Contents

Market Overview

Macro Review

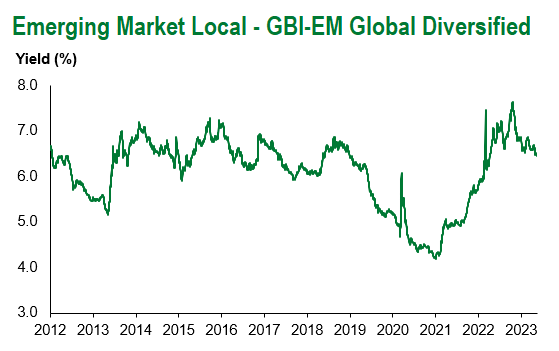

Progress on the U.S. debt ceiling is looking more likely. There were several news items which signalled the end of political brinkmanship is in sight and an ultimate agreement is now expected next week. In that regard, equities rallied, volatility declined, U.S. Treasuries sold-off but T-Bills rallied and commodities like oil and wheat advanced. Elsewhere, Japan’s 1Q GDP was more robust. It’s 20-year auction was solid and the TOPIX drew-out modest gains to reach highs not seen since 1989. The slightest of setbacks was from CNH. China’s problem is more unique. The balance of payment is driven by a high current account surplus, which is then offset by direct and portfolio outflows. The added complication of a weak interest rate differential vis-a-vis the U.S. and a weaker than expected recovery story weighed on CNH as it rose above 7 this week. The second-order derivative in lower swap rates has given way to a rally in CGBs, and in turn EM local rates. However, the growth shock is becoming more challenging to ignore and we even saw Barclays as the first sell-side institution to downgrade China’s 2023 GDP growth forecast to 5.3% from 6.3%. The idea of spiking FX volatility was evident in Thailand after elections as some of the 250 unelected members of the Senate have begun to oppose Pita Limjaroenrat becoming Prime Minister. The political volatility spread around the globe. Ecuador’s government almost-impeached President dissolved parliament via “muerte cruzada”, meaning early elections within 90 days under Article 148 of the constitution. The tentative election date is August 20th, although President Lasso does not intend to run. The same wave of political uncertainty was evident in Turkey, where incumbent President Erdogan is set to maintain his grip on the country as the election heads to a second-round run-off. However, we have begun to see significant IMF progress. Ghana secured a $3 billion 3-year ECF, which paves the way for Zambia next. Suriname also got its second review of the staff-level agreement, but an approved deal is a condition for the bondholder restructuring by June 15th.

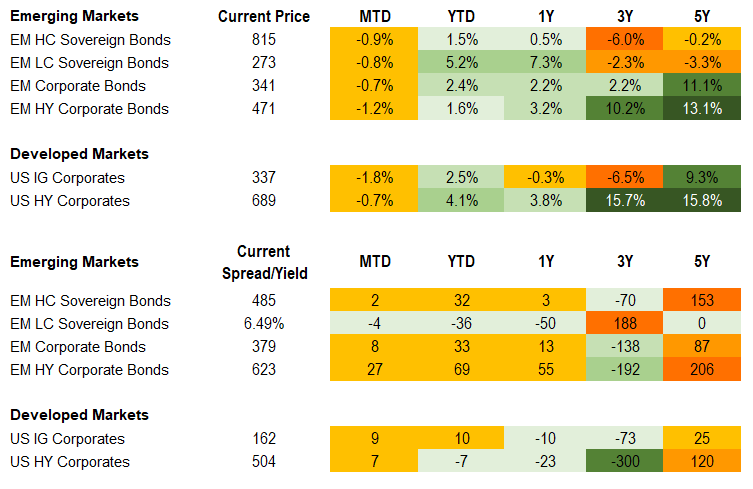

EM Credit Update

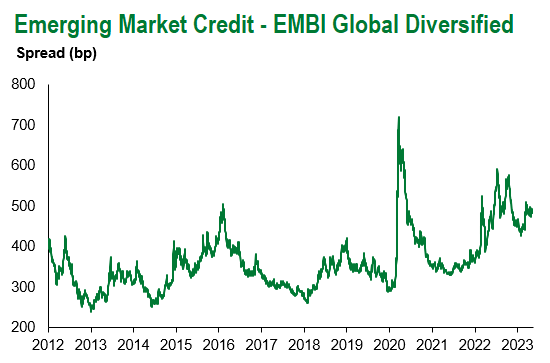

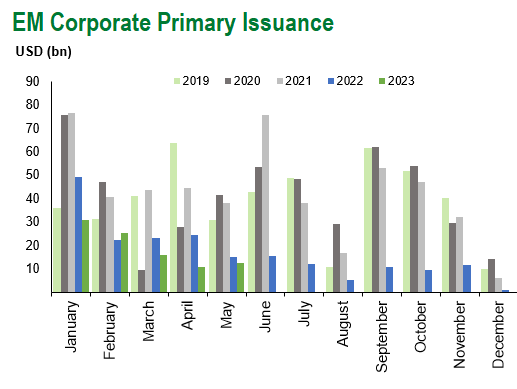

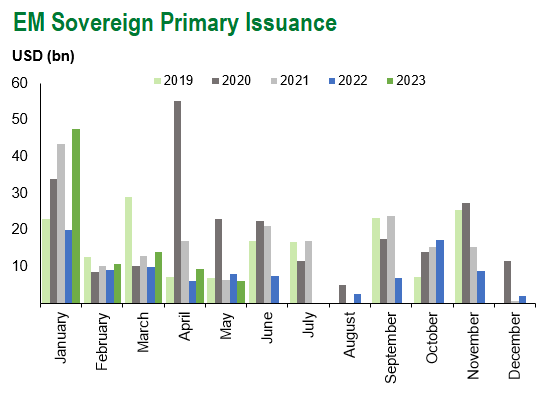

Emerging market sovereign credit (cash bonds) ended the week down 1.1% with spreads a mere 1bp wider as U.S. Treasury yields sold-off 11-24bps. Sovereign outperformers were Zambia, Ukraine and Ghana, while Tunisia, Turkey and Ethiopia underperformed. It is also worth noting that Moody’s lifted its outlook on China’s real estate sector for the first time in almost two years to stable from negative. This reflects a seismic shift in the perception of credit risk and the exciting opportunity set to invest in. The next seismic event was Pfizer issuing $31 billion in the bond market, which is the fourth largest U.S. IG bond transaction on record. Pfizer is looking to fund its acquisition of Seagen, although on the day of issuance the Federal Trade Commission sued to block Amgen’s $27.8 billion Horizon Therapeutics deal. Amgen issued $24 billion in February, which was the tenth largest U.S. IG bond transaction and may have to return borrowed proceeds to investors if the M&A falls through. Nevertheless, the appetite for fixed income credit is back (in size).

The Week Ahead

U.S. debt ceiling dynamics will dominate next week. Lesser events surround the RNBZ rate decision, Japanese inflation and China’s 1-year and 5-year Loan Prime Rate decision, which ought to remain unchanged at 3.65% and 4.30%. Key EM interest rate decisions are due from Ghana (29.5%), Hungary (13.0%), Indonesia (5.75%), South Africa (7.75%), South Korea (3.5%) and Turkey (8.5%). From a G10 perspective, the UK will publish its latest inflation report, which is expected to decline, followed by German IFO surveys and flash PMIs which will filter through. We can expect some focus on FOMC minutes given the June meeting is largely seen as a coin-toss between pausing policy and hiking by 25bps. Then, finally, the Fed’s measure of inflation (U.S. PCE) data is also due out, which is ever important for a data-dependent central bank.

Highlights from emerging markets discussed below: Erdogan heavy favorite to secure re-election in Turkey’s presidential runoff on May 28th, President Lasso dissolves National Assembly to prevent impeachment, triggers early elections and Ghana secured IMF board level approval on its new ECF program.

Fixed Income

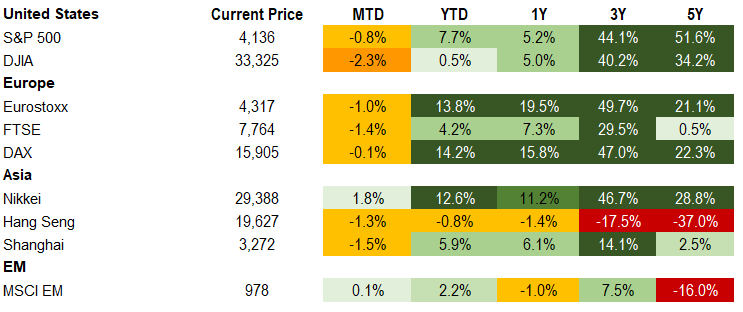

Equities

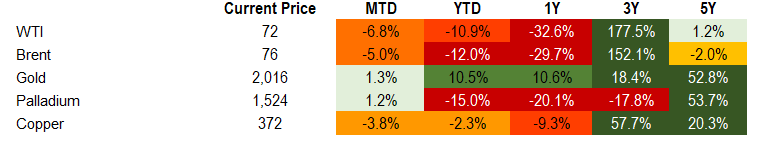

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 19, 2023 (mid-afternoon).

Emerging Markets Weekly Highlights

Erdogan heavy favorite to secure re-election in Turkey’s presidential runoff on May 28th

Event: During last Sunday’s elections, the incumbent candidate narrowly failed to secure a victory in the first round of presidential elections with 49.5% of the votes but leads as the favorite into the runoff against Kemal Kilicdaroglu, the leader of the opposition, who won 44.9% of the votes. Sinan Ogan, a third candidate, performed strongly with 5.2% of the votes. In the parallel parliamentary election, President Erdogan’s AKP-MHP alliance outperformed expectations gaining 323 seats in the 600-member National Assembly.

Gramercy commentary: Last Sunday’s results contradicted most pre-election polls and the market consensus, handing Erdogan a commanding lead ahead of the presidential runoff on May 28th and a comfortable simple majority in the National Assembly for his party alliance. To overcome the deficit in the presidential race, opposition candidate Kemal Kilicdaroglu would need to attract the majority of the 2.8 million voters who supported ultra-nationalist, Sinan Ogan, as well as those who did not vote in the first round, a challenging task in our view. In our base case scenario of President Erdogan’s reelection, we expect a continuation of his heterodox economic policy model prioritizing strong GDP growth and low interest rates at the expense of high inflation and deepening external vulnerabilities. We believe tighter micro-management of the economy, ad-hoc financial support from friendly governments, lower global energy prices and a traditional increase in hard currency inflows during the peak summer tourism season will likely allow the economy to continue to muddle-through in the near-term. However, barring a structural change in the economic policy mix, we expect that over time Turkey will likely be edging closer to a “binding constraint” on external liquidity accompanied by mounting market concerns about a potential balance of payments crisis. The timing of a “crisis episode” is highly uncertain but will hinge mainly on the willingness of friendly countries to continue to provide external financing and the resiliency of domestic economic confidence in the face of prolonged heterodox economic policy management under a likely re-elected Erdogan.

President Lasso dissolves National Assembly to prevent impeachment, triggers early elections

Event: Ecuador’s President Guillermo Lasso decided to invoke the so called “mutual death” clause in the constitution, dissolving the National Assembly and triggering early elections within 90 days. The Constitutional Court reviewed petitions from anti-Lasso lawmakers against the legality of the President’s decree and rejected them on the grounds that no court in the country has competence to rule on the validity of the “serious political crisis and internal conflict” claim invoked by Lasso as a justification to dissolve the National Assembly based on Article 148 of the Ecuadorian Constitution.

Gramercy commentary: Amid a controversial impeachment trial by the legislature against the President, the market believed that Lasso would leverage the unusual “mutual death” clause in Ecuador’s Constitution (Article 148) as a threat against the National Assembly but would not actually use it due to various negative political implications. As such, Lasso’s decision came as a downside surprise, ushering in yet another episode of elevated near-term political uncertainty in the country. The security forces have vowed to protect “the constitutional order” and have cordoned off the building of the National Assembly in Quito, preventing MPs from entering. The streets have also been calm thus far but it remains to be seen if that will remain the case after the Constitutional Court upheld Lasso’s prerogative to dissolve the legislature on Friday. One risk on investors’ minds are potential meaningful street protests by the indigenous groups who have been vehemently opposed to early elections. The National Electoral Council is mandated to call early elections with seven days of the President’s decree, i.e., by Wednesday, May 24th. The elections must take place within 90 days, so by late August, with a potential presidential runoff 45 days thereafter. The populist party of former President Rafael Correa, who is currently exiled in Belgium, appears best positioned to benefit from early elections and could secure the presidency and a majority in the National Assembly until regular elections in early 2025. In the scenario of a populist leaning Correista, the market’s main concern is about potential deterioration in the economic policy environment, which has improved materially in the last couple of years under the Lasso administration, and implications for the servicing of external debt.

Ghana secured IMF board level approval on its new ECF program

Event: The IMF board approved a 3 year $3 billion Extended Credit Facility for Ghana with an initial $600 million disbursement. The program entails a front-loaded macroeconomic adjustment program with a path to a primary surplus of 1.5% of GDP by 2025. External debt relief required to close the financing gap is an estimated $10.5 billion through 2026 or roughly $2-3 billion annually. Bonds traded up in anticipation of the announcement while the cedi appreciated roughly 9.5%.

Gramercy commentary: We see the development as positive and timely in the overall process of debt resolution and credit improvement. The macroeconomic and debt restructuring assumptions outlined in the supporting IMF documentation are in line with expectations and thus should not complicate ongoing negotiations with bondholders. We continue to see incentives for comparatively swift completion of the restructuring process given moderate debt to China and electoral dynamics that will begin to cloud the outlook into next year. Creditors are likely to obtain a better deal sooner rather than later while the government should benefit politically from the virtuous cycle associated with normalization.

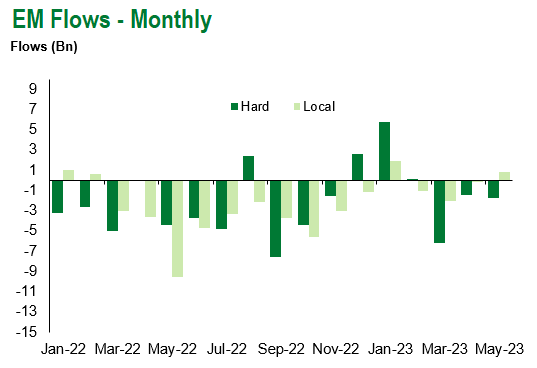

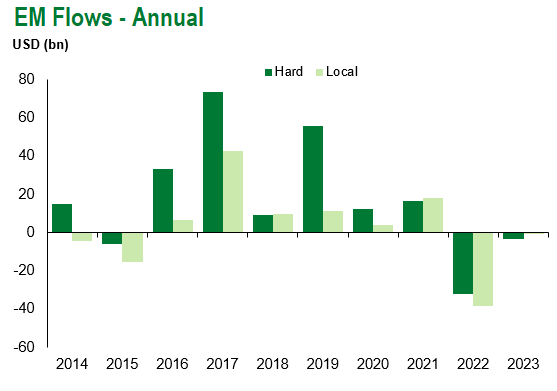

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 19, 2023.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.