June 2023 marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

The short week in the U.S. finished with the Federal Reserve’s preferred measure of inflation, the core personal consumer expenditure deflator, that came in on Friday at 0.2% MoM for April, decelerating from 0.3% MoM in March. Investors were encouraged to see disinflation momentum seemingly moving in the right direction after earlier disappointments and USTs erased modest loses with yields declining as much as 8bps back into 4.8% territory, after the 2Y treasury briefly touched almost 5.0% earlier in the week. The data left consensus expectations of at least one Fed rate cut this year (in September) unchanged. However, additional supportive data will likely be necessary to make policymakers feel more comfortable with starting the easing cycle, namely at least two more 0.2% MoM prints between now and September, further evidence of cooling consumer spending and probably the unemployment rate moving higher as well. Meanwhile, also on Friday, Eurozone inflation surprised to the upside in May, with headline rising to 2.6% YoY from 2.4% in April and core inflation also increasing to 2.9% YoY from 2.7%, while the market was expecting a flat reading. Earlier in the week, EM sovereigns were under pressure across the board amid revived “higher for longer” concerns about DM rates. The USD remained strong, but range-bound against most major DM and EM currencies. Across EM, initial results from South Africa’s election pointed to a coalition scenario with loss of ANC simple majority. President Milei reshuffled his cabinet in Argentina, appointing a new Chief of Cabinet, Guillermo Francos and removing Nicolas Posse from the position. Milei also formally brought his key advisor Federico Sturzenegger, former Central Bank Governor under Macri, into the cabinet with a likely continued focus on deregulation. In Georgia, adoption of the controversial “foreign agent” law by the Russia-friendly parliament majority over the pro-West President’s veto will likely complicate the country’s EU/NATO integration process. The EU, which granted Georgia candidate status in December 2023, has signaled that the adoption of the law jeopardizes Tbilisi’s chances of opening accession talks with the bloc in the fall.

EM Credit Update

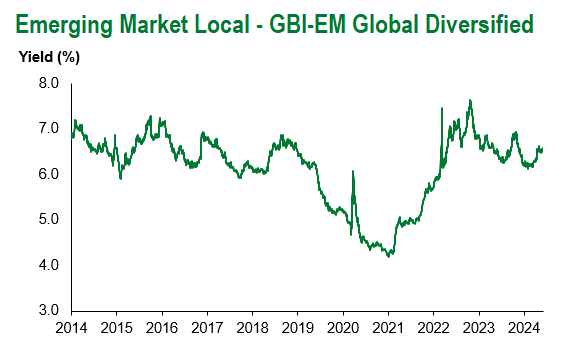

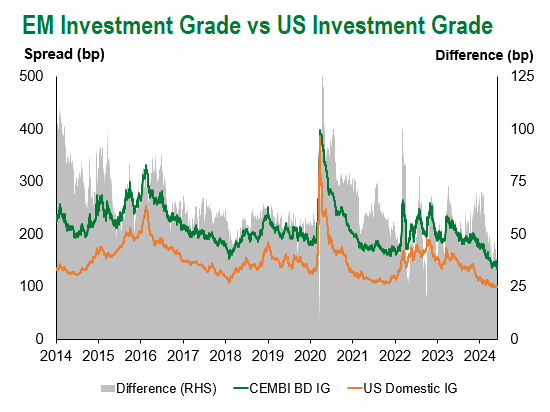

Emerging markets hard currency sovereign credit (cash bonds) lost 0.3%, despite spreads being 2bps tighter. Corporate credit was 0.2% weaker at the index level with spreads 1bp tighter. Sovereign outperformers over the week were Argentina, Guatemala, and Paraguay, while Tunisia, Iraq, and Honduras underperformed. EM local debt underperformed this week, losing 0.7%.

The Week Ahead

Next week, the European Central Bank is widely expected to begin its policy easing cycle with a well telegraphed 25bps rate cut on Thursday, even though recent economic data has not been universally supportive of policy easing. Politics will also be in focus with European Parliament elections taking place from Thursday to Sunday, which according to polls, could shift the EU political center of gravity to the right. In the U.S., all investor eyes will be on Friday’s U.S. jobs report for signals if employment could be on track to slow down. In Asia, key indicators on the docket include wages in Japan and trade data from China. In EM, the main event will be presidential elections in Mexico on Sunday, June 2nd.

Highlights from emerging markets discussed below: South Africa’s initial election results point to coalition scenario with loss of ANC simple majority; Argentina cabinet changes aim to improve governability; and adoption of controversial “foreign agent” law complicates Georgia’s EU/NATO integration process.

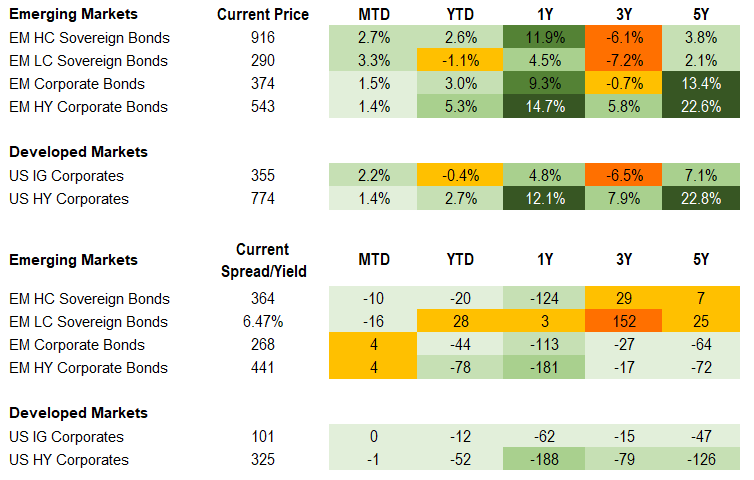

Fixed Income

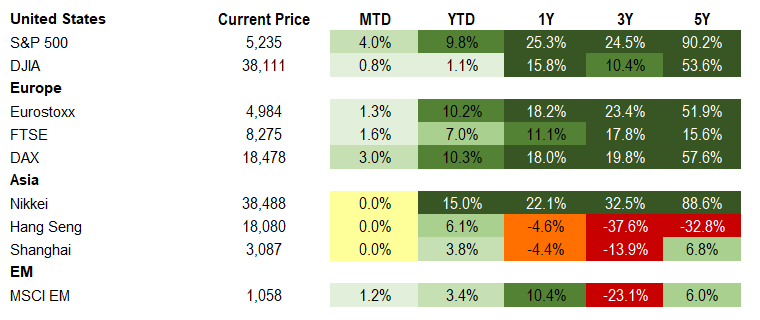

Equities

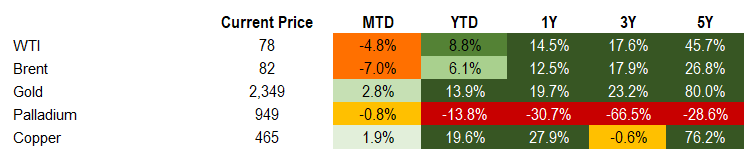

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 31, 2024 (early-afternoon).

Emerging Markets Weekly Highlights

South Africa’s initial election results point to coalition scenario with loss of ANC simple majority

Event: On May 29th, South Africa held its general election. At the time of writing, initial national ballot results based on roughly 71% of districts indicated a turnout of 58.3% with the ruling African National Congress (ANC) support at 41.7% down meaningfully from 57% in 2019. The center-right Democratic Alliance (DA) party backing improved moderately to 22.4% up from 20.8% in 2019 while the Marxist and market disruptive Economic Freedom Fighters (EFF) party saw a dip in support from 10.8% to 9.5%. Former President Jacob Zuma’s newly formed uMkhuonto (MK) party secured a robust 12.4%. The rand was roughly 3% weaker on the preliminary counts with expectation for official tallies by early next week.

Gramercy Commentary: Given the marked decline in ANC support, it is now most likely that the party will need to enter into a coalition with a larger party (DA, MK, or EFF) to govern. While a small party (IFP, PA, ACTIONSA, GOOD) coalition scenario is still possible with support hovering around 8%, uncertainty is likely to remain elevated over the next two weeks as government formation gets underway. In the case of a partnership with the DA, markets should react constructively while a sell-off is anticipated in the event of a government that includes populist MK or EFF. In a small party coalition, we expect broad continuity and President Ramaphosa to remain at the helm. In an MK or EFF partnership, coalition formation could take longer with room for greater jockeying for cabinet positions and pressure against Ramaphosa. Widespread unrest is not currently expected but there is room for isolated incidents.

Argentina cabinet changes aim to improve governability

Event: President Milei appointed a new Chief of Cabinet, Guillermo Francos, and removed Nicolas Posse from the position. At the same time, Federico Sturzenegger, who has been a key advisor to the President since taking office and ran the Central Bank during Macri’s term, is being formally brought into the cabinet with a likely continued focus on deregulation. In the aftermath, an agreement has reportedly been reached on the omnibus and fiscal bills in the Senate, at least on general terms, with planned discussions next week and a vote target date of June 12th. At the same time, Milei spent the week meeting with Silicon Valley tycoons pitching Argentina as an investment destination. The gap between the parallel and official rate briefly touched around 45% earlier in the week before reversing course to roughly 35%.

Gramercy Commentary: We view the cabinet changes as neutral to positive as they reflect a commitment to get the bills over the line with Francos better positioned to negotiate with the opposition. If the bills pass in the Senate on the 12th, this could help fuel optimism as the government and private estimates are signaling another sizeable down-step in monthly inflation due out the following day. If the bills are approved in the Senate, the Lower House will then have to approve or reject the modifications. If the bills face additional resistance in Congress or pressure in the FX market resumes, we do not rule out another round of cabinet changes.

Adoption of controversial “foreign agent” law complicates Georgia’s EU/NATO integration process

Event: With votes exclusively from the ruling Georgian Dream Party, Georgia’s parliament successfully overrode President Salome Zourabichvili’s veto of the so called “transparency of foreign influence” bill, enacting it into law.

Gramercy Commentary: The controversial legislative initiative known as the “foreign agent” law envisions severe penalties for organizations or individuals who receive 20% or more of their income from non-Georgia sources and fail to register as “pursuing the interests of a foreign power.” Opponents of the new law compare it to measures that have been enacted in Russia to silence organizations critical of President Putin’s regime, suggesting the Kremlin’s growing influence over Georgia’s current administration. Sizable street protests erupted at the introduction of the measure, but subsided when pro-Western President Zourabichvili’s vetoed the law. Now that the veto has been defeated by Parliament, turmoil is likely to return, exacerbating already elevated political polarization in the country. Meanwhile, relations with the EU and U.S., Georgia’s staunch supporters until recently, have deteriorated sharply, raising questions about the country’s stated objective to maintain its EU and NATO integration path. The EU, which granted Georgia candidate status in December 2023, has already signaled that the adoption of the “foreign agent” law jeopardizes Tbilisi’s chances of opening accession talks with the bloc in the fall. All of this is credit-negative for an otherwise fundamentally solid sovereign BB credit such as Georgia. Looking ahead, we expect that markets will turn their attention to the upcoming parliamentary elections in October that could determine if Georgia’s sharp pivot away from the West and closer to Moscow could be reversed or gain further traction.

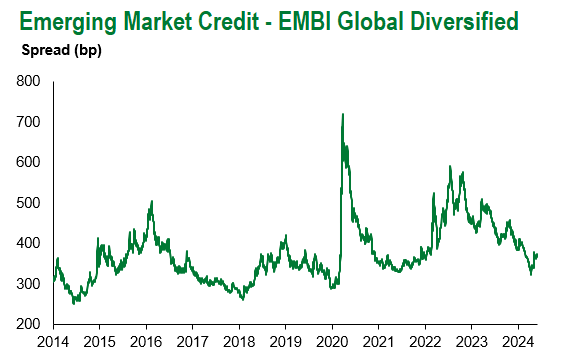

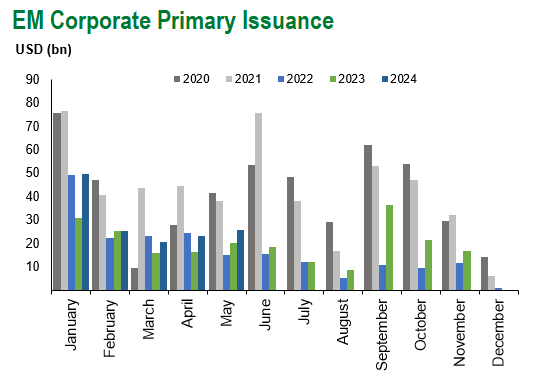

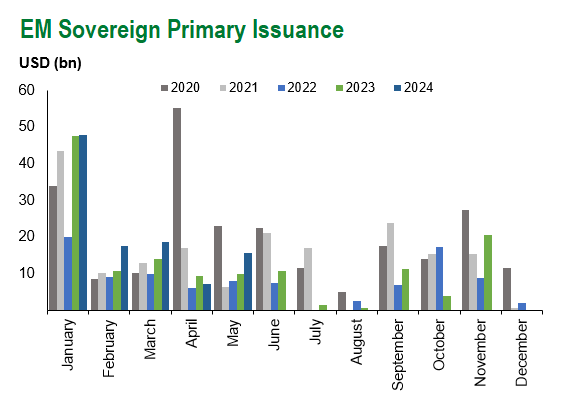

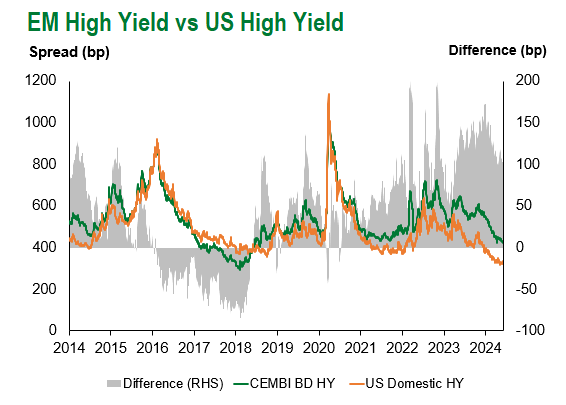

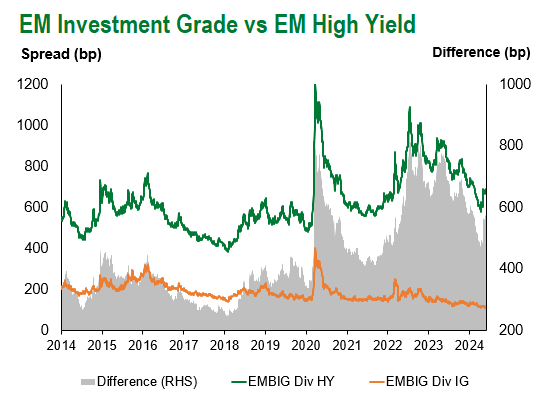

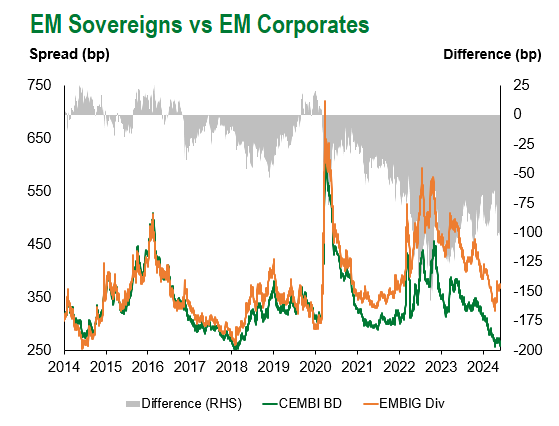

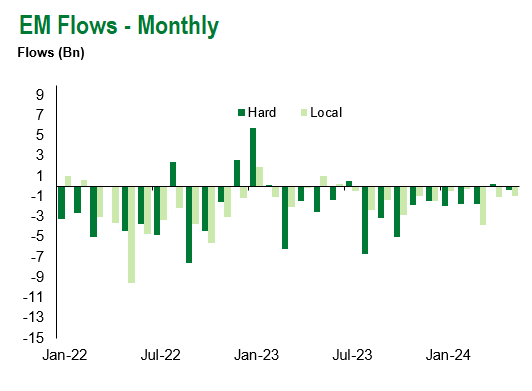

Emerging Markets Technicals

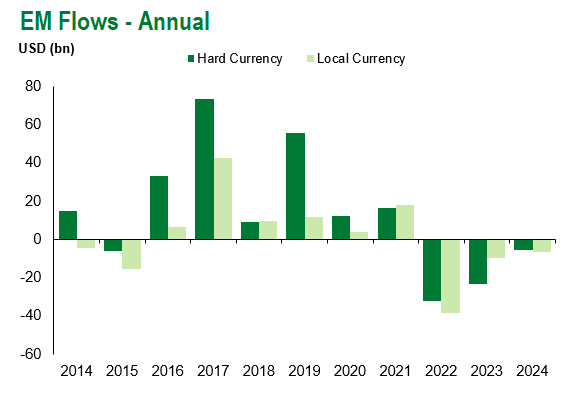

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 31, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.