last week. Finally, Brazil’s revised fiscal package for 2025 will be unveiled on Monday.

Highlights from emerging markets discussed below: 1000 days in, the war in Ukraine enters a new escalatory phase, South Africa cuts policy rate by 25bps; positive rating outlook, and Senegal Parliamentary Election paves way for policy execution.

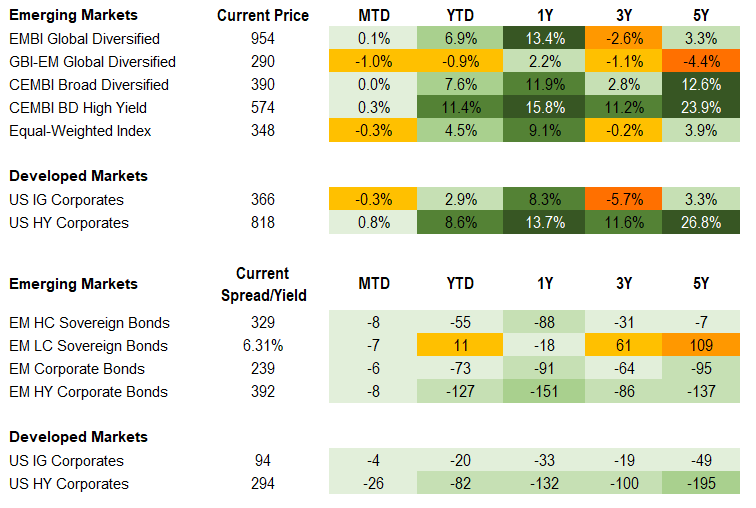

Fixed Income

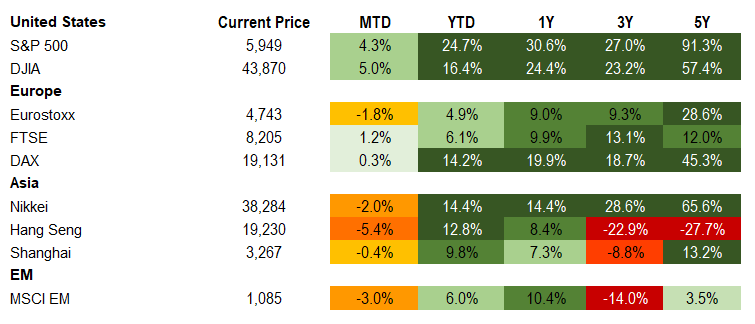

Equities

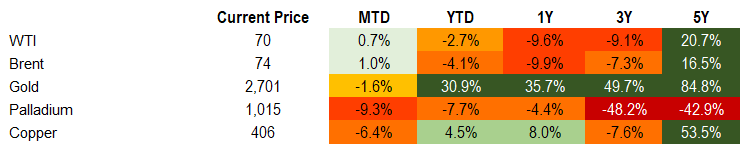

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of November 22, 2024 (early-morning).

Emerging Markets Weekly Highlights

1000 days in, the war in Ukraine enters a new escalatory phase

Event: The outgoing Biden Administration and the UK Government gave permission to Ukraine to use U.S./UK-supplied long-range strategic missiles to hit targets deep inside Russia for the first time during the conflict. Meanwhile, Putin broadened the scope of Moscow’s nuclear deterrence doctrine, specifying that “aggression from any non-nuclear state, but with the participation or support of a nuclear country, will be considered their joint attack on Russia”.

Gramercy Commentary: Last week, in our comment on the Russia-Ukraine war, we argued that the conflict was likely to drag on longer than some market participants seemed to expect in the aftermath of U.S. Presidential Election and that any potential future resolution was likely to be preceded by military escalation. This week, unprecedented Ukrainian ballistic attacks with U.S. and UK weapons deep inside Russia along with Moscow’s upping the ante on its nuclear doctrine/capabilities, seem to support our view. While we believe the probability that Russia uses nuclear weapons in Ukraine remains very small, we are of the opinion that significant conventional miliary escalation is increasingly likely. The political and military leaderships on both sides seem to continue to believe that the war is “winnable” and are looking for “peace from a position of strength”, as Ukraine’s President Zelenskiy told both the Ukrainian and European parliaments this week. This signals to us that at this stage, neither Kyiv nor Moscow are ready to engage in credible ceasefire/peace talks, regardless of broader political and geopolitical dynamics in Europe and the U.S. As such, we are of the view that market participants who have grown bullish in recent weeks on the prospects of near-term conflict resolution in Ukraine will have to rethink their optimism.

South Africa cuts policy rate by 25bps; positive rating outlook

Event: The South Africa Reserve Bank (SARB) unanimously reduced its policy rate to 7.75% from 8.0% following a better than consensus October inflation print of 2.8% y/y (-0.1% m/m) on better food and fuel trends. The next MPC is set for January 30th. Earlier in the week, S&P revised the outlook on its BB- rating of South Africa to positive.

Gramercy Commentary: The rate adjustment was largely anticipated as inflation remains within target and rates are comfortably in positive territory. Authorities have understandably not considered a quicker pace of easing given an uncertain external environment and a disinflation process which faces a ‘bumpy road’. We still see room for an additional cut in January with further action dependent on the external backdrop and Rand volatility. Cautious easing combined with the prospect of improved reform and growth momentum under the Government of National Unity (“GNU”), which has underpinned the positive rating outlook revision, is constructive. Sustained energy sector improvement, investment and reform progress that lifts economic potential in the context of a still well-functioning GNU, and debt stabilization will likely be needed for ratings to be lifted.

Senegal Parliamentary Election paves way for policy execution

Event: Based on initial results, the ruling PASTEF party obtained roughly 80% of National Assembly seats in the snap legislative election held last weekend.

Gramercy Commentary: After a messy electoral year, the decisive outcome and large Parliamentary majority provides President Faye and Prime Minister Sonko with a strong mandate to pursue their policy agenda and sets the stage for normalization next year. We expect a relatively smooth passage of a 2025 budget that sets forth a consolidation path and reconciliatory measures to begin to address the fiscal deterioration in the aftermath of the misreporting discovery, which increased debt to GDP to around 90%. We think authorities will receive an IMF waiver on the data inaccuracies later this year or early next year followed by negotiations of fresh IMF facilities and targets, helping to re-anchor spreads in 2025.

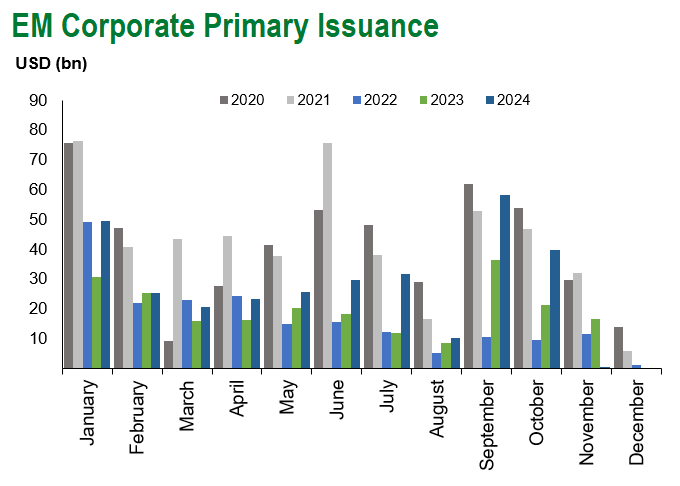

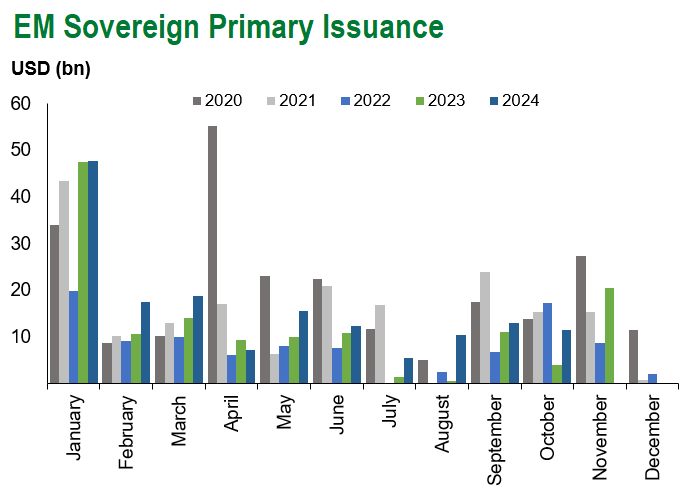

Emerging Markets Technicals

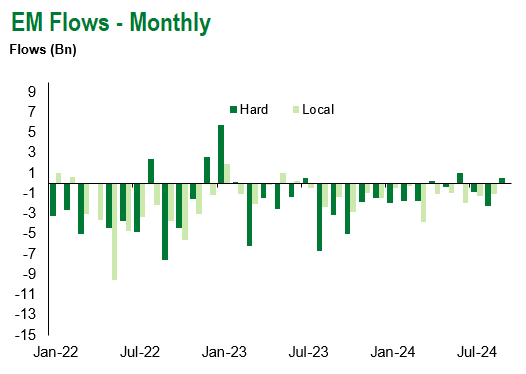

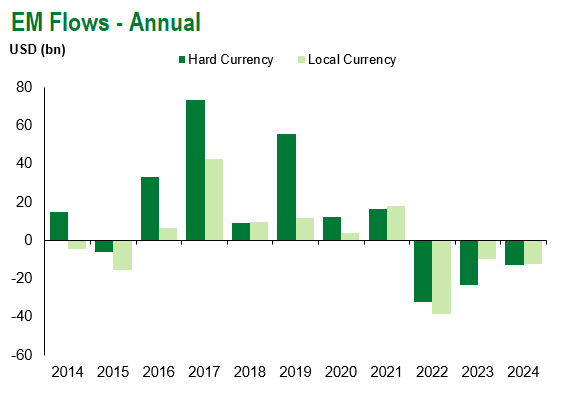

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of November 22, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.