Contents

Market Overview

Macro Review

The U.S. enters a technical recession given two quarters of negative growth. The other concerning feature was Chair Powell’s intent to push ahead in tackling inflation even if it risked a recession, yet there is perhaps more focus on the NBER’s recession definition. However, he did flag in the FOMC presser that the “unusually large” increase in policy rates (75bps) will be data dependent on a meeting-by-meeting basis, which was read as dovish and reduced the forecasted rate hike in September to 50bps. The sell-side are now questioning when a Fed pivot could occur, with a comparison to the ECB’s tightening path in 2008 and 2011. Back in 2008 and 2011, the ECB hiked because of high spot inflation, but was forced to reverse its course. Given these risks to credibility, both the ECB and Fed have opted to scrap forward guidance given the uncertainty. The FOMC did offer some hints that we are now closer to the end, rather than the beginning of this tightening cycle. Powell’s suggestion that the current policy is closer to the terminal U.S. rate was another dovish development, where the June SEP longer-term rate is 2.50%. These features within the press conference allowed U.S. Treasuries and global equities to rally, against a weaker dollar which lifted EM currencies. Prior to the FOMC, the IMF released its world economic outlook with its most severe downgrade in relation to the U.S. economy. The U.S. growth forecast was cut by 140bps in the latest release to 2.3% for 2022. Similarly, China’s GDP growth is forecast to grow at only 3.3% which reflects a -110bps revision to the prior forecast, and is now below market expectations of 4.0%. However, Latin America, Italy, Russia and South Africa had their respective GDP growth estimates increased. In a further twist, the IMF remains sanguine on Euro-area growth at 2.6%, while GS, JPM and Citi are now all calling for a recession as the energy crisis bites. Citi also commented on the weak IFO Expectations survey, which deteriorated significantly and could be one of the early signposts of recessionary risks. Notwithstanding, the slight dip in German inflation in June was quickly reset in July and is trending up toward the all-time high from May.

EM Credit Update

Emerging market sovereign credit ended the week up 1.7% with spreads 18bps tighter. Outperformers over the week were Sri Lanka, El Salvador and Argentina while Ghana, Pakistan and Ecuador underperformed. Key events include Nayib Bukele’s intent to buyback Salvadoran 2023 and 2025 bonds and Argentina’s Minister of Economy replacement as Silvina Batakis leaves the post after a mere 26 days. Then Ghana sold-off with the weaker budget, Pakistan with ensuing political paralysis along with additional IMF needs and technicals remain weak in Ecuador. Meanwhile, state-owned enterprises in Ukraine are following the sovereign’s two-year interest deferral proposal. Ukrenergo sought similar terms, while also seeking to extend the final maturity from 2026 to 2028. In doing so, Ukrenergo is seeking to delay the coupon step-up (35bps) from 2025 to 2027 associated with it’s ESG framework. It is now likely that Ukrenergo will become the first ESG default in CEEMEA.

The Week Ahead

U.S. payrolls, the Bank of England decision, OPEC+ and the slew of earnings will fill up next week’s calendar. However, after the recent bout of disappointing confidence indicators, China’s PMI is in focus. The Economic Surprise Index for Europe reached lows not seen since the pandemic this week and while China’s surprise index has improved over the past three-months, the PMI reading on Sunday is becoming an important indicator for global sentiment. The secondary focus will be China’s FX reserves and trade data. Interest rate decisions are also due out of Brazil (13.25%), Czech Republic (7.0%), India (4.9%) and Romania (4.75%). Another key fixture is Turkey’s inflation release. The challenge for policy-makers is that consensus is already 80.2% and it comes just after the CBRT raised the year-end forecast to 60.4% from 42.8%. We will also have inflation updates out of Colombia, Indonesia, Peru, Philippines and Thailand.

Highlights from emerging markets discussed below include: IMF unsurprisingly downgrades global growth forecast led by developed markets; Egypt ex-post IMF review indicative of key areas of ongoing program discussions; Argentina gets ‘super’ economy minister, Sergio Massa; BCRA hikes rates significantly; El Salvador announces plans to buy back sovereign debt

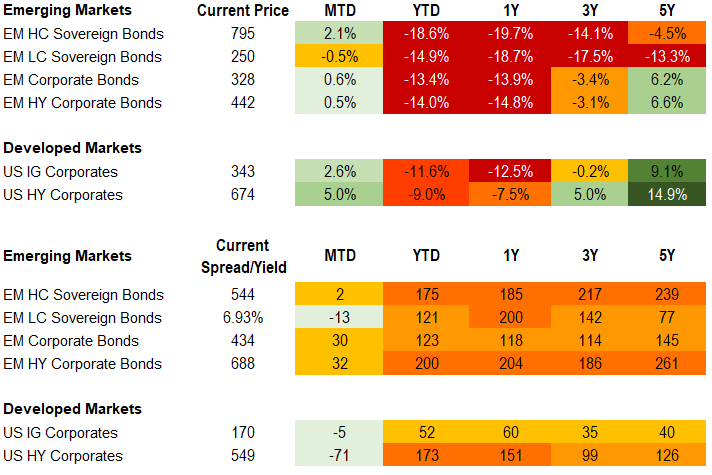

Fixed Income

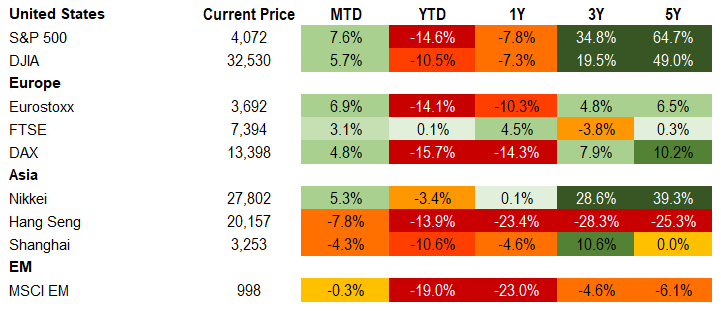

Equities

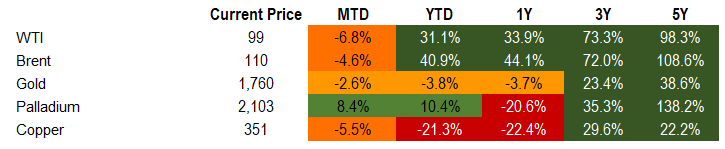

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of July 29, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

IMF unsurprisingly downgrades global growth forecast led by developed markets

Event: The IMF lowered its real GDP growth estimate for 2022 and 2023 by 40bps and 70bps, respectively, to 3.2% and 2.9%. Developed markets 2022 and 2023 forecasts were lowered by 80bps and 100bps, respectively, while emerging markets revisions were less aggressive at 20bps and 50bps, respectively. Global inflation for end-2022 was increased to 8.3% from 6.9%. The report emphasized that uncertainty remains elevated, and risks are tilted to the downside from the ongoing Ukraine war and associated price shocks, broad sticky inflation, and unknown prospects around disinflation.

Gramercy commentary: While the July WEO, in our view, is a fair reflection of the ongoing challenges of elevated inflation and stalling growth amid broader geopolitical uncertainty, we do not see the assessment as overly worrisome particularly relative to market expectations with consensus 2022 global growth already at 3%. Additionally, the fund’s assumptions support prospects for an improved EM-DM growth differential into 2023.

Egypt ex-post IMF review indicative of key areas of ongoing program discussions

Event: This week, the IMF published its standard ex-post review of Egypt’s 2020 SBA that in summary highlighted that the program reached its primary objective of macroeconomic stability and the government delivered on policy implementation in line with targets. The assessment did note that greater FX flexibility and deeper structural reforms to boost competitiveness, improve governance, and strengthen resilience are outstanding areas of focus, despite the authorities having met all reform targets under the 2020 SBA. Lastly, in hindsight, the Fund elaborated on the strong performance on FX reserve targets in the context of better than envisaged external conditions, which could have been better managed with evolution and broadening of the target to more sustainably restore external buffers and reduce vulnerabilities going forward.

Gramercy commentary: We see the conclusion of the report as a necessary precursor to a new program as part of the IMF’s exceptional lending process. While commitment to greater FX flexibility and deeper reform momentum pose challenges for the Egyptian authorities and are likely complicating ongoing program discussions, we think an ultimate deal will be reached later this year. In the meantime, pledged GCC project and deposit support have helped to temporarily stabilize the external profile.

Argentina gets ‘super’ economy minister, Sergio Massa; BCRA hikes rates significantly

Event: Sergio Massa, the former head of Chamber of Deputies, has been appointed the new Minister of Economy which is now an expanded position that encompasses areas of production and agriculture. He replaces Silvina Batakis, who held the role for only a few weeks and just returned from a relatively constructive visit to DC to meet with the IMF team and investors. Meanwhile, BCRA hiked rates by 800bps bringing the policy rate to 60% and the effective annual rate just below 80%. The gap between the parallel and FX rates dropped to just over 140% compared to 165% the week prior while bond prices rose off the lows roughly 4-5pts on the week.

Gramercy commentary: We see the development as constructive with the possibility for better controlling policy in an incrementally more market-friendly manner. While, as always, “proof will be in the pudding”, the market appears willing to give Massa some benefit of the doubt combined with mild stabilization in external conditions, this should provide him with a window to execute on policy measures to better achieve IMF targets and improve local financing conditions. Key signposts in the coming days and weeks will bring clarity on the rest of his team and new fiscal and external sector policy measures. Although Massa has support from the president and vice president, he will need to be savvy and will still be subject to fluid and complex domestic political dynamics, leaving room for volatility.

El Salvador announces plans to buy back sovereign debt

Event: El Salvador’s President Nayib Bukele announced via tweet that his government asked the National Assembly to authorize funds for “a transparent, public and voluntary purchase offer to all holders of Salvadoran sovereign debt from 2023 to 2025, at the market price at the time of each transaction”.

Gramercy commentary: The market has been questioning the Bukele Administration’s willingness to continue to service its external debt obligations, mainly due to the President’s sometimes erratic behavior and distrust of traditional financial markets and his tense relationship with key external factors such as the IMF and the Biden Administration. However, this week’s announced plans for debt pre-payment should assuage the “willingness to pay” concerns, reflected in a recovery of the sovereign bond curve from deeply distressed levels. Details on the proposed transaction remain limited, but the authorities appear to have secured around $560 million for the intended debt repurchasing operation sourced from IMF SDRs allocated to El Salvador as well as a loan from the Central American Bank for Economic Integration (BCIE). Considering market prices at the time of writing, those funds would be sufficient to repurchase around 50% of the outstanding 2023 and 2025 sovereign bonds (with combined face value of $1.6bn and market valuations of around $1.1bn). To the extent El Salvador is able to bring the buy-back operation to a successful completion, the government’s near-term external debt service would be reduced significantly, which should improve overall market sentiment on the credit.

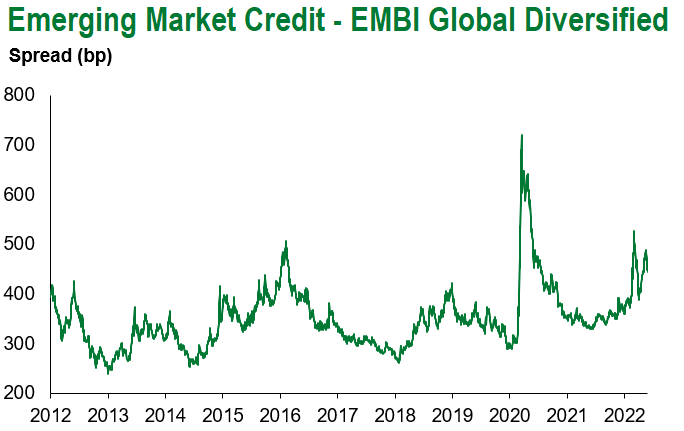

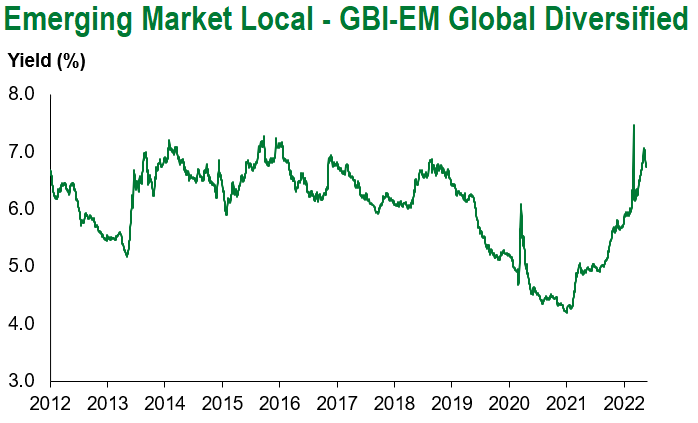

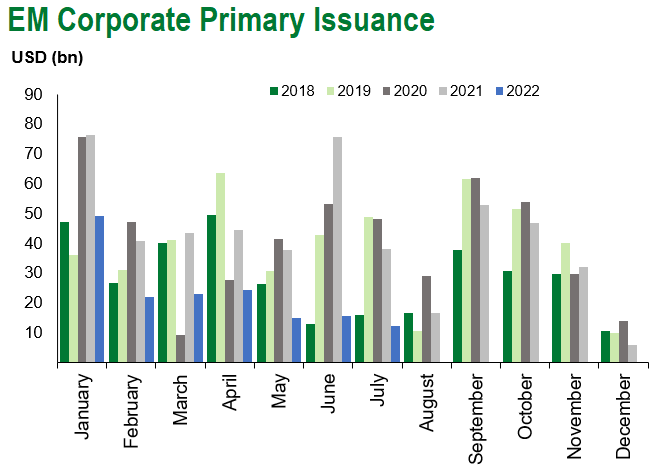

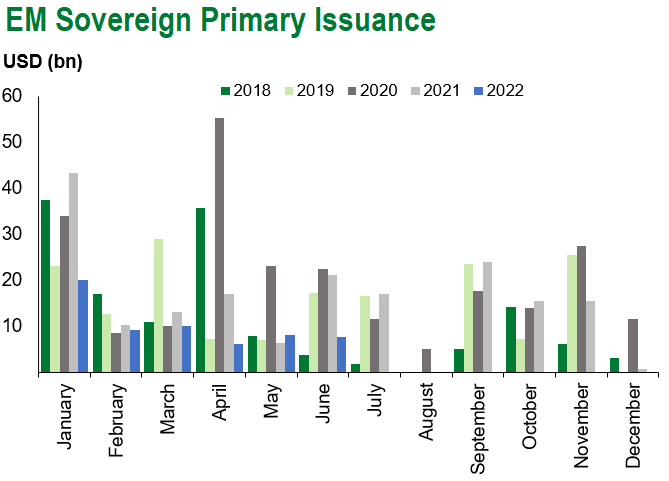

Emerging Markets Technicals

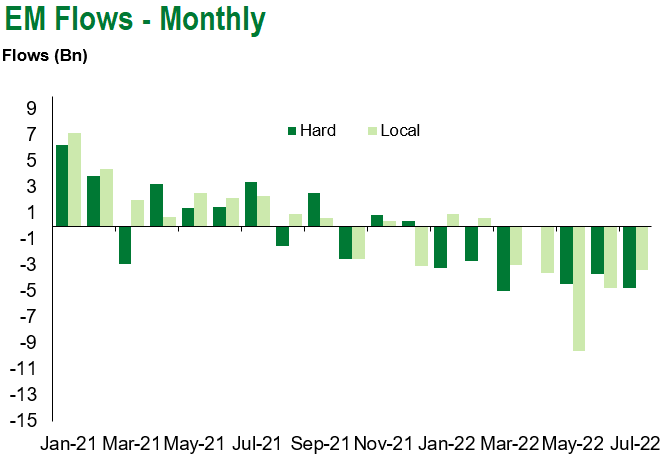

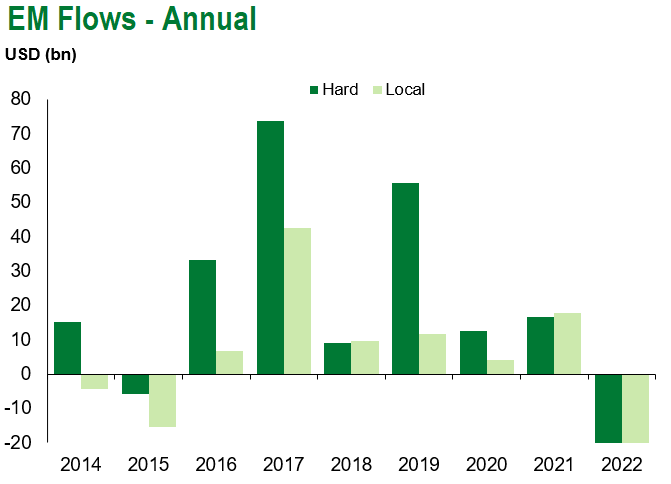

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of July 29, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.