Contents

Market Overview

Macro Review

When stablecoins become simply unstable. The volatility in Bitcoin and Ethereum was triggered by Tether’s parity to USD breaking down and came just as the plumbing in TerraUSD unraveled further noise in the asset class. It broke away from its main stablecoin UST which is exchangeable for the LUNA token, and was partly responsible for Bitcoin’s slump below $26,000. The fragility of the alternative asset class was picked up by U.S. Treasury Secretary Yellen who advocated for stablecoin legislation by the end of 2022 and it was also an item that was flagged in the Fed’s Financial Stability Report. However, volatility in cryptocurrencies did not infect equity or credit markets. Instead, the upside inflation surprises out of the U.S. (8.3%) was coupled by China (2.1%) along with broader growth concerns, higher rates and higher inflation that led to another bout of equity market weakness. Not only did copper fall below $9000/t for the first time in six months spark some concern, but so did the U.S. Treasury market. The 10-year note endured a peak-to-trough move over the week of 39bp, although the rally in global rates is not necessarily from a position of strength. Then came the volatility in CNH. The PBoC’s strategy of stronger daily fixes and the dovish stance has seen CNH and CNY continue to weaken closer to 6.80. The market is now geared up for a LPR cut next week (more below). That said, we did see a surprise tightening out of Malaysia with a 25bp hike as inflation in LATAM has spread to CEEMEA and is slowly emerging in Asia. Within CEEMEA, an interesting monetary policy committee development was with the Czech National Bank. With a dovish committee member reappointed this week (Ales Michl) and two outgoing hawks in June, a challenging dynamic could unfold. There is a growing risk that we could see an outsized hike at the next MPC, which could be subsequently cut by a more dovish committee (we can’t help but think of Turkey here). Nevertheless, Czech inflation remains concerning with the data release of 14.2% over the past week.

EM Credit Update

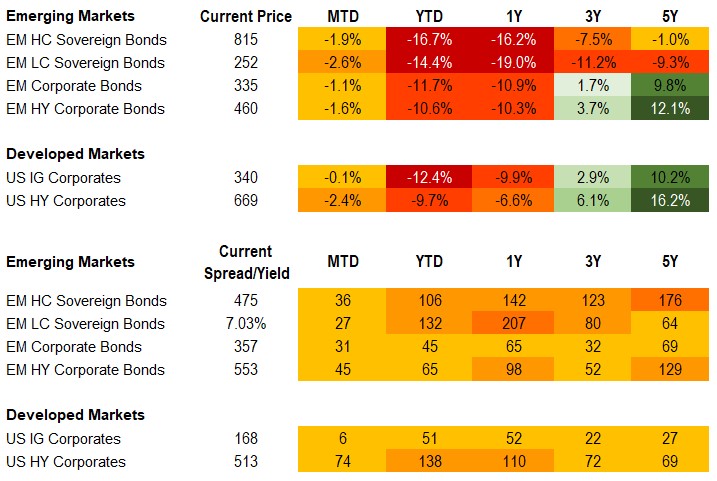

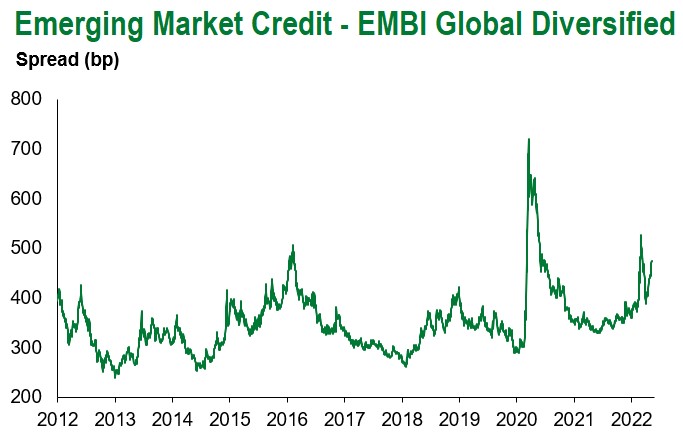

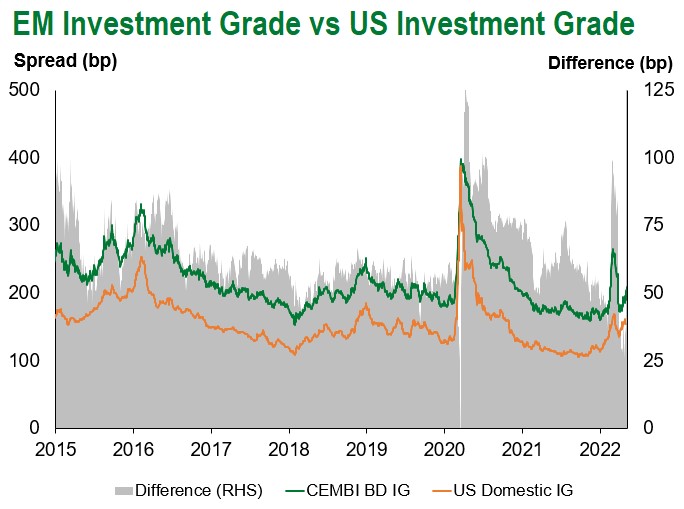

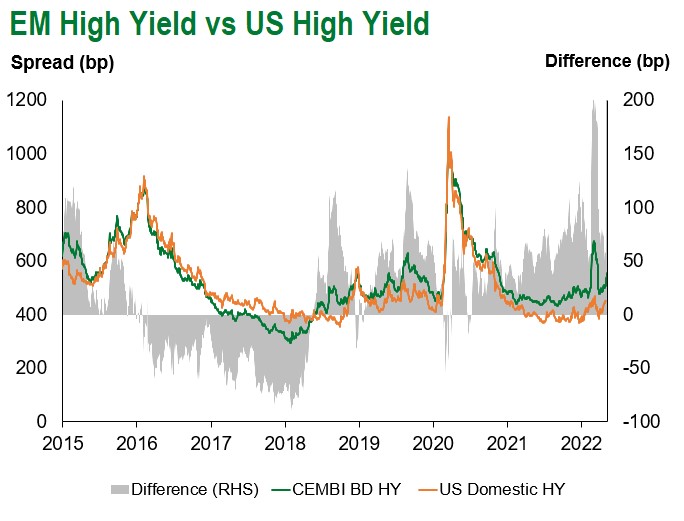

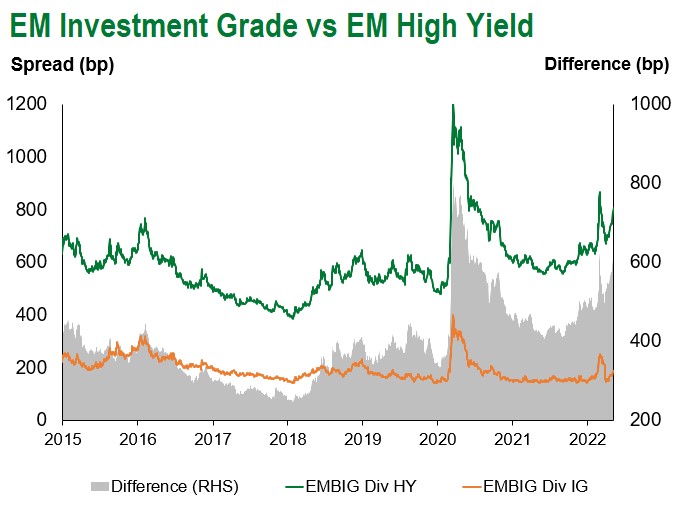

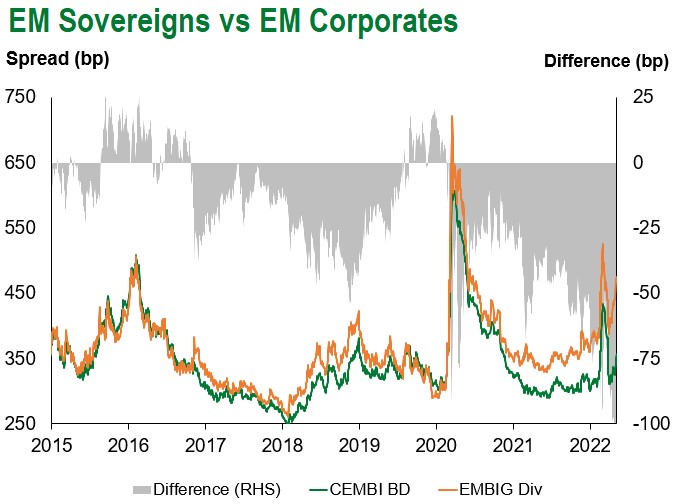

Emerging market sovereign credit ended the week down 0.4% with spreads 30bp wider. Outperformers over the week were Ukraine, China and Cameroon, while Sri Lanka, Ethiopia and Tunisia underperformed. From a corporate sector perspective, transport and consumer names were under most pressure, but at the country level it was Macau, Indonesia and Turkish corporates that underperformed. Outflows in developed markets stood out, with the largest outflows in U.S. Investment Grade since April 2020. However, outflows in EM credit were more mild and manageable. As a natural consequence, the primary market for issuing new bonds is effectively closed.

The Week Ahead

The main event rests with ECB minutes next week. A number of ECB speakers have signaled lift-off in July and this could be validated further in the minutes. Then we will have UK CPI inflation on Wednesday and the second-reading of the Eurozone inflation. The impact of Chinese lockdowns should also be visible in the industrial production release next week. However, Shanghai authorities have penciled in May 20th to start easing restrictions. The market is also anticipating a 5bp cut in the 1-year and 5-year Loan Prime Rates. As for other EM interest rate decisions, we have Egypt (9.25%), Philippines (2.0%) and South Africa (4.25%) coming up. Inflation updates are also due from Israel and Poland, although the toppy releases from Czech Republic (14.2%), Poland (12.4%), Brazil (12.1%) and Hungary (9.5%) barely moved macro markets in their respective countries. Beyond that, economic growth is expected to highlight a 1Q contraction in Chile, along with Israel but it is more uncertain, then upbeat figures out of Hungary, Romania and Thailand are expected. We would also add that economic data out of Brazil is likely to be light given BCB employee strikes.

Highlights from emerging markets discussed below include: Appointment of new Sri Lankan Prime Minister could help ease domestic political turmoil and facilitate upcoming negotiations with the IMF; Ecuador’s completion of a Staff-Level Agreement (SLA) with the IMF confirms policy anchor and further boosts FX liquidity inflows; Philippines election delivers strong mandate for Marcos Jr. and Dutert; Egypt and Ghana inflation accelerates in April; and Global emerging markets corporates in focus: Primary perplexities.

Fixed Income

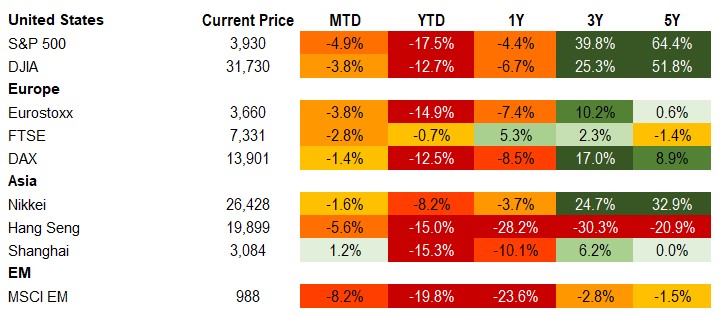

Equities

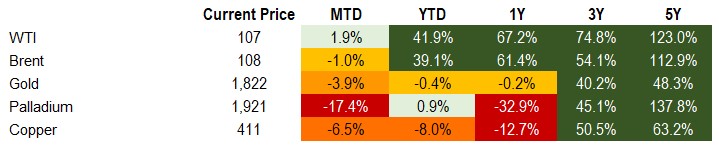

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 13, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Appointment of new Sri Lankan Prime Minister could help ease domestic political turmoil and facilitate upcoming negotiations with the IMF

Event: Sri Lanka’s embattled President Gotabaya Rajapaksa appointed Ranil Wickremesinghe, a veteran policymaker and political opponent of his, as the country’s new Prime Minister.

Gramercy Commentary: President Rajapaksa’s decision to replace his brother Mahinda, who resigned as PM on May 9th in the face of violent social unrest throughout the country, with a political opponent whose economic policy views have differed sharply from those of the Rajapaksa Administration, could prove to be a step toward diffusing Sri Lanka’s political crisis. However, it remains to be seen whether street protests will subside materially as long as the President continues to resist calls that he step down as well. Regardless, we think the choice of a new PM will be welcomed by markets as Mr. Wickremesinghe has been an outspoken critic of the Rajapaksa Administration’s long-standing reluctance to approach the IMF for financial assistance in exchange for economic reforms, despite an acute FX liquidity squeeze feeding into economic malaise. From that perspective, Wickremesinghe’s appointment offers a chance for a U-turn on economic policy and bodes well for negotiations with the IMF going forward. Recovery values for Sri Lanka’s distressed sovereign debt will be a function of the authorities’ ability to devise and present the IMF with a credible and socially feasible economic adjustment strategy that puts sovereign debt back on a sustainable trajectory. The ability to do so hinges on restoring domestic social and political stability and we think the appointment of Mr. Wickremesinghe as PM bodes well on both fronts.

Ecuador’s completion of a Staff-Level Agreement (SLA) with the IMF confirms policy anchor and further boosts FX liquidity inflows

Event: IMF staff and the Ecuadorian authorities reached a Staff-Level Agreement on the combined fourth and fifth reviews of Ecuador’s economic adjustment program under its 27-month Extended Fund Facility (EFF). Upon IMF Executive Board approval, Ecuador would have access to financing for about $1 billion, which the authorities plan to use for budget support.

Gramercy commentary: The agreement with the Fund is an important confirmation of the government’s commitment to the objectives of the IMF economic adjustment program, despite the Lasso Administration’s difficult relationship with the National Assembly. We believe that Ecuador’s fundamental sovereign credit profile remains on an improving trajectory, supported by the strong IMF relationship and a significant fiscal and external liquidity windfall, thanks to materially higher-than- expected global oil prices this year. The infusion of additional fresh FX liquidity supports domestic lending and economic activity across Ecuador’s dollarized economy. Despite the consistently constructive developments on the macroeconomic front, markets remain in a cautious mode on the sovereign credit story, mainly because of governability concerns in the context of President Lasso’s tense relationship with the national legislature. We believe that Ecuador’s sovereign bond complex is undervalued relative to improvements in the underlying credit story, but a sustained repricing would require a shift in market perception about political risks for the Lasso Administration.

Philippines election delivers strong mandate for Marcos Jr. and Duterte

Event: In Monday’s election, presidential candidate Ferdinand (Bongbong) Marcos Jr., son of former Dictator Ferdinand Marcos, and Vice Presidential candidate Sara Duterte, daughter of current President Rodrigo Duterte, secured roughly 60% support, nearly double that of the second-place contenders. While latest polls pointed to this outcome, the scale of victory was somewhat larger than anticipated. Meanwhile, 1Q GDP growth data came in at a robust 8.3% y/y compared to the market consensus estimate of 6.8% y/y.

Gramercy commentary: While the market generally sees the election outcome as supportive for policy continuity, we think there is growing risk of populist or unorthodox policy measures given the comparative lack of specifics in Marcos Jr.’s campaign and preference for cash transfer mechanisms and reinstatement of fuel subsidies to address the current price situation. Cabinet appointments between now and the inauguration on June 30th will be important signposts. This is in the context of an already sizeable fiscal deterioration with a roughly 20% of GDP jump in debt levels since 2019 and a 2021 fiscal deficit of 6.5% of GDP. While metrics are still aligned with an investment grade profile, lack of a medium term fiscal consolidation plan in the backdrop of prospects for weakened governance could begin to pressure credit ratings and spreads. At the same time, strong growth data in the context of accelerating inflation suggests that the rate hiking cycle will likely begin this month, sooner than the market had previously envisaged.

Egypt and Ghana inflation accelerates in April

Event: April consumer price data in Egypt and Ghana quickened by 260 bps and 420 bps to a pace of 13.5% y/y and 23.6% y/y, respectively, which is above expectations despite sizeable rate hikes last quarter. Price pressure was led by food and energy albeit broad-based in nature. CBE’s next rate decision will be on May 19th while BOG’s is set for May 23rd.

Gramercy commentary: We expect both countries to persist with orthodox responses to the current price shock including sizeable rate hikes, although we do not envisage material improvement in the inflation backdrop in the coming months. We think that monetary policy will help to keep outflows and material drops in sentiment at bay, absent unforeseen external developments, with the next key signposts being further clarity and details on IMF support in Egypt and private external financing as well as 1H fiscal data in Ghana.

Global emerging markets corporates in focus: Primary perplexities

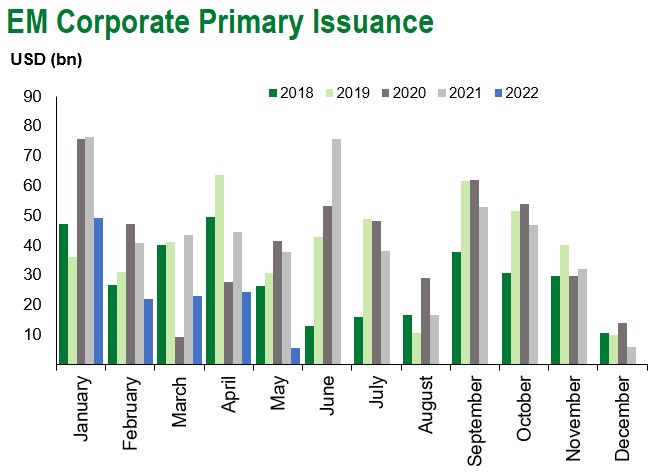

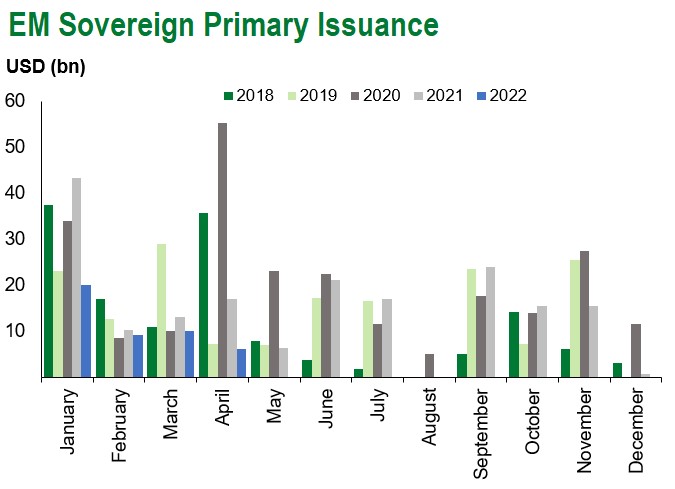

Event: The conflict in Ukraine and concerns about rates and inflation have contributed to a slowdown in Eurobond primary market activity for emerging markets issuers. There are near-term and medium-term implications for corporates, and ways around it too.

Gramercy commentary: The dearth of new supply, coupled with the exclusion of certain issuers from key emerging markets bond indices, may lead to a decline in the size of the investable universe, reversing a long-running trend of asset class growth. This decrease in Eurobond issuance may also lead to an increase in the focus on corporates’ cashflows, specifically cash on hand and non-market sources of foreign currency liquidity to repay existing bonds. What some consider to be the ‘original sin’ in emerging markets – currency mismatches between revenues and assets on one hand and funding and liabilities on the other – may also garner more attention. Such mismatches clearly still exist and may exacerbate the impact of weakening local currencies on corporates’ leverage and other metrics. There are solutions to all this, of course. For some issuers, private credit markets may provide the financing required without the glare and scrutiny often involved in public issuance. Domestic bond markets, where available, are another alternative. There have been reports of emerging markets issuers increasing the use of these markets and, in some cases, offering collateral to raise the funds required. Pairing buybacks of existing instruments with new issues is another way some issuers may raise funds in skittish markets. Others may choose to issue shorter tenor bonds than would be expected in stronger markets, or to pay even more than they may have been initially guided to get deals done. Yet others have negotiated with existing bondholders to extend the maturities of securities maturing or callable this year, addressing near-term debt repayments with the help of an already-captive group of investors.

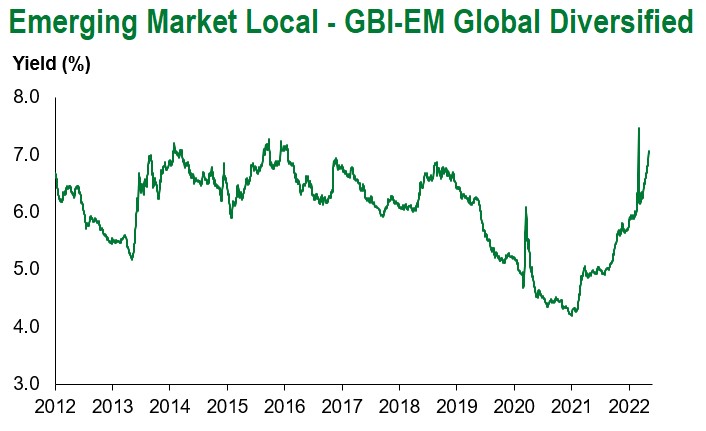

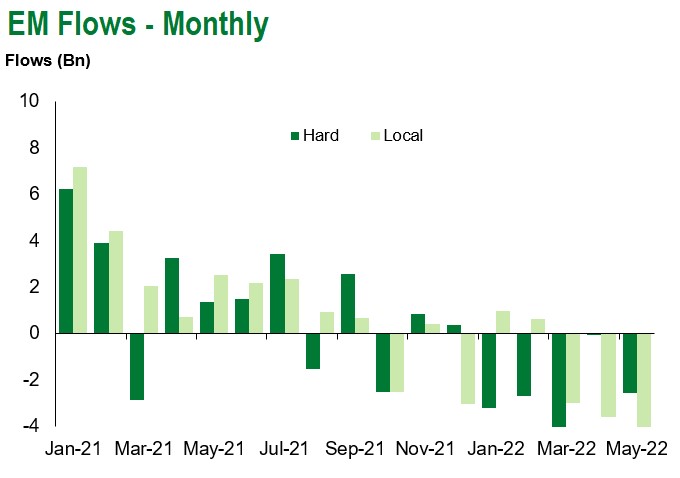

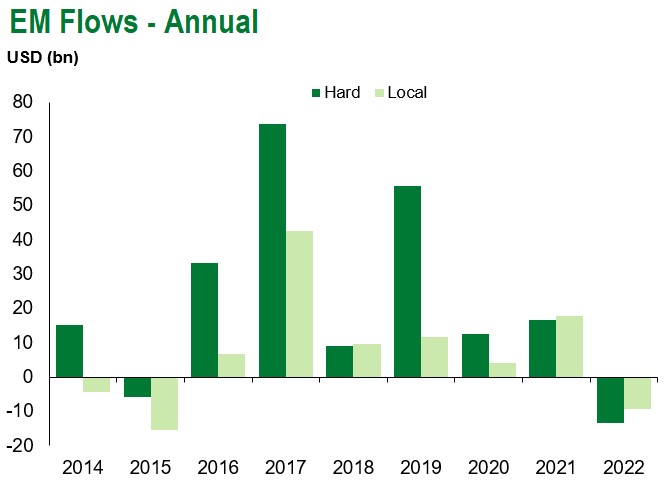

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 13, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

Tolu Alamutu, CFA, Director, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.